Key Takeaways

- Expanding ultra-wealthy demand, personalization options, and new hybrid/electric models are driving revenue growth, pricing power, and margin resilience.

- Diversification into lifestyle, strong brand engagement, and strict scarcity reinforce high margins and protect against economic downturns.

- Heightened trade and regulatory risks, slow EV transition, shrinking China demand, and luxury market shifts threaten Ferrari’s margins, revenue growth, and market positioning amid stronger competition.

Catalysts

About Ferrari- Through its subsidiaries, engages in design, engineering, production, and sale of luxury performance sports cars worldwide.

- The global rise in ultra-high-net-worth individuals and the expansion of wealth in emerging markets continue to drive Ferrari’s strong order book, with demand covering all current models through 2026 and robust traction for new launches like the Dodici Cilindri and upcoming hybrid/electric models, indicating future revenue growth.

- Personalization and experiential luxury remain key demand drivers, as evidenced by personalizations accounting for over 19% of total revenues and further investments in customization, directly supporting pricing power, higher average selling prices, and industry-leading net margins.

- The highly anticipated launch of Ferrari’s first fully electric model, the Ferrari Elettrica, with staged unveilings and October 2026 delivery start, positions the company at the forefront of sustainable luxury performance, unlocking premium pricing and expanding addressable volume, which should support both top-line growth and long-term margin resilience.

- Expansion of high-margin Lifestyle and non-automotive revenue streams—including new collectibles, sponsorships, and brand experiences—adds diversification beyond vehicle sales, promoting earnings growth and enhanced brand engagement that will positively impact overall EBITDA.

- Tight production discipline and the scarcity model continue to sustain demand far in excess of supply, reinforcing pricing discipline, residual values, and ongoing EBITDA margin strength, while ensuring long-term protection against macroeconomic volatility and market cyclicality.

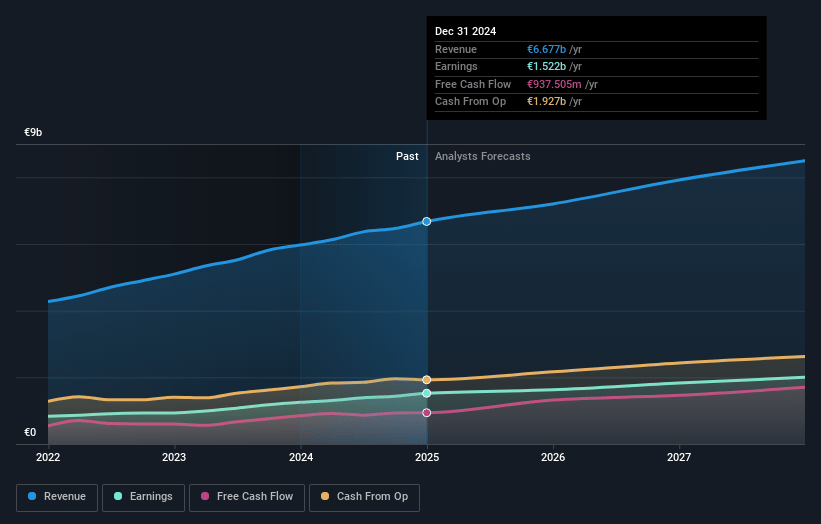

Ferrari Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ferrari's revenue will grow by 7.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 23.0% today to 23.5% in 3 years time.

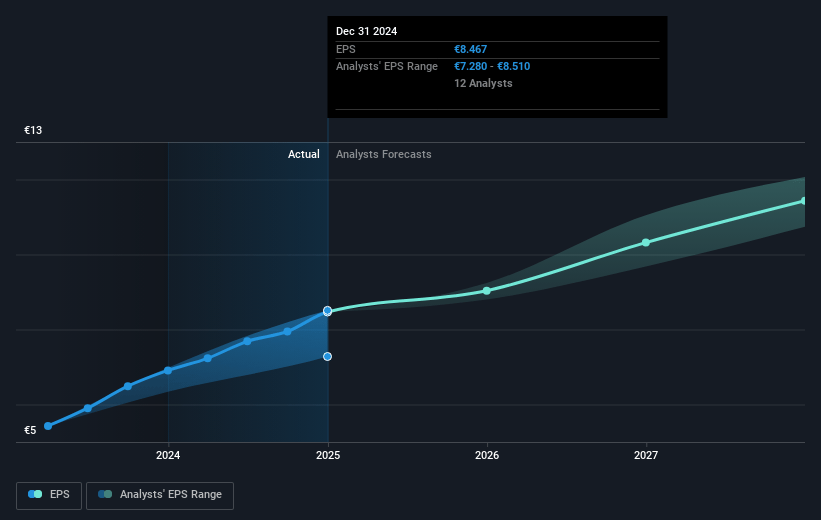

- Analysts expect earnings to reach €2.0 billion (and earnings per share of €11.5) by about July 2028, up from €1.6 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as €1.8 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 58.7x on those 2028 earnings, up from 48.3x today. This future PE is greater than the current PE for the US Auto industry at 29.5x.

- Analysts expect the number of shares outstanding to decline by 0.86% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.88%, as per the Simply Wall St company report.

Ferrari Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ferrari’s exposure to rising trade tensions and tariffs—especially new US import tariffs on EU cars—creates uncertainty for both pricing and volume, potentially pressuring US demand, squeezing net margins, and risking lower revenue expansion in its key US market.

- Persistently declining deliveries in Greater China, now down to 7% of volumes, highlight Ferrari's sensitivity to higher local taxes on flagship models and the risk that regulatory or economic headwinds in China could thwart growth in Asia, impacting future revenue streams.

- Ambitious electrification goals face execution risk, as the first full EV model will only launch in late 2026, raising concerns about whether Ferrari can transition fast enough to meet secular EV demand and regulations without compressing margins from higher R&D and capital expenditures.

- Ferrari’s ultra-luxury customer base remains small and concentrated; demographic shifts, changes in affluent customer preferences, or rising social scrutiny of luxury goods might reduce demand for iconic combustion vehicles or dilute brand value, creating long-term revenue stagnation risk.

- Intensifying competition from both incumbent luxury automakers investing in electrification and new, well-funded EV entrants may erode Ferrari’s market share and technological edge, especially as advanced technology and digital features become critical, potentially pressuring earnings and margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €443.608 for Ferrari based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €548.0, and the most bearish reporting a price target of just €360.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €8.6 billion, earnings will come to €2.0 billion, and it would be trading on a PE ratio of 58.7x, assuming you use a discount rate of 15.9%.

- Given the current share price of €428.5, the analyst price target of €443.61 is 3.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.