Key Takeaways

- Limited shift from road to rail and competition from digital platforms threaten CONCOR's revenue growth and traditional business model.

- Rising costs from sustainability investments, regulatory pressures, and increased competition risk compressing margins and destabilizing earnings.

- Strategic investments in expansion, operational efficiency, and value-added services position the company for higher market share, sustainable growth, and margin improvement despite competition.

Catalysts

About Container Corporation of India- Engages in handling, transportation, and warehousing activities in India.

- Global trade pattern shifts such as nearshoring, regionalization, and the persistent stagnation or reduction of India's rail coefficient at key ports like JNPT and Mundra indicate that the anticipated transition from road to rail for containerized freight may underwhelm, limiting both future volume growth and CONCOR's abilities to capture incremental revenue from the much-hyped Dedicated Freight Corridor investments.

- Accelerating technological disruption by digital freight platforms and the rise of integrated supply chain startups threaten to erode CONCOR's pricing power and position, potentially disintermediating its traditional rail logistics model; over time, this would depress margins and restrict sustainable earnings growth despite the company's ongoing investment in infrastructure.

- The looming requirement for large-scale investments in greener and more sustainable logistics-underscored both by management ESG initiatives and the relentless tightening of environmental regulations-could materially increase capital expenditure and ongoing operating costs, pressuring already stable EBITDA margins and threatening net margins if CONCOR cannot pass through these extra costs to its price-insensitive, contract-bound customers.

- Intensifying competitive pressures from private logistics and multimodal operators, exacerbated by Indian Railways opening up freight corridors and by CONCOR's recent trend of offering volume-based discounts, will likely result in margin compression and stiffer pricing competition as these players chase organized market share, leading to downward pressure on both revenue per TEU and overall earnings quality.

- A combination of volatile global freight rates, ongoing disputes and cost escalations regarding land license fees, and slow progress in diversifying services beyond rail-based container handling increase the risk of unpredictable and stagnant revenue streams, exposing CONCOR to abrupt drops in net earnings if cyclical or structural setbacks occur in either international trade flows or domestic logistics demand.

