Key Takeaways

- Investments in AI-led digital transformation, proprietary platforms, and global expansion are driving revenue growth, client retention, and differentiation in next-generation technologies.

- Merger synergies and operational transformation are boosting margins, while broad-based IT outsourcing demand supports sustainable, profitable long-term growth.

- Cautious client spending, incomplete merger synergies, high utilization risks, pricing pressure, and disruptive technology trends could constrain LTIMindtree's revenue growth and margin expansion.

Catalysts

About LTIMindtree- A technology consulting and digital solutions company, provides information technology services and solutions in India, North America, Europe, and internationally.

- Strong acceleration in large deal wins (order inflow up 17% YoY, with multi-service/multi-year contracts and a robust pipeline), together with the company's increased focus on AI-led digital transformation for clients, positions LTIMindtree to capture surging enterprise investments in AI, automation, and cloud-driving significant revenue expansion and higher deal sizes.

- Launch and scaling of proprietary AI ecosystem BlueVerse and AI Foundry, plus new offerings like GCC-as-a-Service, are expected to strengthen LTIMindtree's differentiation in next-gen technologies, improving long-term client retention and supporting sustainable net margin expansion.

- Integration synergies from the LTI and Mindtree merger, as well as the ongoing fit-for-future program (focused on sales transformation, operational efficiency, agile cost management, and sales productivity), are beginning to show in EBIT margin improvement, with the potential for further operating leverage and earnings growth ahead.

- Growing presence in high-growth international markets (e.g., ramp-up of NextEra JV in Saudi Arabia, European sequential growth of 9.7%) and expansion in verticals like retail/consumer, BFSI, and manufacturing, align with broad-based worldwide IT services demand and the secular trend towards IT outsourcing, providing both revenue and margin tailwinds.

- Persistent shift among global enterprises towards remote work, cybersecurity, and data privacy compliance (as evidenced by industry recognitions and partnerships with hyperscalers and platform providers) creates recurring high-value service opportunities that can support durable, higher-quality revenue and increasing long-term profitability.

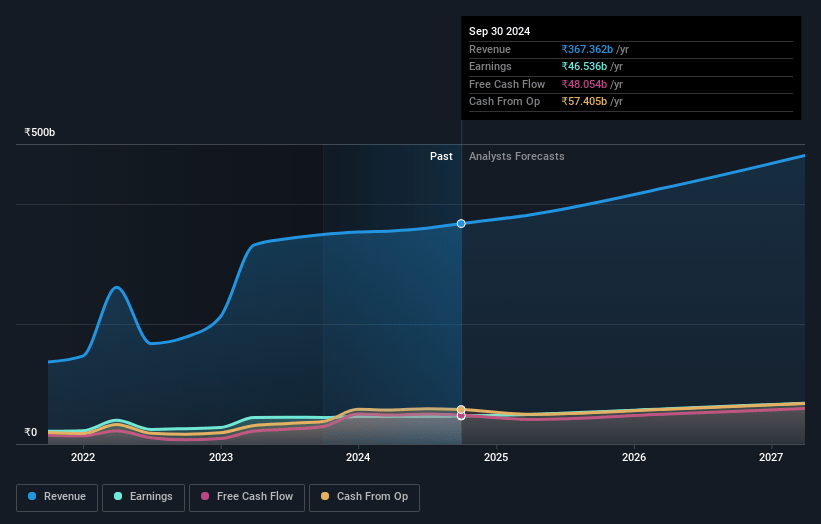

LTIMindtree Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming LTIMindtree's revenue will grow by 9.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.2% today to 13.5% in 3 years time.

