Key Takeaways

- Unmatched execution, integration, and innovation enable Prysmian to capture outsized growth, premium margins, and dominate emerging mega-trends in transmission, electrification, and digital infrastructure.

- Strategic M&A and supply chain advantages accelerate margin expansion and position Prysmian as a leader across U.S. and European data center, 5G, and cloud fiber markets.

- Margin pressures from rising material costs, global supply chain risks, project delays, mature market exposure, and acquisition-related execution challenges may constrain Prysmian's long-term growth and profitability.

Catalysts

About Prysmian- Produces, distributes, and sells power and telecom cables and systems, and related accessories under the Prysmian, Draka, and General Cable brands worldwide.

- Analyst consensus expects sustainable EBITDA margins of 17% in Transmission, but current execution and order book visibility indicate that substantial project mix and unmatched installation capabilities could push Transmission margins closer to 18% to 20% well ahead of guidance, leading to outsized EBITDA and earnings growth through 2028.

- Analysts broadly agree that Encore Wire integration should yield operational synergies, yet the ongoing U.S. market share shift-due to competitors' supply chain disruptions and tariff-driven demand pivot to local producers-coupled with rapid cross-selling and optimized delivery from the McKinney hub could drive I&C EBITDA margins to nearly 20% standard metal terms and accelerate both revenue and net margin expansion.

- Prysmian's leadership in next-generation grid and digital infrastructure positions it to disproportionately benefit from the massive, multi-decade global investments tied to the electrification of economies and digitalization mega-trend, supporting structural double-digit revenue growth and robust free cash flow far beyond 2028.

- Strong and disciplined pricing, unprecedented customer stickiness bolstered by technological innovation, and the ability to add unique cable features (such as digital monitoring and resilience enhancements) position Prysmian to command premium pricing and resist margin erosion, enabling higher-than-expected net margins and earnings quality.

- Recent and future M&A, notably the addition of Channell and high-performance connectivity assets, establish Prysmian as a dominant player in U.S. and European data center, 5G, and cloud fiber solutions; this creates a new multi-year growth vector with above-group-mix EBITDA margin potential, materially upwardly revising the medium-term revenue and earnings trajectory.

