Key Takeaways

- Strategic acquisitions and R&D in high-tech defense innovations are set to enhance revenue and profit margins through product diversification and market share gains.

- International expansion plans, including a U.S. manufacturing facility, aim to boost long-term revenue streams from North American and European markets.

- Delayed order materialization, M&A risks, and geopolitical pressures could affect Zen Technologies' revenue stability, margins, and require substantial R&D investment impacting short-term profitability.

Catalysts

About Zen Technologies- Together with its subsidiary, designs, develops, manufactures, and sells training simulators in India and internationally.

- Zen Technologies anticipates a significant increase in domestic orders, estimating ₹800 crores in the pipeline, expected to materialize by the second quarter of the next financial year. This will likely boost future revenue growth.

- The company is targeting an average growth of 50% CAGR over the next three years, supported by an expanded market size estimate, which should positively impact both top-line revenue and bottom-line earnings.

- Recent strategic acquisitions, including ARI for naval simulations and Vector Technics for drone technology, aim to diversify and strengthen Zen's product offerings, potentially enhancing both revenue and margin profiles through synergies and expanded market opportunities.

- Zen's focus on deep R&D and innovation, particularly in developing state-of-the-art anti-drone systems, positions it to capture substantial market share in high-tech, defense-related products, potentially improving both revenue and profit margins.

- The company plans to accelerate its international expansion, particularly in the U.S., with expectations of establishing a manufacturing facility to tap into the North American and European markets, which could significantly enhance revenue streams from FY '27 onward.

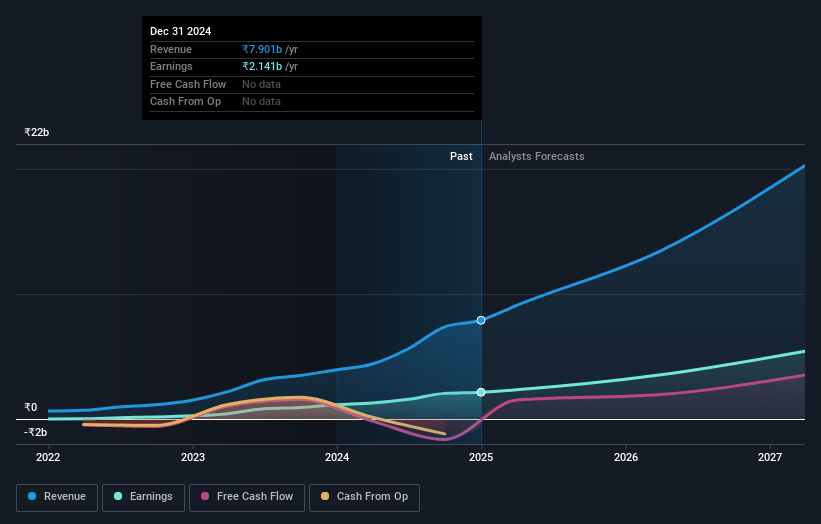

Zen Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Zen Technologies's revenue will grow by 49.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 27.1% today to 26.7% in 3 years time.

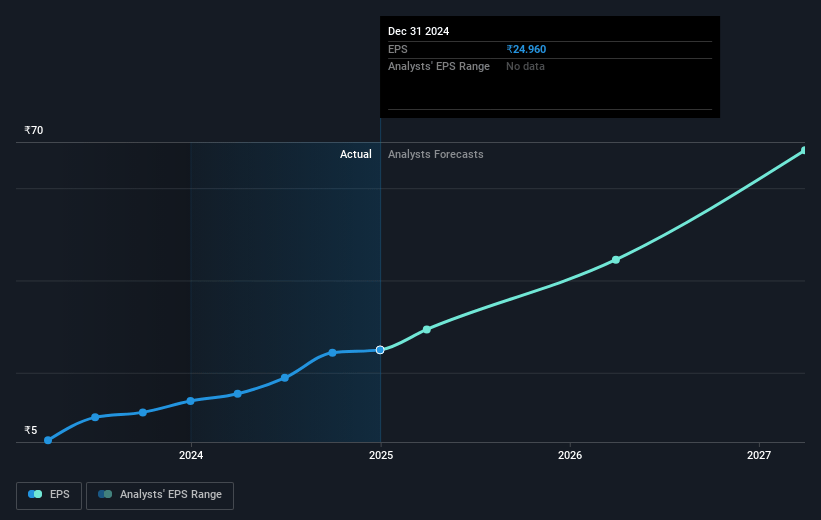

- Analysts expect earnings to reach ₹7.1 billion (and earnings per share of ₹90.56) by about February 2028, up from ₹2.1 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 40.5x on those 2028 earnings, down from 47.0x today. This future PE is lower than the current PE for the IN Electronic industry at 42.2x.

- Analysts expect the number of shares outstanding to grow by 6.93% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.58%, as per the Simply Wall St company report.

Zen Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The delayed materialization of expected orders, which were anticipated to begin from December, poses an uncertainty in future revenue streams and could impact earnings projections.

- The success rate of mergers and acquisitions being generally low at 10% to 25% highlights a significant risk with Zen Technologies' recent acquisitions, which might affect net margins if integration challenges arise.

- The Indian government's procurement process's pace and potential geopolitical pressures, such as defense deals with the U.S., could result in slower or reduced revenue inflow from domestic orders.

- Unpredictability in the order pipeline for export markets, coupled with competition and dependency on securing foreign contracts, introduces revenue instability and pressure on profit margins.

- The technological advancements and innovations in the anti-drone and naval simulator sectors necessitate substantial R&D investments, which could affect short-term profitability and pressure earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1740.0 for Zen Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1970.0, and the most bearish reporting a price target of just ₹1600.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹26.6 billion, earnings will come to ₹7.1 billion, and it would be trading on a PE ratio of 40.5x, assuming you use a discount rate of 14.6%.

- Given the current share price of ₹1113.7, the analyst price target of ₹1740.0 is 36.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives