Narratives are currently in beta

Key Takeaways

- New capacity and strategic expansions are set to sustain production and boost revenue by meeting increasing customer demand efficiently.

- Investment in R&D for advanced intermediates and contrast media suggests future growth and enhanced margins in high-value markets through innovation.

- Revenue volatility, increased HR costs, high working capital needs, and dependency on key product success impact Blue Jet Healthcare's financial stability and profitability risks.

Catalysts

About Blue Jet Healthcare- Engages in the manufacturing and sale of pharmaceutical intermediates and active pharmaceutical ingredients (APIs) for use in pharmaceutical and healthcare products.

- Blue Jet Healthcare has completed new capacity additions in Unit 2, which are expected to drive sustainable production levels for existing customer demand. This expansion is likely to boost revenue as it allows the company to meet increasing customer demand efficiently.

- The company's investment of ₹40 crores in R&D to develop advanced intermediates and expand contrast media portfolios indicates future growth in high-value markets, potentially enhancing revenue and net margins through innovative offerings and product pipeline expansion.

- The robust contract manufacturing order book and strong customer uptake across segments suggest sustained growth and increased revenue visibility in the near term.

- The strategic backward integration plans at Unit 3 in Mahad promise improved operational efficiency and cost leadership, which are expected to positively impact net margins by reducing raw material costs and operational dependencies.

- The global tailwinds in the CDMO business, driven by small and midsized biotech innovations, along with Blue Jet's enhanced capabilities in amino acid derivatives and GLP-1 targeted therapies, point to significant growth potential in revenue and earnings driven by these high-demand sectors.

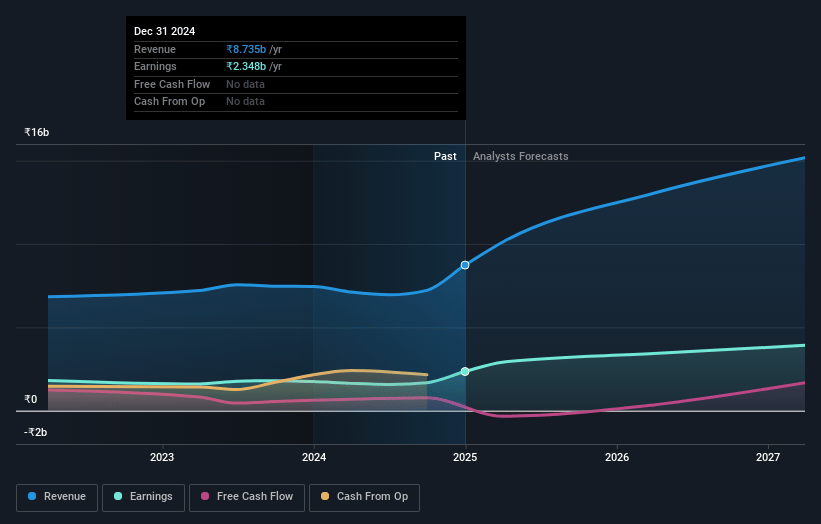

Blue Jet Healthcare Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Blue Jet Healthcare's revenue will grow by 25.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 26.9% today to 26.6% in 3 years time.

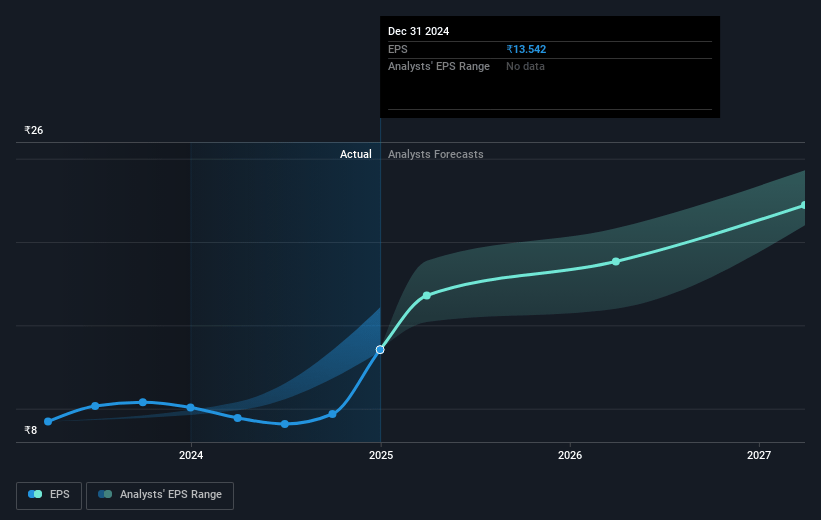

- Analysts expect earnings to reach ₹4.6 billion (and earnings per share of ₹26.35) by about February 2028, up from ₹2.3 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 37.8x on those 2028 earnings, down from 55.9x today. This future PE is greater than the current PE for the IN Pharmaceuticals industry at 31.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.15%, as per the Simply Wall St company report.

Blue Jet Healthcare Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The degrowth of 17% in the contrast media segment, due to customer offtake issues beyond the company’s control, signals potential revenue volatility and customer dependency risks.

- Increased HR costs due to doubling the R&D hardware and talent pool, and further investments in operational and process excellence could impact net margins if not matched by proportional revenue growth.

- Working capital requirements have increased by ₹1,200 million, driven by higher inventory for pharmaceutical intermediates. This can strain cash flows and affect overall net margins if not optimized.

- High dependency on the success of the cardiovascular product, with concerns about patent expiry and market dynamics, could lead to revenue instability and profitability issues if competitive pressures increase.

- Heavy reliance on sustained operational leverage and optimal capacity utilization to maintain current EBITDA margins suggests potential downside risk if expected sales don’t materialize, affecting overall earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹706.67 for Blue Jet Healthcare based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹17.1 billion, earnings will come to ₹4.6 billion, and it would be trading on a PE ratio of 37.8x, assuming you use a discount rate of 12.2%.

- Given the current share price of ₹756.8, the analyst's price target of ₹706.67 is 7.1% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives