Key Takeaways

- Investments in advanced, sustainable auto parts and geographic diversification position CIR for long-term growth and resilience as industry shifts accelerate.

- Streamlining toward high-margin core businesses and improving healthcare segment capacity are driving profitability and reducing earnings volatility.

- Heavy reliance on mature European markets, unhedged currency risk, and challenging sector dynamics threaten CIR's growth, margins, and earnings stability across its core businesses.

Catalysts

About CIR. - Compagnie Industriali Riunite- Through its subsidiaries, primarily operates in the automotive components and healthcare sectors in Italy, the rest of European countries, North America, South America, Asia, and internationally.

- CIR's core auto component subsidiary is positioned to benefit from the accelerating transition to electric and greener vehicles, having already invested in advanced lightweight and sustainable parts; as OEMs shift production, this should increase Sogefi's volumes and support technology-driven revenue and margin growth.

- Persistent growth in the global vehicle fleet's age profile is set to drive recurring demand for parts and replacement components, which underpins stable, long-term revenue streams and helps smooth earnings volatility for suppliers like CIR.

- CIR's ongoing operational streamlining and focus on high-margin, core divisions has yielded improved EBIT and net results versus the prior year-continued divestiture of non-core/underperforming segments can further expand net margins and ROE.

- Increasing occupancy rates and greenfield capacity in the healthcare (KOS) segment, with further price/tariff adjustments expected in Europe, should drive sustained top-line growth and enhance net profitability as cost inflation is gradually offset.

- Diversified geographic exposure in both auto and healthcare businesses, particularly outside Western Europe, lowers market risk and positions CIR to capture additional revenue from higher-growth international markets, aiding earnings stability and long-term growth potential.

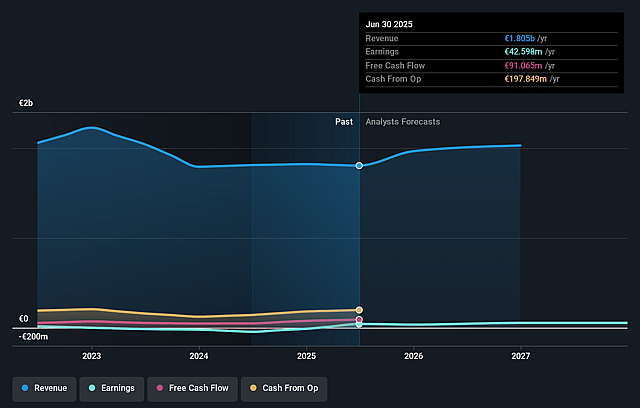

CIR. - Compagnie Industriali Riunite Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CIR. - Compagnie Industriali Riunite's revenue will grow by 8.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.4% today to 2.7% in 3 years time.

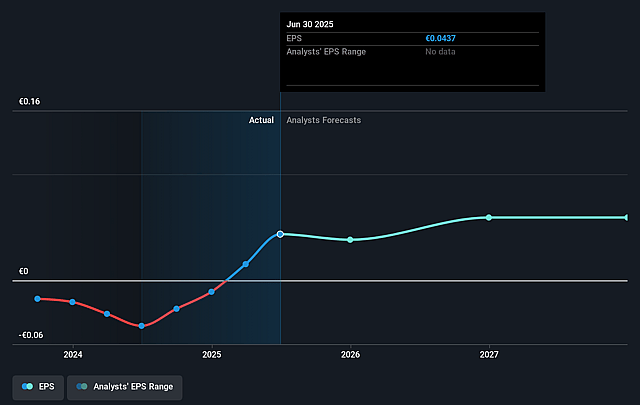

- Analysts expect earnings to reach €62.3 million (and earnings per share of €0.06) by about September 2028, up from €42.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.7x on those 2028 earnings, up from 12.6x today. This future PE is greater than the current PE for the GB Auto Components industry at 12.7x.

- Analysts expect the number of shares outstanding to decline by 1.01% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 17.78%, as per the Simply Wall St company report.

CIR. - Compagnie Industriali Riunite Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- CIR's exposure to ongoing global supply chain volatility and unpredictable geopolitical tensions-including significant currency fluctuations and unhedged exposure to the US dollar in its private equity portfolio-creates sustained cost pressures and operational disruptions, negatively impacting net income and cash flow predictability.

- The company's automotive subsidiary Sogefi faces persistent volume declines in core markets (especially in Europe and NAFTA) due to secular trends such as EV adoption and weak regional demand, which undermine long-term revenue growth and risk further contraction if Sogefi fails to capture market share in next-generation mobility platforms.

- CIR's healthcare business (KOS) operates in a highly regulated, public-funded environment with tariffs that have been frozen for six to seven years, constraining the ability to offset rising labor and input costs, leading to margin compression and limiting future earnings growth unless public policies change.

- Ongoing industry-wide consolidation and increasing pressure from automotive OEMs for lower pricing and risk-sharing in procurement contracts threaten Sogefi's pricing power and profitability relative to larger, more diversified competitors, putting CIR's future margins and revenue stability at risk.

- CIR's reliance on mature Western European markets for both its industrial and healthcare operations leaves it exposed to structurally low economic growth and heightened competition, which could result in long-term stagnation of revenue and increasing earnings volatility.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €0.84 for CIR. - Compagnie Industriali Riunite based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €2.3 billion, earnings will come to €62.3 million, and it would be trading on a PE ratio of 18.7x, assuming you use a discount rate of 17.8%.

- Given the current share price of €0.61, the analyst price target of €0.84 is 27.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.