Catalysts

About Aquafil

Aquafil is a global producer of nylon based fibers and engineering plastics, including regenerated ECONYL materials, serving flooring, textile, and technical applications.

What are the underlying business or industry changes driving this perspective?

- The ongoing shift of customers toward higher performance and more sustainable materials is supporting strong growth in engineering plastics and ECONYL based products. This can lift group revenues and structurally improve blended margins as mix shifts away from basic polymers.

- Completion of the EUR 20 million cost reduction and energy saving program through 2026 should lower unit production costs. This provides potential for margin expansion and EBITDA growth even under conservative volume assumptions.

- Capacity rationalization and plant closures among European and Asian caprolactam and nylon producers are tightening regional supply. This positions Aquafil as a flexible, reliable supplier that can capture pricing power and support higher gross margins.

- Recovery in carpet fibers and NTF demand, including new programs in maritime, aviation, transportation, circular fishing nets, ropes, and area rugs, can turn current volume softness into mid term top line growth and better fixed cost absorption. This may enhance operating leverage and earnings.

- Optimization of the supply chain with diversified European and overseas raw material sourcing, combined with a gradual normalization of payment terms, should improve the cash cycle and net financial position. This may reduce financial charges and enhance net income.

Assumptions

How have these above catalysts been quantified?

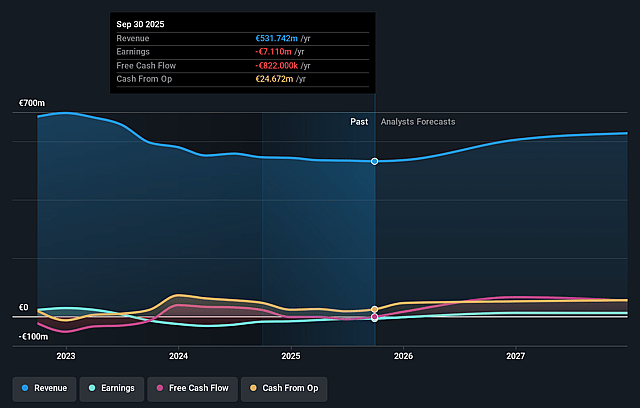

- Analysts are assuming Aquafil's revenue will grow by 8.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from -1.3% today to 4.0% in 3 years time.

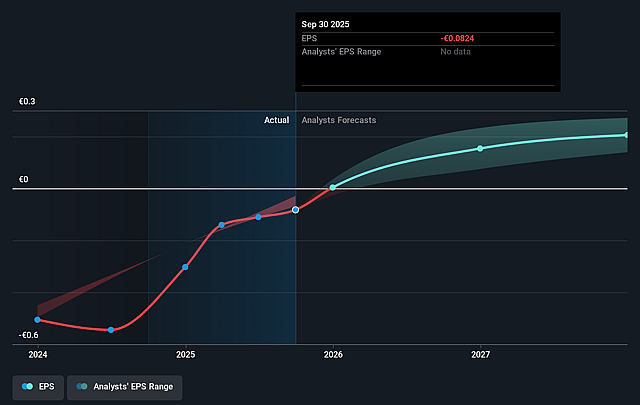

- Analysts expect earnings to reach €26.8 million (and earnings per share of €0.31) by about December 2028, up from €-7.1 million today.

- In order for the above numbers to justify the price target of the analysts, the company would need to trade at a PE ratio of 9.8x on those 2028 earnings, up from -16.7x today. This future PE is lower than the current PE for the IT Luxury industry at 21.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 17.92%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Structural weakness in European and Asia Pacific demand for fibers, combined with uncertainty in BCF and NTF volume recovery, could cap top line growth over several years and limit operating leverage, constraining revenue and EBITDA expansion.

- Heavy reliance on Chinese caprolactam and nylon imports after multiple European supplier shutdowns may expose Aquafil to supply concentration, geopolitical risk, and price volatility, which could compress gross margins and increase earnings volatility.

- Persistent competitive pressure from low cost Chinese producers redirecting exports into Europe could keep selling prices under pressure, making it harder to pass through input cost inflation and undermining long term net margins.

- Delays, downsizing, or lower than expected benefits from the EUR 20 million cost reduction and energy saving program, especially against a backdrop of ongoing wage inflation, could mean that the anticipated structural margin uplift and EBITDA improvement fail to fully materialize.

- More cautious and structurally lower capital expenditure, while protecting near term cash flow, risks underinvesting in automation and growth projects, which could weaken Aquafil's competitive position in higher value engineering plastics and constrain future revenue and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of €1.85 for Aquafil based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analysts, you'd need to believe that by 2028, revenues will be €673.9 million, earnings will come to €26.8 million, and it would be trading on a PE ratio of 9.8x, assuming you use a discount rate of 17.9%.

- Given the current share price of €1.38, the analyst price target of €1.85 is 25.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.