Key Takeaways

- Major capacity investments and automation are set to boost revenues, efficiency, and margins, positioning the company for long-term expansion and earnings quality.

- Strong government support and diverse, expanding client relationships reduce risks and enable sustained sales growth, increased resilience, and improved return ratios.

- Heavy dependence on expiring government incentives, rising inventory levels, limited R&D, and capital-intensive projects challenge sustained margin growth and magnify risks from demand or cost volatility.

Catalysts

About PG Electroplast- Provides electronic manufacturing services for original equipment and design manufacturers in India and internationally.

- The company is ramping up major capacity investments (greenfield plants for ACs, washing machines, and refrigerators) to position itself for multi-year demand growth driven by expanding urbanization, rising middle-class consumption, and higher adoption of consumer durables in India; once these assets come online, they are set to drive a step-change in revenues and margin accretion through greater scale and operating leverage.

- Continued government incentives (PLI, state-level support) and the shift toward local manufacturing (bolstered by “China+1” and Make in India policies) are enabling PG Electroplast to onboard more brands as clients and win larger contract sizes, giving clear visibility for above-industry sales growth and ongoing EBITDA improvement.

- Investment in automation, R&D and higher-value product segments (like compressors and ODM) is expected to yield enhanced cost efficiency, more differentiated product offerings, and a shift to higher margin business, all of which will support long-term expansion in net margins and overall earnings quality.

- The company’s expanding relationships with over 35 brands (reducing customer concentration risk) and entrance into new categories such as refrigerators and EV assembly position it to benefit disproportionately from the growing trend of brands outsourcing manufacturing, thus increasing revenue predictability and earnings resilience.

- With net cash on the balance sheet and a disciplined approach to capital allocation, PG Electroplast is set to finance growth internally, mitigate interest cost risks, and maximize reinvestment for future expansion, all of which should translate into sustained growth in return ratios and bottom-line earnings.

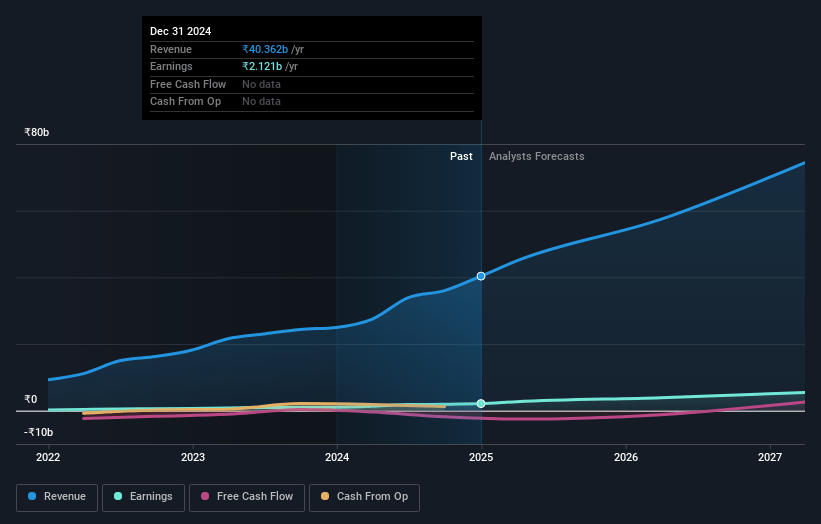

PG Electroplast Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming PG Electroplast's revenue will grow by 27.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.9% today to 7.6% in 3 years time.