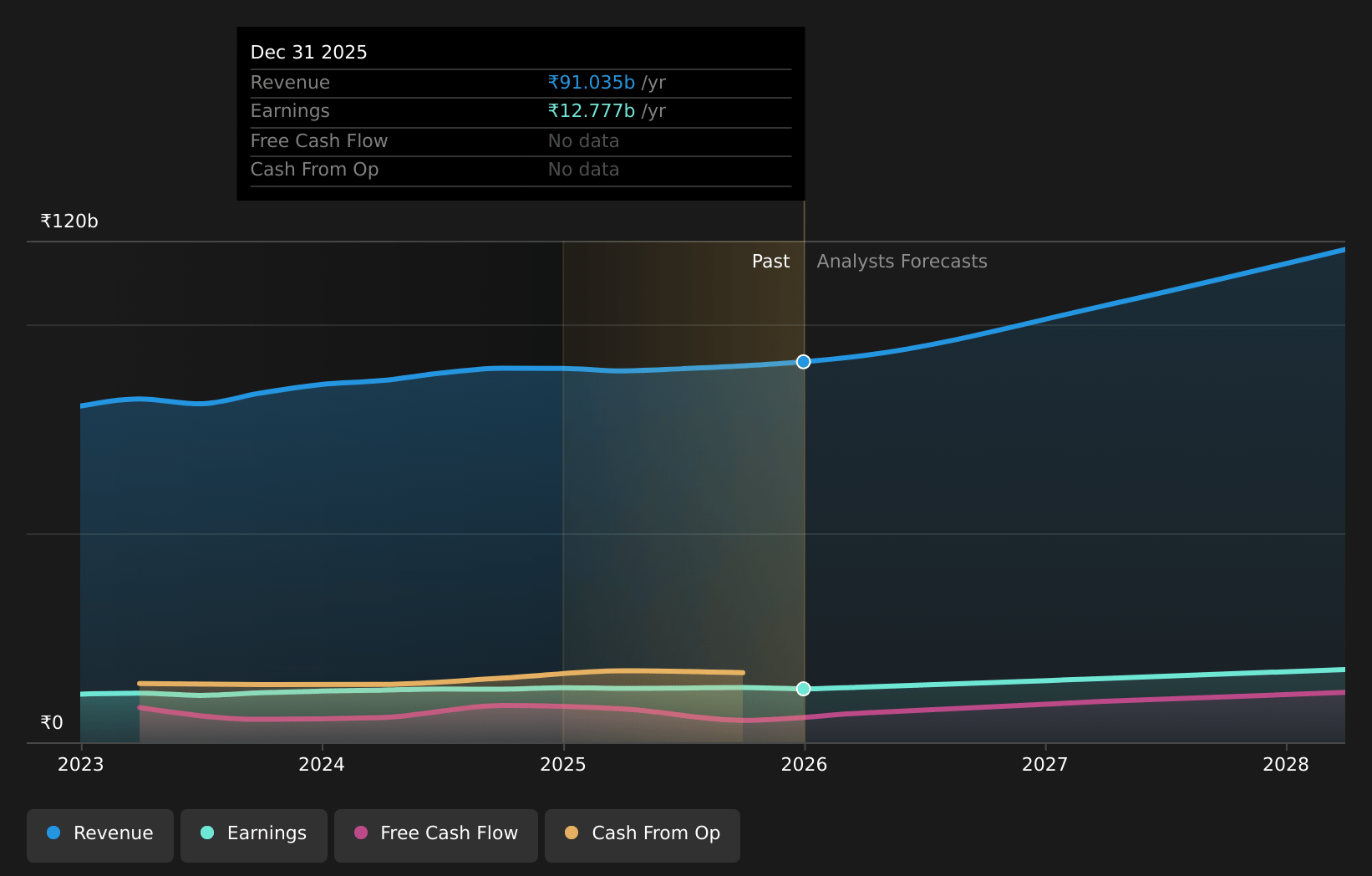

Container Corporation of India Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Container Corporation of India compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Container Corporation of India's revenue will grow by 10.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 14.5% today to 15.9% in 3 years time.

- The bearish analysts expect earnings to reach ₹19.2 billion (and earnings per share of ₹25.16) by about July 2028, up from ₹12.9 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 28.9x on those 2028 earnings, down from 36.0x today. This future PE is greater than the current PE for the IN Transportation industry at 20.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.23%, as per the Simply Wall St company report.

Container Corporation of India Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Robust expansion plans, such as the targeted commissioning of 100 terminals, 500-plus rakes, and 70,000 containers by 2028, indicate the company's intention to support long-term volume growth and asset utilization, which could underpin increasing revenues and earnings over the coming years.

- The committed shift from road to rail, especially with the impending completion of the Western Dedicated Freight Corridor (WDFC), is likely to drive substantial modal shift, lower costs, and higher market share for CONCOR, supporting sustainable improvement in volumes and operating margins.

- Stable to rising market share in key ports (like JNPT, Mundra, Pipavav) despite competitive pressures and maintenance of high rail freight and operating margins demonstrate resilience in the company's business model, which could continue to support net margins and overall profitability.

- Strategic moves into value-added services-such as end-to-end logistics, first and last-mile connectivity, green logistics, and agreements with major corporations for bulk movement-may enable an enhanced share of wallet and yield improvement per container, directly benefiting both top-line growth and margins.

- Continued focus on operational efficiency, as evidenced by a persistent decline in empty running costs and ongoing efforts to optimize lead distances and asset deployment, may result in further cost savings and improved EBITDA and net margins even in a challenging environment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Container Corporation of India is ₹490.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Container Corporation of India's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹950.0, and the most bearish reporting a price target of just ₹490.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹120.6 billion, earnings will come to ₹19.2 billion, and it would be trading on a PE ratio of 28.9x, assuming you use a discount rate of 14.2%.

- Given the current share price of ₹609.35, the bearish analyst price target of ₹490.0 is 24.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.