Key Takeaways

- Increased solar capacity and operational coal plants position Tata Power for higher revenues and sustained margins amid rising demand.

- Significant projects and strategic investments in renewables and transmission are expected to drive robust revenue growth and profitability improvements.

- Weather disruptions and regulatory delays threaten Tata Power's revenues and earnings, while competition and supply chain issues pressure margins.

Catalysts

About Tata Power- Engages in the generation, transmission, distribution, and trading of electricity in India and internationally.

- The upcoming ramp-up and stabilization of Tata Power's solar cell manufacturing plant, expected by December, along with the full operation of the module manufacturing plant, signifies increased capacity and efficiency. This should lead to higher revenues from solar sales in the next few quarters.

- The expected increase in demand for coal-based power during the winter, due to maintenance shutdowns of other plants, can drive revenue up and sustain margins as Tata Power's coal plants remain operational.

- With significant investments in large utility-scale projects and an expected surge in rooftop solar orders in the third and fourth quarters, Tata Power is poised to expand its revenue base significantly.

- Approval and execution of several transmission projects and a 1,000-megawatt pump hydro project by early 2025 are expected to lead to sustained revenue growth from its transmission and renewable energy segments.

- Cost reductions and improved ratings on their debt, alongside anticipated regulatory asset realizations, will likely lead to better net margins and profitability, improving earnings in the coming quarters.

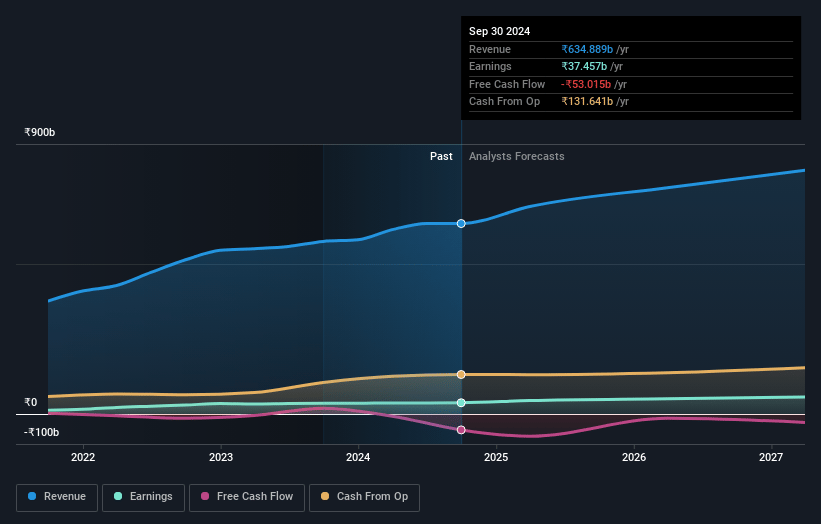

Tata Power Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Tata Power's revenue will grow by 9.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.9% today to 7.5% in 3 years time.

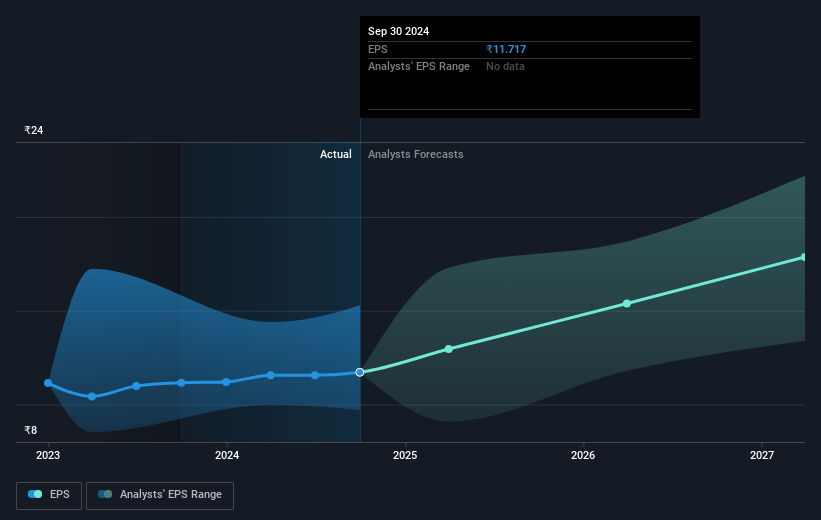

- Analysts expect earnings to reach ₹62.9 billion (and earnings per share of ₹18.56) by about January 2028, up from ₹37.5 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ₹71.0 billion in earnings, and the most bearish expecting ₹40.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.5x on those 2028 earnings, up from 29.9x today. This future PE is lower than the current PE for the GB Electric Utilities industry at 34.8x.

- Analysts expect the number of shares outstanding to grow by 1.97% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.15%, as per the Simply Wall St company report.

Tata Power Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The prolonged monsoon led to a muted power consumption, impacting Tata Power's revenue recovery, with potential lower revenues in wet and similar unplanned weather conditions.

- Supply chain disruptions impacted solar module production, indicating stabilization delays that could increase operational costs, affecting net margins.

- Regulatory delays and heavy rains in Odisha disrupted collections, which could affect earnings due to cash flow constraints.

- The extension of Section 11 without resolution on Supplementary PPA for Mundra implies reliance on temporary measures, increasing the risk of volatile revenue from this segment.

- Increased competition and potential low accretion in third-party solar orders could affect earnings if market dynamics force Tata Power to reduce prices and margins in response to competitive pressures.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹441.48 for Tata Power based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹583.0, and the most bearish reporting a price target of just ₹270.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹837.8 billion, earnings will come to ₹62.9 billion, and it would be trading on a PE ratio of 33.5x, assuming you use a discount rate of 12.2%.

- Given the current share price of ₹351.05, the analyst's price target of ₹441.48 is 20.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives