Key Takeaways

- Expansion in value-added logistics, tech adoption, and differentiated services positions TCI for higher margins and increased market share versus unorganized competitors.

- Infrastructure investment, digitalization, and sustainability initiatives are expected to improve efficiency, favor organized operators, and drive long-term profitability growth.

- Heavy reliance on asset-light operations, auto sector exposure, and rising competition raise risks to profitability, margins, and long-term value if investments and diversification lag.

Catalysts

About Transport Corporation of India- Provides end-to-end integrated supply chain and logistics solutions in India.

- Despite near-term macro headwinds, the rapid growth of e-commerce and quick commerce in India is expected to drive strong demand for integrated, tech-enabled logistics and last-mile delivery services, enlarging TCI's addressable market and supporting top-line revenue growth.

- The Indian government's continued infrastructure investments (e.g., highways, multimodal corridors), along with formalisation and digitization (GST, e-way bill adoption), are set to reduce logistics costs and favor organized players like TCI, improving market share and potentially enhancing operating margins as scale efficiencies deepen.

- TCI's ongoing expansion in high-margin verticals such as supply chain management (SCM), cold chain, and warehousing is likely to structurally lift consolidated net margins over time, especially as capacity additions in these segments start to yield incremental returns.

- Accelerated adoption of multimodal logistics (rail, sea, road) and differentiated end-to-end, value-added offerings (such as automated, IT-driven control towers and process automation for perishables) position TCI to win share from unorganized operators and command higher revenue per customer, strengthening both revenue growth and earnings quality.

- Strategic fleet modernization (new energy-efficient rigs/ships, digital transformation, and sustainability initiatives) not only aligns TCI with rising ESG requirements but also supports margin expansion through operational efficiencies, lowered emissions-related risks, and reduced long-term capex burden, translating to improved ROCE and net earnings.

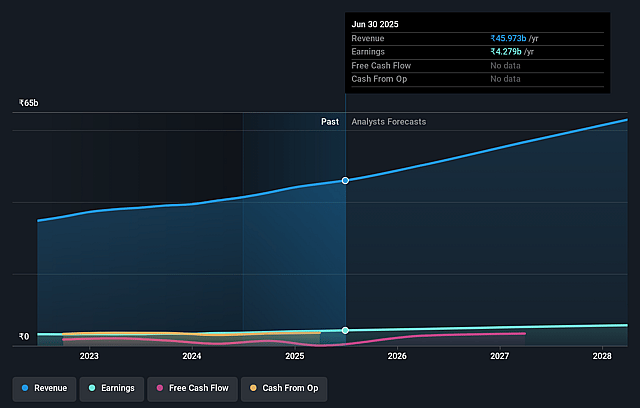

Transport Corporation of India Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Transport Corporation of India's revenue will grow by 12.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 9.3% today to 9.1% in 3 years time.

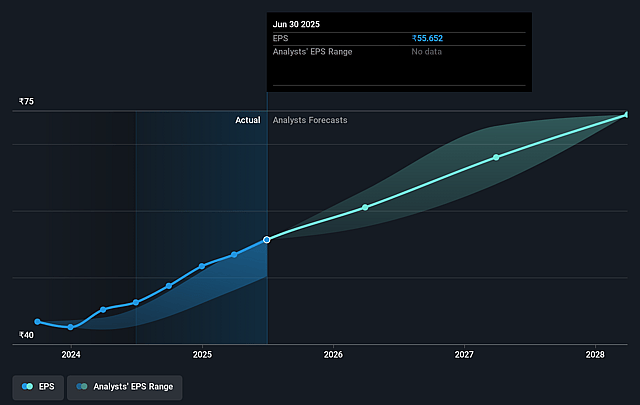

- Analysts expect earnings to reach ₹5.9 billion (and earnings per share of ₹72.72) by about September 2028, up from ₹4.3 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.8x on those 2028 earnings, up from 21.1x today. This future PE is greater than the current PE for the IN Logistics industry at 22.4x.

- Analysts expect the number of shares outstanding to decline by 1.49% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.56%, as per the Simply Wall St company report.

Transport Corporation of India Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Asset-light strategy in core freight and supply chain businesses could expose TCI to margin compression and market share erosion if asset-owning competitors optimize costs or gain pricing power during periods of overcapacity or heightened competitive intensity, potentially leading to lower net margins and revenue growth.

- Continued concentration in automotive logistics (75–80% of supply chain business) makes TCI vulnerable to cyclical slowdowns in the auto sector and heightened client concentration risk, risking revenue volatility and constraining earnings during sector downturns.

- Seaways division's recent margin expansion has been supported by temporary global supply disruptions (e.g., Middle East crisis); normalization or increased supply on Indian routes could drive down freight rates and margins, while upcoming ship additions will initially elevate depreciation and interest costs, negatively impacting net earnings and return measures in the medium term.

- Rising competitive intensity from asset-light, tech-focused digital logistics start-ups-some backed by venture capital and offering aggressive pricing and automation-may erode TCI's pricing power and market share, affecting revenue growth and profitability if TCI's in-house investments in technology do not keep pace.

- High and ongoing capital expenditure (₹400–450 crores annually) combined with further potential ship acquisitions could pressure TCI's balance sheet; if asset utilization or returns on incremental capital lag, interest costs may rise and ROCE may fall, putting downward pressure on net earnings and long-term shareholder value.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1365.778 for Transport Corporation of India based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹64.7 billion, earnings will come to ₹5.9 billion, and it would be trading on a PE ratio of 24.8x, assuming you use a discount rate of 13.6%.

- Given the current share price of ₹1178.6, the analyst price target of ₹1365.78 is 13.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.