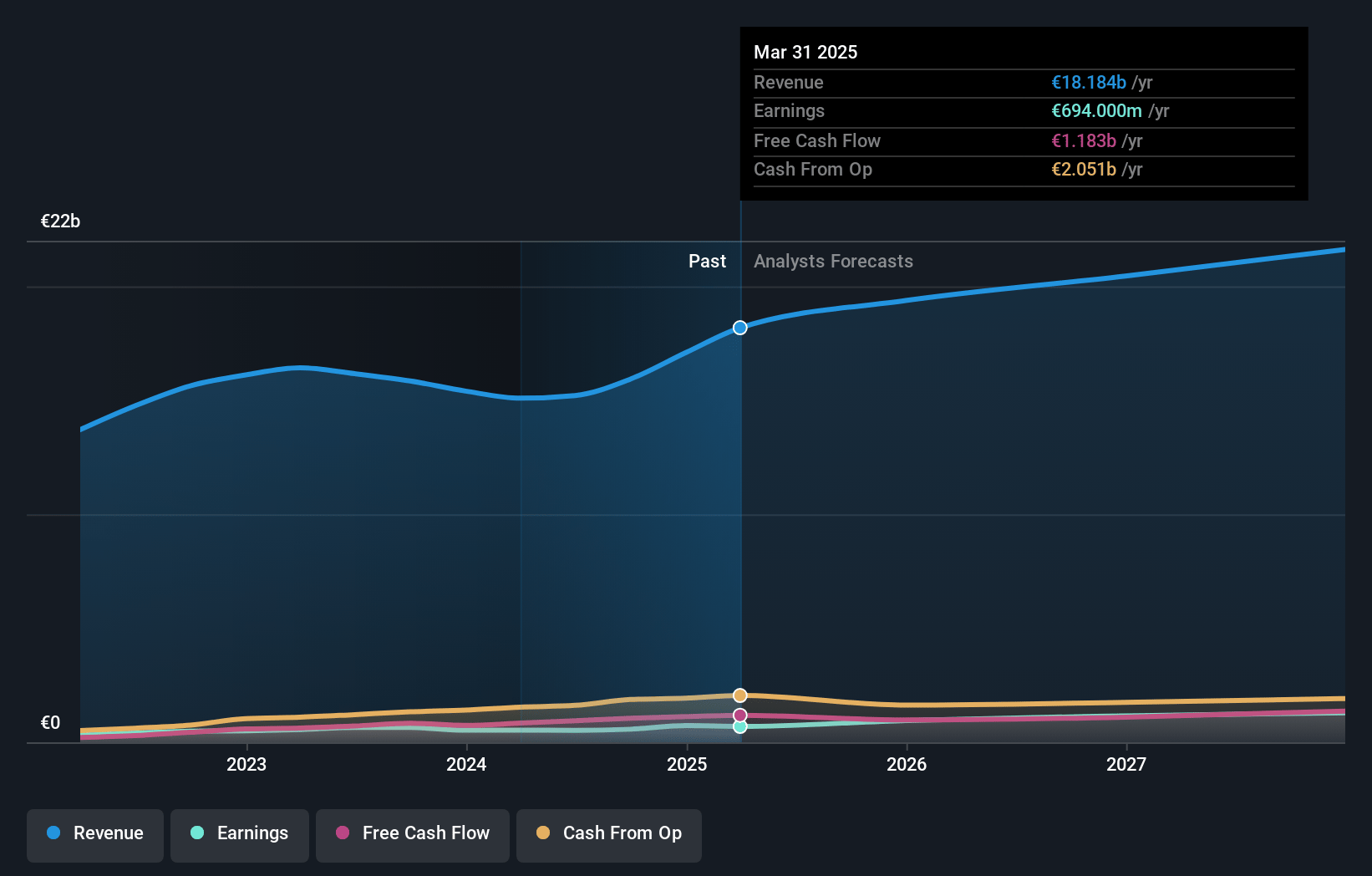

Prysmian Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Prysmian compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Prysmian's revenue will grow by 8.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 3.8% today to 7.0% in 3 years time.

