Last Update 19 Nov 25

Fair value Decreased 5.62%CONCORDBIO: Revenue And Profit Margins Are Expected To Drive Stronger Performance

Analysts have lowered their fair value estimate for Concord Biotech from ₹1,840 to approximately ₹1,737. This revision reflects expectations for improved revenue growth and profit margins, partially offset by a higher discount rate and lower projected future P/E multiples.

What's in the News

- Concord Biotech's Board of Directors will meet on November 13, 2025, to review and approve the Standalone and Consolidated Unaudited Financial Results for the second quarter and half year ending September 30, 2025. The board will also consider other business matters (Key Developments).

Valuation Changes

- Fair Value Estimate: Lowered from ₹1,840 to approximately ₹1,737, reflecting a modest decrease.

- Discount Rate: Increased slightly from 12.73% to 12.76%.

- Revenue Growth: Projected to rise from 22.60% to 25.55%.

- Net Profit Margin: Expected to improve from 31.12% to 32.26%.

- Future P/E Multiple: Reduced from 40.22x to 37.43x.

Key Takeaways

- Expansion in manufacturing, regulatory approvals, and commercial reach is strengthening market position and supporting sustained revenue and margin growth.

- Diversification into niche, high-value pharmaceuticals and increasing CDMO contracts are driving recurring, high-margin earnings and reducing competitive pressures.

- Heavy dependence on niche APIs, reduced R&D investment, exposure to global risks, and industry shift toward biologics threaten Concord Biotech's long-term growth and profitability.

Catalysts

About Concord Biotech- A biopharma company, engages in the research and development, manufacturing, marketing, and sale of pharmaceutical products in India and internationally.

- Expansion of advanced manufacturing capabilities (notably the new injectable facility at Valthera) and strategic ramp-up in capacity utilization across plants is expected to enable Concord to address rising global demand for specialty pharmaceuticals, supporting medium-term revenue growth and operating leverage-driven improvement in EBITDA margins.

- Growing momentum in the global CDMO business, with initial contracts secured and more in the pipeline, positions Concord to benefit from the industry's shift towards outsourcing API and high-quality manufacturing, which could drive high-margin, recurring revenues and boost long-term earnings.

- Enhanced regulatory clearances (US FDA, EU GMP, Russian GMP) across multiple facilities create barriers to entry and support uninterrupted global market access, allowing Concord to capture a larger share of the growing international market and stabilize future revenues.

- Direct expansion of commercial operations in the U.S. (via Stellon Biotech) and deepening presence in domestic markets (through Concord Lifegen) are expected to improve market penetration and customer engagement, lifting the addressable market and supporting sustained top-line growth.

- Diversification of the product portfolio into complex, niche molecules (including new antibiotic and oncology APIs/formulations with limited competition) enables stronger pricing power, reduces competitive intensity, and is likely to support net margin expansion over time.

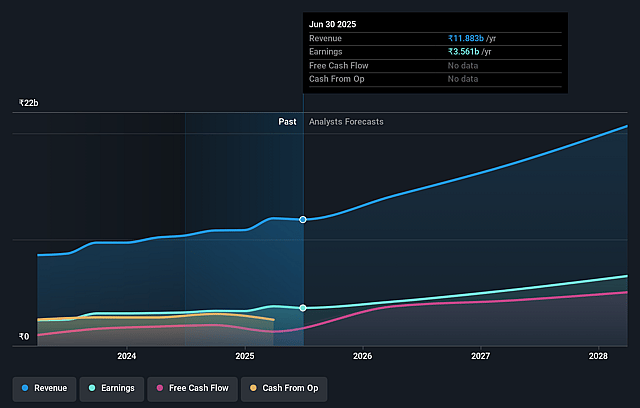

Concord Biotech Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Concord Biotech's revenue will grow by 22.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 30.0% today to 31.1% in 3 years time.

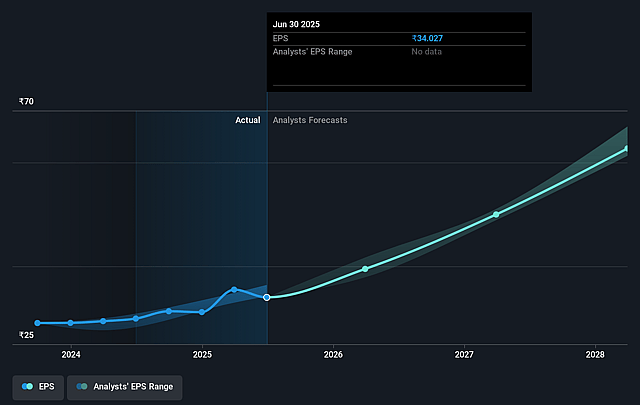

- Analysts expect earnings to reach ₹6.8 billion (and earnings per share of ₹59.51) by about September 2028, up from ₹3.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 40.2x on those 2028 earnings, down from 49.9x today. This future PE is greater than the current PE for the IN Pharmaceuticals industry at 29.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.73%, as per the Simply Wall St company report.

Concord Biotech Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on a narrow portfolio of niche, complex APIs-primarily immunosuppressants, anti-infectives, and select antibiotics-means Concord Biotech is exposed to revenue and margin risk if new or existing competitors offer superior alternatives, enter with aggressive pricing, or if market share in key products erodes as these molecules become more commoditized.

- The ongoing reduction in R&D spend as a percentage of sales (from 3.6% to 2.3%) could limit Concord's ability to replenish its innovation pipeline relative to larger peers, potentially stalling long-term revenue growth and compressing margins as existing products face pricing and patent challenges.

- A significant portion of Concord's revenue (~45% exports, with 17% directly to the US) exposes the company to foreign exchange volatility and international regulatory/tariff risks-particularly if global trade policies shift or if pricing pressures intensify in major overseas markets, jeopardizing net profit margins and earnings predictability.

- Long-term secular industry trends favoring biologics, cell, and gene therapies could lessen demand for Concord's core fermentation-based APIs, leading to slower market growth and the risk of technological obsolescence, thus impacting future revenues and sector relevance.

- Increasing evidence of pricing pressure-especially as Concord enters new geographies or acts as a "second source" supplier and offers 20–25% price discounts-could trigger a broader trend of margin compression as products mature or as government and major buyer price controls expand globally, reducing the company's long-run profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1840.0 for Concord Biotech based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1965.0, and the most bearish reporting a price target of just ₹1600.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹21.9 billion, earnings will come to ₹6.8 billion, and it would be trading on a PE ratio of 40.2x, assuming you use a discount rate of 12.7%.

- Given the current share price of ₹1698.9, the analyst price target of ₹1840.0 is 7.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.