Key Takeaways

- New state-of-the-art facility and expansion into branded generics and CDMO deepen client relationships and position the company for sustainable global revenue growth.

- Backward integration, cost-plus pricing, and R&D into specialized products are expected to drive margin improvement and long-term earnings stability.

- Innova Captab faces margin pressure from overcapacity, reliance on key customers, regulatory changes, and limited progress in high-value products, threatening sustainable long-term profitability.

Catalysts

About Innova Captab- An integrated pharmaceutical company, engages in the research and development, manufacture, distribution, and marketing of drugs in India and internationally.

- The commissioning and rapid ramp-up of the new Jammu greenfield facility-with industry-leading automation, compliance with global cGMP norms, and large excess capacity-positions the company to capture growing demand from both domestic and international customers as healthcare access and expenditure rise globally, supporting strong revenue growth and future margin expansion through operating leverage.

- Expansion of exports in the Branded Generics segment (59% YoY growth in Q1, diversified across 10–15 therapeutic categories and multiple emerging markets) demonstrates the company's ability to capitalize on an aging global population and increasing demand for affordable medicines, underpinning long-term revenue and earnings potential.

- Increased scale and backward integration, coupled with a cost-plus pricing model and GST/state incentives at the Jammu facility, are expected to drive margin improvement and support stable net margins as operating costs scale more slowly than revenue, especially once utilization rises from the current low base.

- Deepening CDMO client relationships (partner of choice for over 300 pharma companies) and growing wallet share-enabled by expanded capacity, regulatory compliance, and reliable supply-are set to support consistent earnings and revenue growth as global generics adoption accelerates and larger pharma players seek compliant, high-quality manufacturing partners.

- The company's ongoing R&D initiatives to move into more complex products (respules, sterile products) provide a pathway to higher-value offerings, better product differentiation, and future margin resilience as industry standards and client needs evolve, thus supporting long-term EBITDA and return on capital.

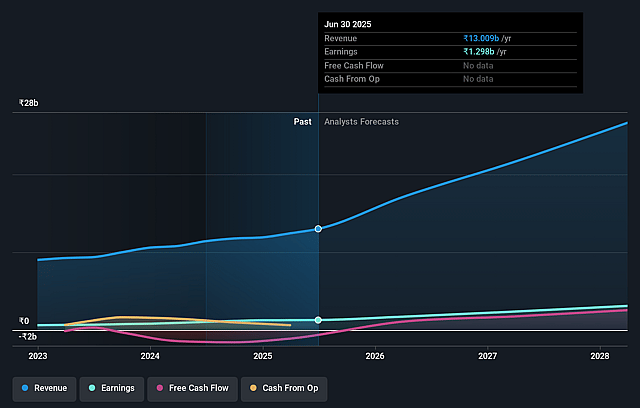

Innova Captab Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Innova Captab's revenue will grow by 30.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.0% today to 11.7% in 3 years time.

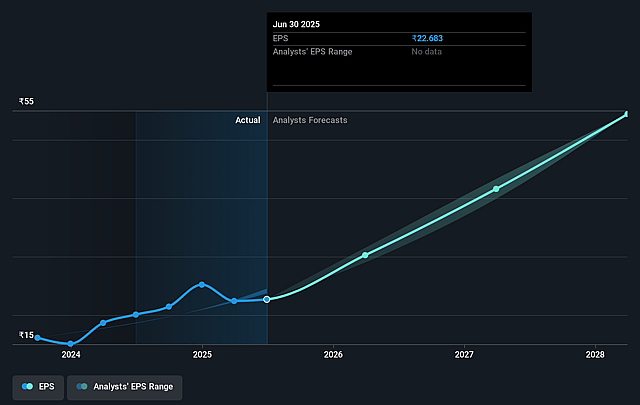

- Analysts expect earnings to reach ₹3.3 billion (and earnings per share of ₹51.18) by about September 2028, up from ₹1.3 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.8x on those 2028 earnings, down from 40.1x today. This future PE is lower than the current PE for the IN Life Sciences industry at 50.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.58%, as per the Simply Wall St company report.

Innova Captab Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained decline in API (Active Pharmaceutical Ingredient) prices-driven by global overcapacity and price crashes of key inputs-poses a significant risk to Innova Captab's revenue and net margins, especially since their business model only partially protects them from such pricing volatility.

- Heavy reliance on the CDMO segment (~71% of revenue), where customer concentration and contract wins/losses can lead to material revenue swings, creates earnings volatility and exposes the company to long-term client attrition risk.

- Aggressive capacity additions across the Indian formulation/CDMO industry-including new plants from Innova and competitors-raise the risk of excess capacity, intensifying pricing pressure and risking structural margin compression for players unable to sufficiently differentiate or fully utilize assets.

- Regulatory changes, such as potential reductions in GST rates or tighter compliance norms (e.g., Schedule M or evolving international GMP requirements), could reduce tax incentives and materially increase compliance and remediation costs, negatively impacting cash flows, operating margins, and bottom-line profitability.

- Limited visibility into the company's ability to scale up complex generics or high-value specialty products may hinder long-term value chain progression, leaving the business exposed to high competition in commoditized generics and making sustainable net margin expansion challenging.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1076.0 for Innova Captab based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹28.6 billion, earnings will come to ₹3.3 billion, and it would be trading on a PE ratio of 26.8x, assuming you use a discount rate of 13.6%.

- Given the current share price of ₹908.9, the analyst price target of ₹1076.0 is 15.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.