Key Takeaways

- Strategic expansion into North America and SME-focused investments are poised to drive revenue growth through enhanced market access and service integration.

- Strong market recognition and a debt-free status bolster financial resilience and strategic growth, enhancing Intellect Design Arena's reputation and potential earnings.

- Intellect Design Arena's expansion and investments could strain short-term margins, while realizing strategic benefits and converting pipelines are crucial for sustained growth.

Catalysts

About Intellect Design Arena- Provides software development and related services for banking, insurance, and other financial services in India and internationally.

- Intellect Design Arena's strategic move to expand its presence in North America, including an agreement with Central One Credit Union, positions it to enhance revenue growth through access to a substantial network of Canadian credit unions and the potential for cross-selling opportunities. This move is expected to significantly increase recurring revenue streams and further boost ARR by ₹200 crores.

- Investment in Higivation Digital Solutions to strengthen the SME enablement strategy through Global Linker aims to tap into the vibrant SME segment, forecasted as a key growth engine in trade and supply chain finance. This could drive revenue growth as the company integrates these SME services with its banking and procurement platforms.

- The eMACH.ai platform’s recent selection by major institutions across multiple regions underpins Intellect Design Arena's potential to drive significant growth in licensing and implementation revenue. Its adoption for digital transformation across the banking and insurance sectors is likely to accelerate earnings.

- Continued market recognition and awards for Intellect Design Arena’s platforms, like the strong performer rating from Forrester Wave, enhance the company's reputation, supporting potential revenue growth through increased market penetration and customer acquisitions.

- The company’s significant cash reserves and debt-free status provide operational stability and financial resilience, enabling strategic investments without financial strain, which in turn supports sustainable earnings growth over time.

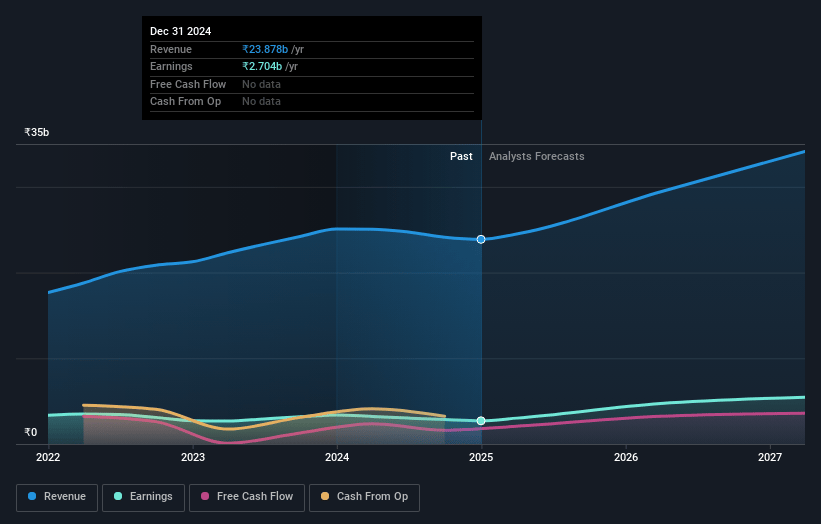

Intellect Design Arena Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Intellect Design Arena's revenue will grow by 16.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.3% today to 17.1% in 3 years time.

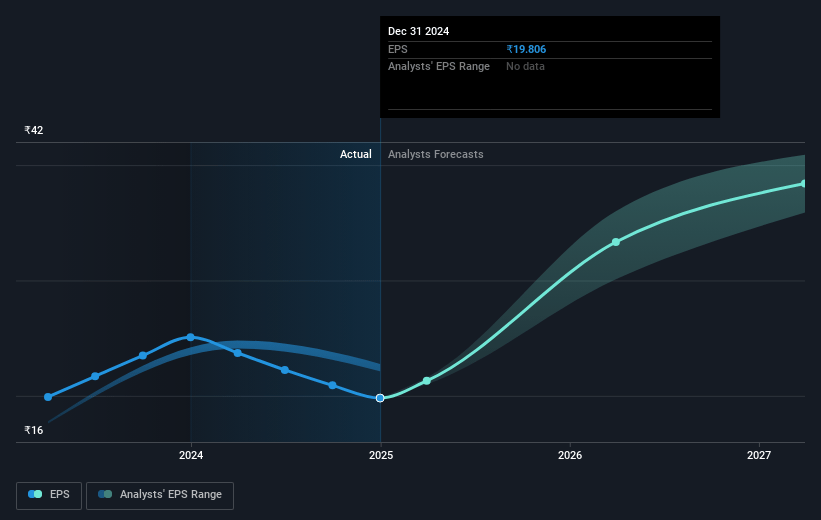

- Analysts expect earnings to reach ₹6.4 billion (and earnings per share of ₹44.86) by about May 2028, up from ₹2.7 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.6x on those 2028 earnings, down from 40.5x today. This future PE is greater than the current PE for the IN Software industry at 30.0x.

- Analysts expect the number of shares outstanding to grow by 1.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.95%, as per the Simply Wall St company report.

Intellect Design Arena Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intellect Design Arena’s expansion into North America, particularly with their acquisition of the digital banking operations from Central One Credit Union, could initially be margin dilutive, which might affect short-term profitability until cross-selling opportunities are fully realized. [Earnings, Net Margins]

- Although the company is achieving new deals and growing its pipeline, the conversion of this pipeline into actual revenues has experienced delays, which could result in inconsistent revenue growth in the short term. [Revenue, Net Margins]

- Significant investment in R&D continues, with approximately ₹140 crores capitalized and ₹200 crores expensed, potentially affecting net margins if new products don't yield expected returns. [Net Margins, Earnings]

- The anticipated benefits from AI integration for operational efficiencies might take time to materialize, and failure to achieve the intended cost reductions could impact long-term profitability growth. [Net Margins, Earnings]

- The competitive landscape in financial technology remains strong, and Intellect's ability to maintain its growth trajectory and market share may be challenged unless it effectively leverages its strategic acquisitions and innovative products like eMACH.ai. [Revenue, Market share]

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹898.0 for Intellect Design Arena based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹37.2 billion, earnings will come to ₹6.4 billion, and it would be trading on a PE ratio of 30.6x, assuming you use a discount rate of 14.9%.

- Given the current share price of ₹789.55, the analyst price target of ₹898.0 is 12.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.