Last Update 28 Nov 25

Fair value Increased 0.22%HCLTECH: Future AI Alliances And Global Expansion Will Guide Measured Outlook

Analysts have modestly raised their price target for HCL Technologies from ₹1,645.30 to ₹1,648.93. This reflects minor adjustments in the company’s discount rate, projected revenue growth, and profit margin outlooks.

What's in the News

- HCLTech and Amazon Web Services formed a strategic collaboration to deliver AI-powered, industry-compliant solutions for financial services organizations. New offerings will help modernize contact centers and core platforms across Banking, Wealth, and Insurance. (Client Announcements)

- HCL Technologies inaugurated a new office in Calgary, Alberta, deepening its commitment to technology innovation and job creation in Canada. The facility will serve as a client co-innovation and delivery center. (Business Expansions)

- HCLTech and NVIDIA launched an innovation lab in Santa Clara, California, to support enterprise adoption of physical AI and cognitive robotics. The lab will integrate the NVIDIA technology stack with HCLTech's physical AI solutions. (Strategic Alliances)

- In partnership with Zscaler, HCLTech expanded its strategic alliance to deliver AI-powered network transformation and zero-trust security services globally, enhancing the security posture for enterprise clients. (Client Announcements)

- HCL Technologies revised its Services Revenue growth guidance for FY26 to 4% to 5%, while maintaining overall revenue and margin forecasts. (Corporate Guidance New/Confirmed)

Valuation Changes

- Fair Value increased slightly from ₹1,645.30 to ₹1,648.93.

- Discount Rate rose marginally from 15.89% to 16.00%.

- Revenue Growth decreased modestly from 7.19% to 7.02%.

- Net Profit Margin edged down from 14.44% to 14.43%.

- Future P/E changed very slightly from 30.76x to 30.78x.

Key Takeaways

- Strategic moves in AI and public sector markets signal potential for revenue expansion and operational efficiency improvements.

- Software segment growth driven by consolidation and emerging market expansion supports overall revenue enhancement.

- Economic uncertainty, seasonality, geopolitical factors, and AI dependence present risks to HCL Technologies' revenue growth and financial performance.

Catalysts

About HCL Technologies- Offers software development, business process outsourcing, and infrastructure management services worldwide.

- HCL Technologies has a strong pipeline and high growth bookings, with a recent record high in engineering and R&D services business bookings, which signals potential future revenue expansion.

- The strategic establishment of HCL Tech Public Sector Solutions could enhance market penetration and expand revenue streams from U.S. government and defense sectors.

- The company's focus on AI and Generative AI, including partnerships with leading AI technology providers, is likely to drive revenues through new innovative offerings and efficiency solutions, supporting revenue growth and potentially improving net margins due to cost efficiencies.

- HCL Tech's ongoing efforts to consolidate its software operations and strategic expansion into emerging markets indicate a potential uplift in software revenue, enhancing overall revenue growth in the software segment.

- The focus on AI-led automation efforts and reduction in voluntary attrition imply potential for increased operational efficiency and margin enhancements, aligning to non-linearity in business leading to potential earnings growth.

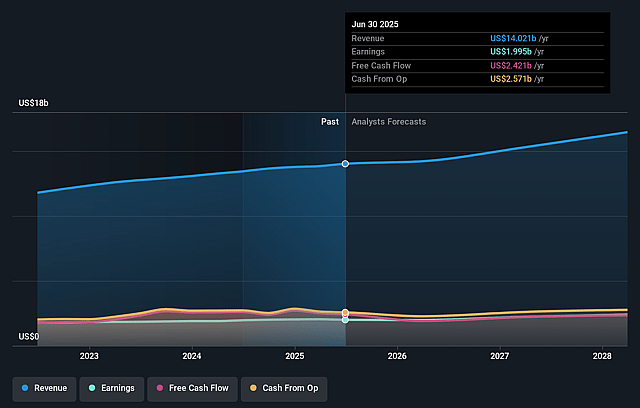

HCL Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming HCL Technologies's revenue will grow by 6.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.2% today to 14.5% in 3 years time.

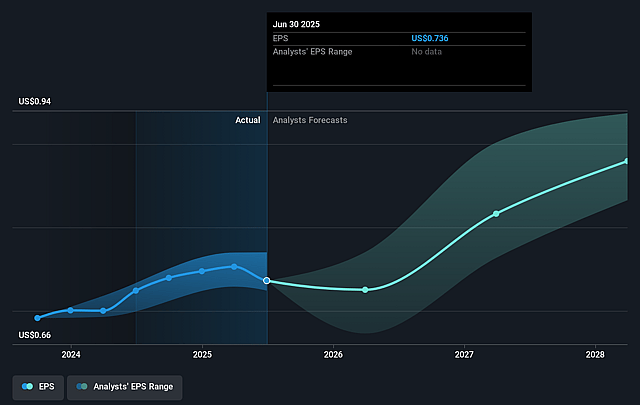

- Analysts expect earnings to reach $2.5 billion (and earnings per share of $0.91) by about September 2028, up from $2.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 32.7x on those 2028 earnings, up from 22.6x today. This future PE is greater than the current PE for the IN IT industry at 26.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.91%, as per the Simply Wall St company report.

HCL Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The global economic uncertainty and reduced discretionary spending could hinder revenue growth, as many industry verticals are facing a slowdown. This could impact overall financial performance, including revenue and net margins.

- Seasonality in the software business is contributing to sequential revenue declines, potentially impacting quarterly financial performance and leading to fluctuations in earnings.

- Geopolitical factors like tariffs and deglobalization may negatively affect IT services, leading to budget cuts, contract renegotiations, or delays, which could influence revenue and operational margins.

- The forecasted deterioration in the macro environment, including potential recessions, could decrease demand for HCL Technologies' services, especially if companies reduce spending or delay projects, impacting revenue growth.

- The reliance on AI-driven transformation as a growth strategy carries execution risks. If clients fail to adopt AI solutions effectively, or if there are delays in implementing AI projects, it could impact revenue and profitability forecasts.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1688.186 for HCL Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹2000.0, and the most bearish reporting a price target of just ₹1389.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $17.0 billion, earnings will come to $2.5 billion, and it would be trading on a PE ratio of 32.7x, assuming you use a discount rate of 15.9%.

- Given the current share price of ₹1466.1, the analyst price target of ₹1688.19 is 13.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on HCL Technologies?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.