Key Takeaways

- Regulatory headwinds, undifferentiated generics, and capital-intensive OTC expansion combine to threaten profit margins, put cash flows at risk, and constrain long-term growth prospects.

- Elevated debt and shrinking revenue limit financial flexibility, raising concerns over sustainability, new investments, and the potential for ongoing margin pressure.

- Recovery in exports, improved operational efficiency, strong product launches, and normalization after regulatory challenges set the stage for sustainable growth and rising profitability.

Catalysts

About Indoco Remedies- Manufactures, markets, and sells formulations and active pharmaceutical ingredients in India and internationally.

- Sustained and intensifying regulatory scrutiny, highlighted by repeated US FDA warning letters on Indoco's sterile facilities, is likely to drive persistently higher compliance costs, potential delays in product launches, and a risk of ongoing export disruptions-directly affecting future revenue growth and maintaining downward pressure on profit margins.

- The rapid global shift of healthcare expenditure toward advanced therapies such as biologics and personalized medicine is set to erode long-term demand for traditional generic offerings, which make up Indoco's core portfolio, thereby limiting volume growth and stalling topline expansion over time.

- Despite heavy investments in manufacturing expansion and process upgrades, Indoco's lack of meaningful differentiation in its generics pipeline will leave the company exposed to continued price compression and competitive rivalry in both regulated and emerging markets, further squeezing gross margins and jeopardizing profit sustainability.

- The company's aggressive expansion into the capital-intensive OTC segment, which requires prolonged high levels of marketing and distribution spend with uncertain payback, risks extending a period of negative cash flows and delaying any improvement in earnings per share or return on invested capital.

- Elevated debt levels resulting from recent large-scale CapEx and ongoing remediation costs, in a context of already-declining revenues and compressed EBITDA, increase the threat of prolonged financial strain, curtail the flexibility to pursue new growth opportunities, and place further pressure on net margins.

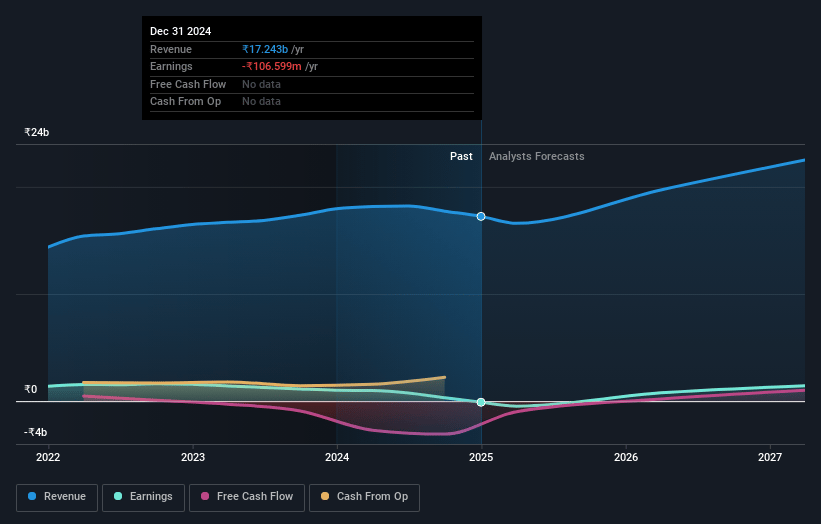

Indoco Remedies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Indoco Remedies compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Indoco Remedies's revenue will grow by 14.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -4.4% today to 13.3% in 3 years time.

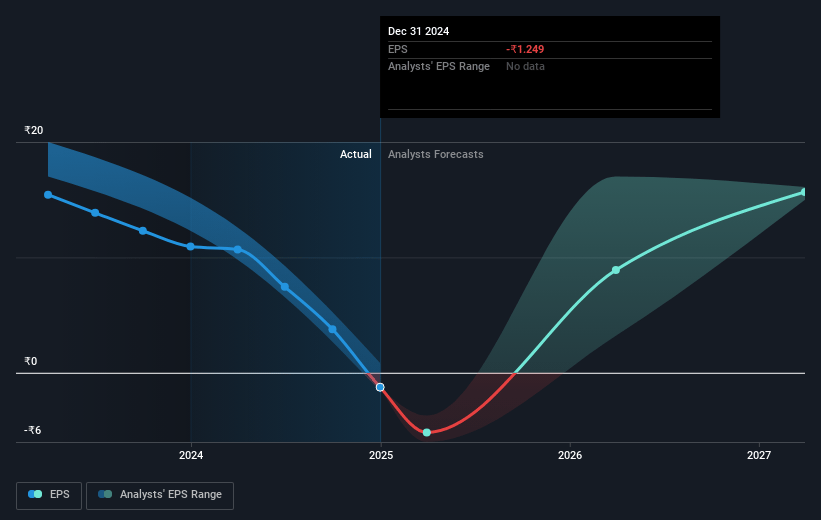

- The bearish analysts expect earnings to reach ₹3.3 billion (and earnings per share of ₹37.1) by about July 2028, up from ₹-737.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 6.4x on those 2028 earnings, up from -42.4x today. This future PE is lower than the current PE for the IN Pharmaceuticals industry at 33.1x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.55%, as per the Simply Wall St company report.

Indoco Remedies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Successful remediation of the US FDA warning letter and clearance from the European Medicines Agency for the sterile plant paves the way for a resumption of exports to the US and Europe, which could drive a strong recovery in international revenues and lead to improved profitability.

- Significant investments in manufacturing infrastructure and a master manufacturing plan are expected to yield higher efficiencies, reduced costs, and increased capacity utilization, which should positively impact operating margins and earnings in the coming years.

- The company's leading market share in key molecules in regulated markets like the UK (60% paracetamol market) and Germany (80% allopurinol market), along with strong domestic product launches showing double-digit growth, indicate resilience and potential for sustainable revenue growth.

- The OTC strategy for products like Sensodent-K/KF, backed by heavy initial brand investments and growing distribution across chemists, grocers, and modern retail, positions Indoco to capture a larger share of a fast-growing segment, potentially boosting topline and, over time, margins as advertising costs normalize.

- Management guidance suggests that most operational and financial pain caused by plant shutdowns, warning letters, and high fixed costs are at or past their peak, with a likely improvement in margins, normalization of cash flows, and a path to debt reduction, all of which could support higher net earnings in the medium to long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Indoco Remedies is ₹200.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Indoco Remedies's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹325.0, and the most bearish reporting a price target of just ₹200.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹24.8 billion, earnings will come to ₹3.3 billion, and it would be trading on a PE ratio of 6.4x, assuming you use a discount rate of 12.5%.

- Given the current share price of ₹339.1, the bearish analyst price target of ₹200.0 is 69.5% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.