Key Takeaways

- Strategic expansion in China and cost efficiencies, focusing on global OEMs and adjacency, aims to enhance revenue and competitive positioning.

- Leveraging cybersecurity and client diversification in automotive and commercial vehicles targets top-line growth and improved margins.

- Heavy reliance on China for growth and slow OEM spending pose risks to revenue, while increased competition pressures KPIT to invest in R&D, affecting margins.

Catalysts

About KPIT Technologies- Provides embedded software, artificial intelligence, and digital solutions for the automobile and mobility sector in the Americas, the United Kingdom, Europe, and internationally.

- KPIT Technologies is focusing on geographical adjacency, offering expansion, and vertical adjacency. The company's strategy to take learnings from the Chinese market and apply them globally, especially in terms of new features and cost reduction, is expected to improve its competitive positioning and drive future revenue growth.

- The company is targeting significant opportunities in China by leveraging its expertise in architecture and digital cockpit solutions to benefit global OEMs. This is expected to enhance its revenue streams from existing and new clients in the emerging Chinese market.

- KPIT is expanding its offerings in cost reduction, cybersecurity, and end-to-end validation, which are anticipated to address global automotive industry challenges. This strategic move is likely to support revenue growth and improve the company's net margins by targeting high-demand areas.

- KPIT is pursuing vertical adjacency by engaging with new clients in commercial vehicles and off-highway equipment, which should diversify revenue sources and potentially increase top-line growth.

- The company's strategy to capitalize on European OEMs' vendor consolidation and the move towards transformative fixed-price models and offshoring could lead to improved margins and cost efficiencies, providing a catalyst for earnings growth.

KPIT Technologies Future Earnings and Revenue Growth

Assumptions

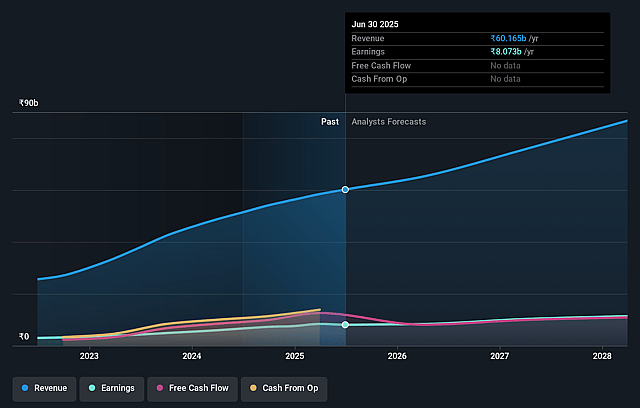

How have these above catalysts been quantified?- Analysts are assuming KPIT Technologies's revenue will grow by 14.4% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 14.4% today to 14.2% in 3 years time.

- Analysts expect earnings to reach ₹12.4 billion (and earnings per share of ₹44.56) by about July 2028, up from ₹8.4 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as ₹13.9 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 45.9x on those 2028 earnings, up from 41.2x today. This future PE is greater than the current PE for the IN Software industry at 38.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.05%, as per the Simply Wall St company report.

KPIT Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The reliance on China as a growth avenue introduces political and economic uncertainties due to geopolitical tensions and potential trade barriers, which could impact revenue generation from the region.

- The slow ramp-up and cautious spending by OEM clients, particularly in converting orders into revenue, suggest potential delays in realizing anticipated revenue growth, affecting the overall revenue projections.

- The uncertainty surrounding global tariffs, especially those impacting the automotive sector, could delay or hinder strategic initiatives and agreement executions with OEMs, impacting revenue and net margins.

- Increased competition from Chinese automotive companies and the need to keep up with rapid innovation in the sector could pressure KPIT to continuously invest heavily in R&D, potentially affecting earnings and net margins.

- A broad-based strategy, including geographical and vertical adjacencies, risks overextending resources and diluting focus, which may lead to inefficiencies in execution, thus impacting net profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1379.9 for KPIT Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1590.0, and the most bearish reporting a price target of just ₹1000.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹87.4 billion, earnings will come to ₹12.4 billion, and it would be trading on a PE ratio of 45.9x, assuming you use a discount rate of 15.1%.

- Given the current share price of ₹1274.1, the analyst price target of ₹1379.9 is 7.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.