Last Update 20 Nov 25

Fair value Decreased 6.35%RUSTOMJEE: Revenue Strength and Fundraising Efforts Will Elevate Future Performance

Analysts have reduced the fair value price target for Keystone Realtors from ₹866.67 to ₹811.67. This change reflects an updated outlook based on revised assumptions around growth rates and profit margins.

What's in the News

- The board meeting held on November 12, 2025, addressed the approval and record of unaudited standalone and consolidated financial results for the quarter and half year ended September 30, 2025. This included the limited review report with unmodified opinion (Key Developments).

- On September 10, 2025, the board considered raising funds through the issuance of fully paid up, senior, secured, redeemable, listed, rated non-convertible debentures aggregating up to INR 375 crore via private placement. The board also discussed other business matters (Key Developments).

Valuation Changes

- Consensus Analyst Price Target: Lowered from ₹866.67 to ₹811.67, representing a decrease of approximately 6%.

- Discount Rate: Increased slightly from 17.08% to 17.53%.

- Revenue Growth: Updated upward from 22.11% to 26.58%.

- Net Profit Margin: Reduced significantly from 22.62% to 14.51%.

- Future P/E: Increased from 24.21x to 30.98x.

Key Takeaways

- Expanding high-value projects and efficient execution support strong revenue growth, consistent earnings, and margin improvement amid robust demand and urbanization trends.

- Strong balance sheet and strategic market focus enable leadership consolidation, cost efficiency, and capitalize on digitization for future growth and competitive advantage.

- Keystone Realtors faces revenue and margin volatility due to Mumbai market concentration, elevated redevelopment risks, mounting competition, and exposure to both regulatory delays and cyclical demand shifts.

Catalysts

About Keystone Realtors- Engages in the real estate construction, development, and other related activities in India.

- The rapid addition of high-value redevelopment and cluster projects, particularly in areas like Sion and Lokhandwala, combined with a robust launch pipeline that significantly exceeds annual guidance, sets up strong, forward visibility for both topline revenue growth and long-term earnings consistency as these projects come online.

- Record presales and strong collections growth, driven by increasing demand in the premium and mid/mass segments, align with the secular trend of urban migration and rising disposable income in Maharashtra-indicating continued, sustainable volume growth and upward pricing potential supporting both revenue and margins.

- The company's ability to accelerate construction cycles and maintain disciplined execution-despite operational challenges in MMR-enables faster revenue recognition, improved operating cash flows, and reduces overall delivery risk, positively impacting net margins.

- Proactive focus on cluster redevelopment and entry into new micro-markets allow Keystone to consolidate its leadership, leverage economies of scale, and benefit from ongoing industry consolidation, which should drive higher gross margins and strengthen brand trust over time.

- The company's robust balance sheet, low net debt, and upgraded credit profile provide flexibility for sustained project acquisitions and execution, positioning it to capitalize on the ongoing digitization of real estate transactions-potentially reducing customer acquisition costs and further supporting net margin expansion.

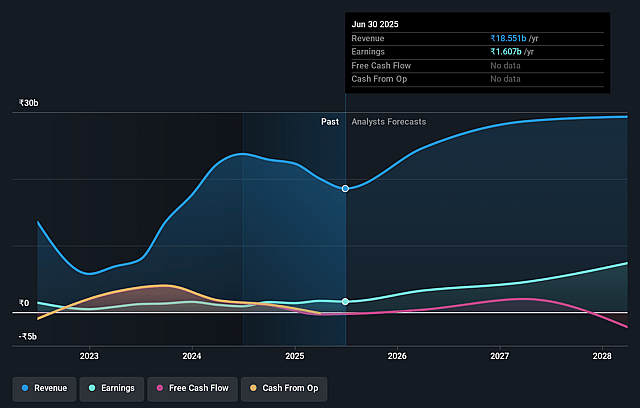

Keystone Realtors Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Keystone Realtors's revenue will grow by 22.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.7% today to 22.6% in 3 years time.

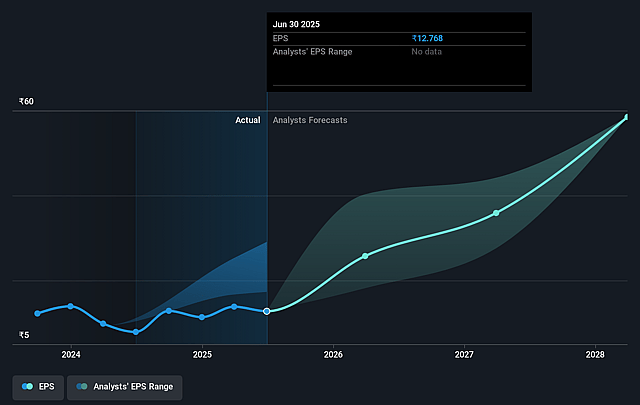

- Analysts expect earnings to reach ₹7.6 billion (and earnings per share of ₹52.82) by about September 2028, up from ₹1.6 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.2x on those 2028 earnings, down from 48.0x today. This future PE is lower than the current PE for the IN Real Estate industry at 35.4x.

- Analysts expect the number of shares outstanding to grow by 2.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 17.08%, as per the Simply Wall St company report.

Keystone Realtors Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Despite management optimism, there is a risk of oversupply in the Mumbai property market due to increased redevelopment, slum rehabilitation initiatives, and the entry of multiple new developers, which may pressure sale velocities and lead to potential stagnation or decline in property prices, impacting Keystone Realtors' future revenues and earnings.

- Heavy concentration in the Mumbai Metropolitan Region exposes the company to local regulatory risks, delays in environmental or other clearances, and economic slowdowns specific to that geography, which could cause significant volatility in revenue recognition and project execution timelines, thus affecting both top-line and bottom-line growth.

- The company's increasing focus on large-scale cluster and redevelopment projects, while offering scale benefits, heightens execution risk due to complex stakeholder management, potential consent delays, and greater exposure to bureaucratic or legal hurdles; any project delays or cost overruns from these could compress net margins and disrupt predictable earnings.

- Rising competitive intensity in the redevelopment and mid/mass housing segments, with more established and new players targeting the same customer base, may necessitate higher sales and marketing spend and/or price discounts, pressuring gross margins and potentially eroding company profitability over the long term.

- Expansion into premium segment projects-as seen with new launches-subjects the company to cyclical fluctuations in luxury housing demand, which tends to be more volatile and interest-rate sensitive, increasing the risk of slower inventory liquidation and irregular revenue flow, thereby impacting both revenue stability and margin consistency.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹866.667 for Keystone Realtors based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹33.8 billion, earnings will come to ₹7.6 billion, and it would be trading on a PE ratio of 24.2x, assuming you use a discount rate of 17.1%.

- Given the current share price of ₹611.5, the analyst price target of ₹866.67 is 29.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.