Key Takeaways

- Diversification with Emberstone SM REIT and focus on asset-light revenue streams promise better net margins and enhanced earnings.

- Strategic expansion and strong project pipeline across key verticals indicate promising future revenue growth and margin enhancement.

- Heavy reliance on real estate demand and increased interest expenses could strain profit margins, impact cash flows, and impede future expansions in leasing and furniture verticals.

Catalysts

About EFC (I)- Engages in real estate leasing business in India.

- The recent registration and preparation for an IPO of the Emberstone SM REIT, which is planned for submission in February, signifies a diversification in operations, likely enhancing future earnings via management fee income and boosting net margins by creating a more asset-light revenue stream.

- Expansion of the leasing vertical with a focus on managed workspaces has shown strong performance, including a 31% year-on-year increase in rental revenue. This signifies future revenue growth as demand for flexible office solutions remains high.

- The significant project pipeline in the design and build vertical, with ₹92 crores worth of projects and a 51% year-on-year revenue increase, indicates strong future revenue streams and potential margin enhancement as more projects are completed.

- The growing order pipeline and strategic focus on high-value projects in the furniture vertical, with ₹8.57 crores slated for immediate completion, is poised to increase revenue and enhance earnings with higher margins from efficient project execution.

- Continued strategic expansion and optimization efforts in core verticals such as leasing and furniture manufacturing suggest that operational efficiencies will drive better net margins and potentially enhanced earnings in subsequent years.

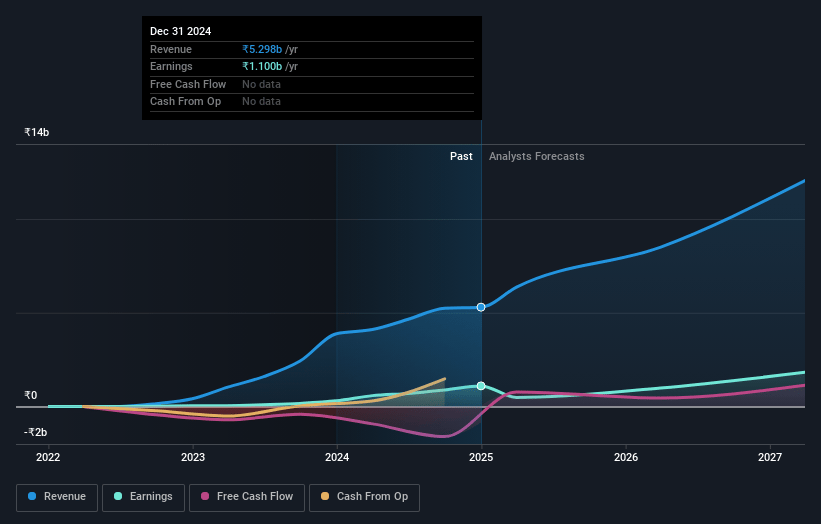

EFC (I) Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming EFC (I)'s revenue will grow by 42.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 20.8% today to 14.8% in 3 years time.

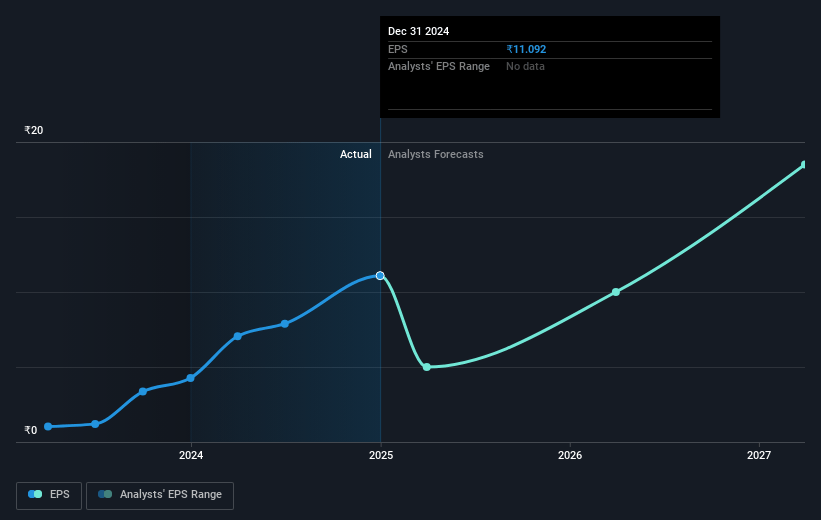

- Analysts expect earnings to reach ₹2.2 billion (and earnings per share of ₹22.72) by about February 2028, up from ₹1.1 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.0x on those 2028 earnings, down from 20.2x today. This future PE is lower than the current PE for the IN Retail Distributors industry at 25.9x.

- Analysts expect the number of shares outstanding to decline by 6.24% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.25%, as per the Simply Wall St company report.

EFC (I) Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's leasing vertical is heavily reliant on a significant number of sites and seats, and any downturn in real estate demand or occupancy rates could adversely affect rental revenues and EBITDA.

- With substantial planned capital expenditures in advance of demand in the leasing vertical, any failure to secure favorable financing from landlords or any delays in tenants occupying seats could lead to increased costs and decreased profit margins.

- Given the company's expansion plans in the furniture vertical and potential increases in working capital requirements, any missteps or inefficiencies could lead to reduced margins and stress on cash flows.

- Interest expenses have increased significantly, which may impact net margins and reduce earnings available to shareholders, thus potentially affecting the company's ability to fund future expansions or return profits.

- The growth in rental income and seat occupancy may not align proportionately, indicating potential issues with cost management and reflecting inefficiencies that could impair overall profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹365.0 for EFC (I) based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹15.2 billion, earnings will come to ₹2.2 billion, and it would be trading on a PE ratio of 19.0x, assuming you use a discount rate of 14.3%.

- Given the current share price of ₹232.75, the analyst price target of ₹365.0 is 36.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

WA

Consensus Narrative from 1 Analyst

Emberstone SM REIT IPO And Vertical Expansions Will Increase Asset-Light Revenue Streams

Key Takeaways Diversification with Emberstone SM REIT and focus on asset-light revenue streams promise better net margins and enhanced earnings. Strategic expansion and strong project pipeline across key verticals indicate promising future revenue growth and margin enhancement.

View narrative₹365.00

FV

34.5% undervalued intrinsic discount42.01%

Revenue growth p.a.

0users have liked this narrative

0users have commented on this narrative

1users have followed this narrative

6 days ago author updated this narrative