Last Update 09 Dec 25

Fair value Increased 0.70%INDGN: Upcoming Board Meeting Will Drive Continued Positive Momentum

Analysts have modestly raised their price target on Indegene by about 1 percent to approximately $612, citing slightly stronger long term revenue growth expectations and a marginally higher future earnings multiple, despite largely stable profit margin and discount rate assumptions.

What's in the News

- Board meeting scheduled on October 30, 2025 to review unaudited consolidated and standalone financial results for the quarter ended September 30, 2025 and consider equity allotments under ESOP 2020 and RSU 2020 schemes (company filing)

- Expansion of Indegene's Consulting Practice to provide integrated strategy and transformation support for life sciences clients facing large scale, technology driven change across the value chain (company announcement)

- Strategic partnership with Datavant to integrate its health data network into Indegene's NEXT Patient Recruitment platform, aiming to speed up clinical trial enrollment and improve patient recruitment, particularly in rare diseases (Datavant and company announcement)

Valuation Changes

- The fair value estimate has risen slightly to about ₹612 per share from roughly ₹608 per share, reflecting a modest upward revision.

- The discount rate has edged down marginally to about 14.01 percent from 14.04 percent, indicating a slightly lower implied risk profile.

- Revenue growth has increased slightly to around 16.97 percent from 16.90 percent, signaling a modestly stronger long term growth outlook.

- The net profit margin has dipped marginally to about 13.16 percent from 13.18 percent, suggesting essentially stable long run profitability assumptions.

- The future P/E has risen slightly to around 34.16x from 33.94x, implying a small expansion in the expected valuation multiple.

Key Takeaways

- AI-driven digital solutions and deeper multi-year client relationships are expanding Indegene's market presence, improving revenue growth and operational efficiencies in pharma services.

- Strategic reinvestment and targeted acquisitions are shifting revenues toward higher-margin, technology-led offerings and expanding capabilities across new verticals and geographies.

- Revenue and margin growth face challenges from client concentration risk, industry conservatism, regulatory-driven volatility, wage inflation, and sector-wide drug pricing pressures.

Catalysts

About Indegene- Operates as a digital-first life sciences commercialization company in India, the United States, Europe, and internationally.

- Indegene is seeing strong client interest in large-scale digital transformation and AI adoption within the pharma industry, supported by the need to improve cost efficiency and speed to market in response to ongoing drug pricing pressures; this is expected to expand Indegene's addressable market, drive higher revenue growth, and enable deeper, multi-year client relationships.

- The company's Tectonic offering, which moves Indegene further up the value chain in commercial content creation by leveraging AI and end-to-end digital solutions, is already generating revenue and is positioned to unlock 2-4x more of clients' marketing budgets, pointing to material revenue acceleration and higher net margins over time as this scales.

- Deepening integration and multi-year engagements with top global pharma clients-alongside a strengthening and broadening sales pipeline-are enhancing long-term revenue visibility and higher operating leverage, which should support improved margin expansion as Indegene's platform-based solutions gain scale.

- Continued, strategic reinvestment into AI-enabled platforms (such as Cortex) and expansion of high-value service offerings are expected to drive differentiation versus competitors and shift more of Indegene's revenues toward higher-margin, technology-led services, with the medium

- to long-term impact being a structural uplift in net margins and earnings.

- Management's active M&A pipeline, fueled by strong cash generation, aims to further accelerate top-line growth by acquiring complementary capabilities in digital health and medical communications both in the US and Europe, enabling cross-sell opportunities and expansion into new service verticals and geographies-supportive of sustained revenue and potential EPS growth.

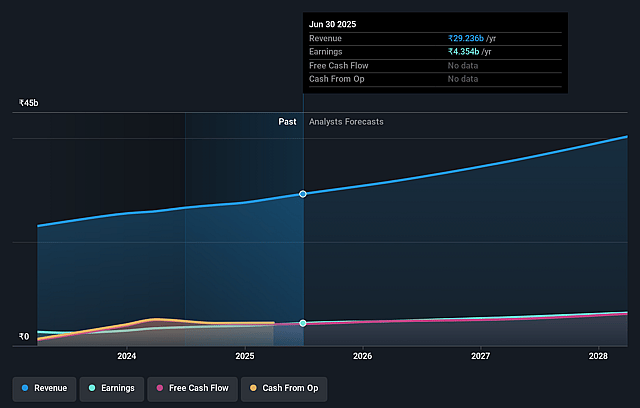

Indegene Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Indegene's revenue will grow by 12.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.9% today to 15.7% in 3 years time.

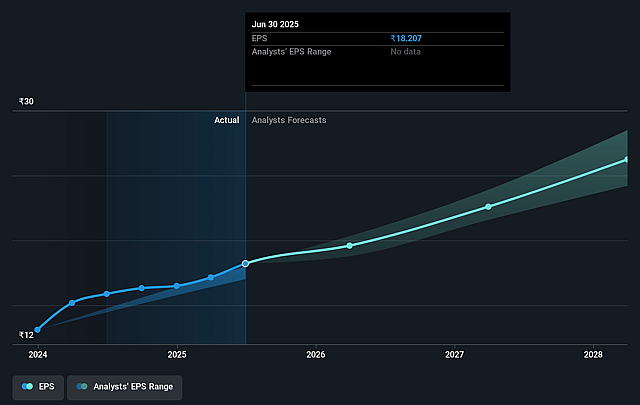

- Analysts expect earnings to reach ₹6.5 billion (and earnings per share of ₹25.32) by about September 2028, up from ₹4.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 35.2x on those 2028 earnings, up from 30.5x today. This future PE is lower than the current PE for the IN Life Sciences industry at 50.5x.

- Analysts expect the number of shares outstanding to grow by 0.29% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.33%, as per the Simply Wall St company report.

Indegene Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is experiencing significant quarterly variability in its Brand Activation (Omnichannel Activation) segment, with material project deferrals and conclusion of sizable projects due to client regulatory hurdles, potentially leading to revenue volatility and compressed margins if this persists.

- Wage inflation and annual compensation resets, especially with a notable portion of staff outside India, are expected to continue putting pressure on margins; ongoing reinvestment in AI and transformation initiatives may offset productivity benefits, limiting net margin expansion in the medium term.

- High client concentration risk remains, with 76% of revenues coming from the top 20 clients; though efforts to broaden the client base are ongoing, loss or slowdown in a single large account (as experienced in the previous year) could materially impact revenues and earnings.

- Despite strong positioning around AI offerings, client adoption continues to be slow due to the conservative nature of the pharma industry and significant risk perceptions, which could delay the realization of differentiated revenue streams and limit margin upside from new platforms.

- The pharma industry's persistent pressure on drug pricing and potential reduction in US federal drug spending via Medicaid-even if currently non-material-signals secular headwinds that may drive long-term pricing pressures on Indegene's core services, potentially impacting future revenue growth and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹644.667 for Indegene based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹700.0, and the most bearish reporting a price target of just ₹540.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹41.0 billion, earnings will come to ₹6.5 billion, and it would be trading on a PE ratio of 35.2x, assuming you use a discount rate of 13.3%.

- Given the current share price of ₹553.0, the analyst price target of ₹644.67 is 14.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Indegene?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.