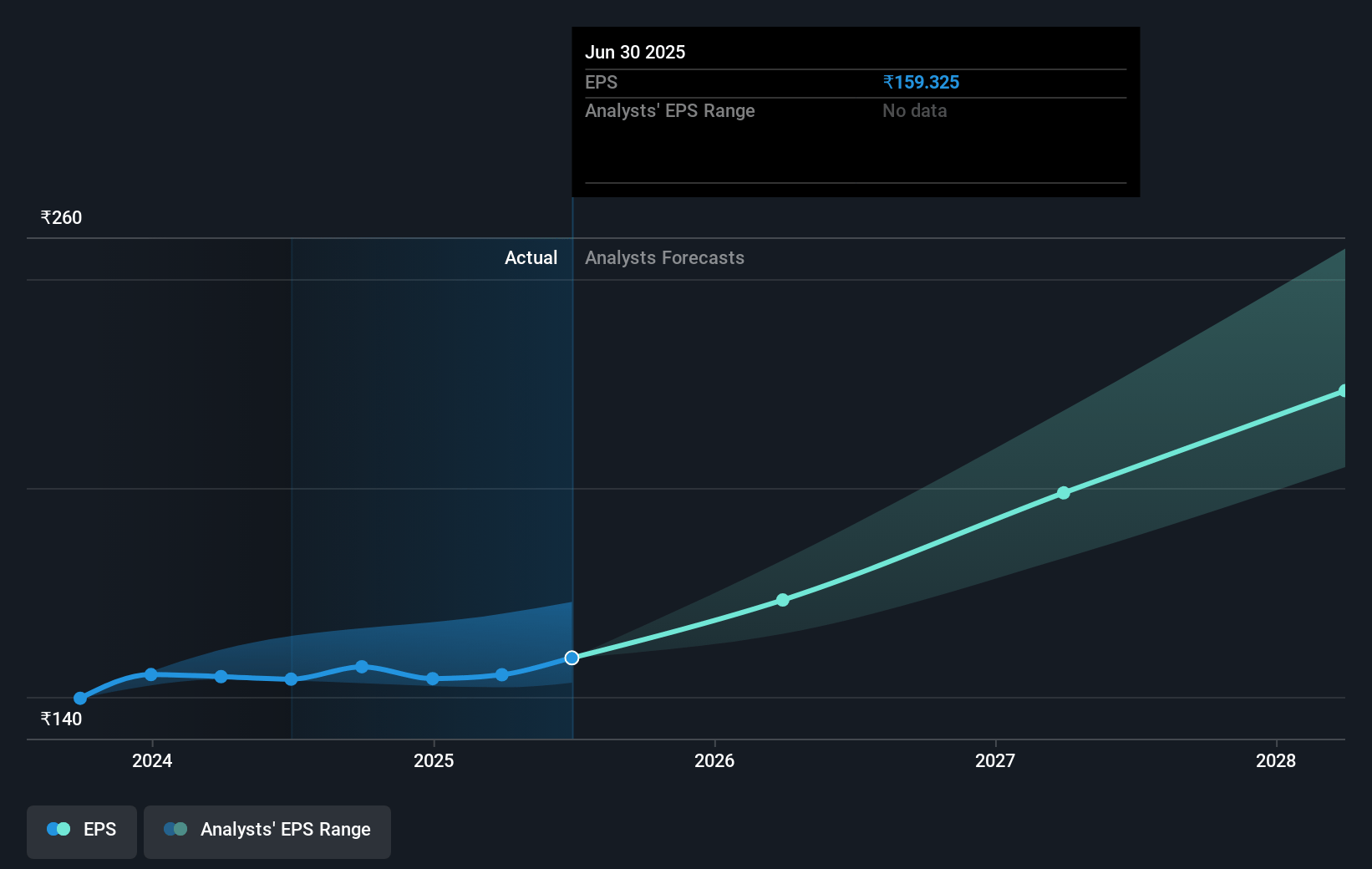

- Analysts expect earnings to reach ₹68.6 billion (and earnings per share of ₹230.29) by about July 2028, up from ₹47.2 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ₹76.3 billion in earnings, and the most bearish expecting ₹60.9 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 35.8x on those 2028 earnings, up from 33.3x today. This future PE is greater than the current PE for the IN IT industry at 30.1x.

- Analysts expect the number of shares outstanding to grow by 0.08% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.41%, as per the Simply Wall St company report.

LTIMindtree Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Demand in key verticals like BFSI and Hi-Tech remains cautious, with management highlighting ongoing macroeconomic uncertainty and account-specific challenges; this could restrict sustained revenue growth if large clients reduce IT spending or are slow to renew projects.

- The ongoing merger integration between LTI and Mindtree has not fully unlocked its cross-sell/upsell potential among top clients, and management admits further progress is needed; if these synergies remain unrealized, expected margin improvement and earnings growth could fall short of projections.

- Ramp-ups in large deals may pressure utilization and resource allocation, with management warning current high utilization rates (88%+) are above their long-term preferred level; a decline in utilization, or over-reliance on freshers and delayed hiring, could adversely impact both revenue realization and margins.

- The company acknowledges a market-wide trend towards cost takeouts, vendor consolidation, and clients demanding "productivity benefits"-this could create pricing pressure, requiring LTIMindtree to deliver more value for less, compressing net margins even as revenue grows.

- Although the company is investing heavily in AI, automation, and innovation (e.g., BlueVerse ecosystem), accelerated client adoption of Gen AI and process automation could make some traditional IT services less relevant, resulting in long-term revenue headwinds if LTIMindtree fails to sufficiently diversify and reposition its service portfolio.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹5379.2 for LTIMindtree based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹6273.0, and the most bearish reporting a price target of just ₹4050.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹506.8 billion, earnings will come to ₹68.6 billion, and it would be trading on a PE ratio of 35.8x, assuming you use a discount rate of 15.4%.

- Given the current share price of ₹5298.0, the analyst price target of ₹5379.2 is 1.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.