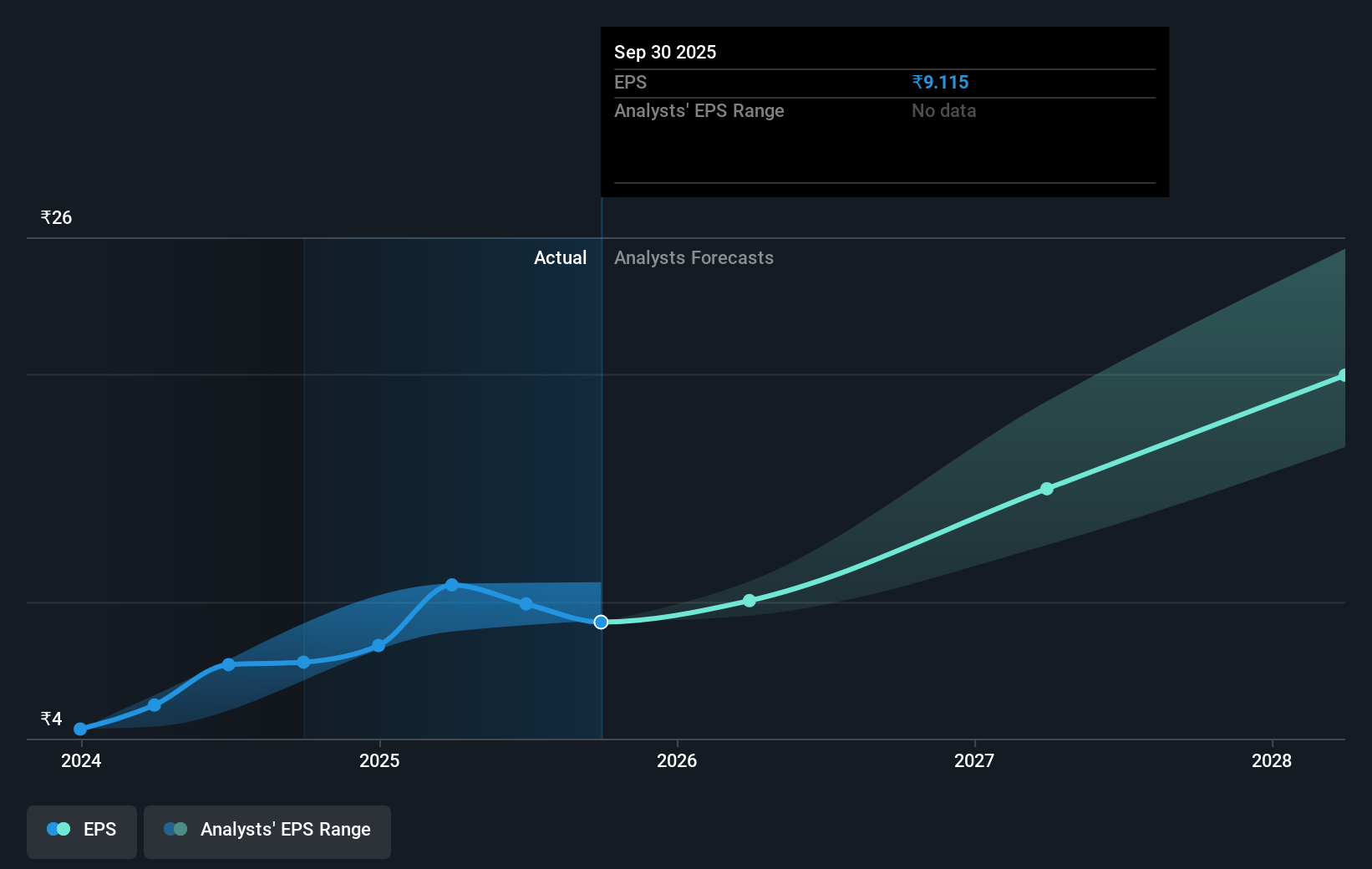

- Analysts expect earnings to reach ₹7.7 billion (and earnings per share of ₹26.83) by about July 2028, up from ₹2.9 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 65.6x on those 2028 earnings, down from 77.9x today. This future PE is greater than the current PE for the IN Electronic industry at 40.9x.

- Analysts expect the number of shares outstanding to grow by 4.7% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.61%, as per the Simply Wall St company report.

PG Electroplast Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on government Production Linked Incentive (PLI) schemes and state incentives, which are scheduled to phase out in 2-3 years, poses a significant risk to sustaining high revenue growth and net margins once these incentives end.

- Increasing inventory levels—particularly due to strategic stockpiling of compressors to mitigate supply chain and regulatory risks—elevate working capital requirements, potentially impacting future cash flows and earnings if demand slows or inventory turns remain high.

- Limited R&D expenditure (currently ~0.5–0.75% of turnover) compared to industry leaders could restrict long-term movement up the value chain and margin expansion, challenging the company’s ability to defend net margins against rising competition and technological change.

- Slowdown in the plastic division, driven by lower petroleum prices and a pass-through pricing model, indicates vulnerability to input cost volatility and limits the overall revenue growth rate, especially if similar commodity-linked pricing dynamics affect other business divisions.

- Intensifying capital expenditure (₹800–900 crores in FY ’26 and further greenfield expansions) increases operating and financial leverage; any underutilization of new capacity or delays in achieving expected asset turns could pressure return on capital and depress earnings in a downturn.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1035.0 for PG Electroplast based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1250.0, and the most bearish reporting a price target of just ₹756.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹101.8 billion, earnings will come to ₹7.7 billion, and it would be trading on a PE ratio of 65.6x, assuming you use a discount rate of 14.6%.

- Given the current share price of ₹791.4, the analyst price target of ₹1035.0 is 23.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.