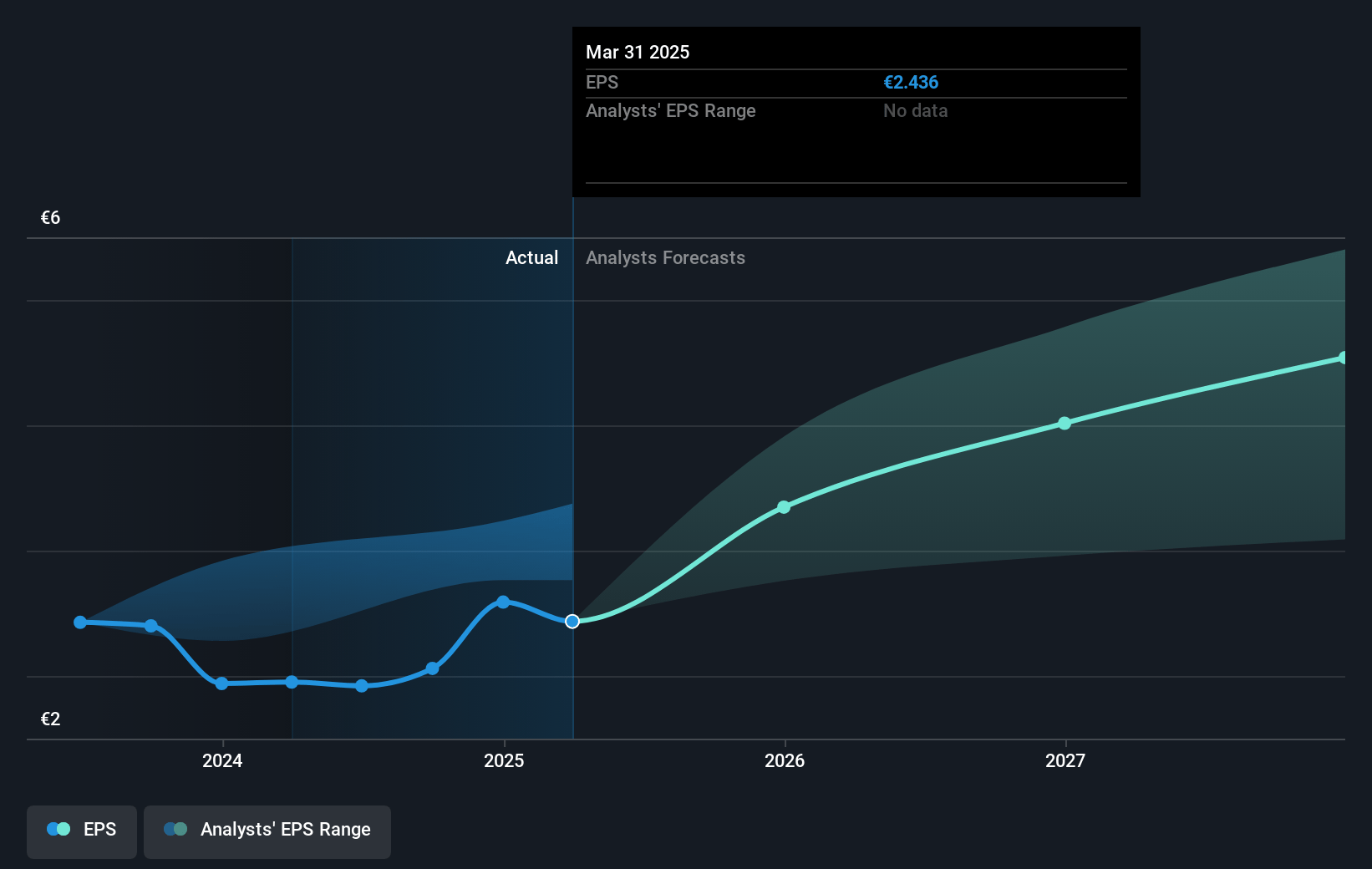

- The bullish analysts expect earnings to reach €1.6 billion (and earnings per share of €5.82) by about July 2028, up from €694.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 22.0x on those 2028 earnings, down from 25.2x today. This future PE is greater than the current PE for the GB Electrical industry at 14.1x.

- Analysts expect the number of shares outstanding to grow by 2.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.66%, as per the Simply Wall St company report.

Prysmian Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising input costs and volatility in key raw materials such as copper and aluminum, as well as temporary negative impacts from metal derivatives, could lead to sustained margin compression if Prysmian cannot consistently pass these costs through to customers, ultimately putting net margins and earnings at risk.

- The trend toward accelerating deglobalization and increasing trade protectionism, including tariffs and shifting customer behavior away from importers, could risk long-term disruptions to Prysmian's global supply chain and limit access to international markets, ultimately threatening revenue growth.

- Cyclical and project-based fluctuations in infrastructure spending-highlighted by project delays and potential cancellations (e.g., offshore wind projects being canceled in Europe)-create volatility in Prysmian's order book and revenue streams, especially if macroeconomic or political conditions shift, impacting long-term revenue and earnings visibility.

- Prysmian's significant exposure to mature and sometimes stagnating European markets, together with weaker ongoing demand for low-voltage products, may cap future revenue growth and earnings potential versus more geographically diversified peers.

- Large-scale integrations and acquisitions such as Encore Wire and Channell involve operational and execution risks; delayed synergies, higher financial charges, and possible goodwill impairments could negatively affect net income and return on capital, particularly as the company's debt load has risen.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Prysmian is €82.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Prysmian's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €82.0, and the most bearish reporting a price target of just €35.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €23.1 billion, earnings will come to €1.6 billion, and it would be trading on a PE ratio of 22.0x, assuming you use a discount rate of 12.7%.

- Given the current share price of €61.1, the bullish analyst price target of €82.0 is 25.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.