Narratives are currently in beta

Key Takeaways

- Profitability is improving through high-margin product focus, cost control, and strategic U.S. product launches to counter prior market challenges.

- Growth in emerging and ROW markets, alongside MedTech innovations, will diversify revenue streams and enhance margins.

- Alkem Laboratories faces revenue challenges due to weak U.S. market growth, low-margin product withdrawal, domestic headwinds, and uncertainties in MedTech partnerships.

Catalysts

About Alkem Laboratories- A pharmaceutical company, engages in the research and development, manufacture, and sale of pharmaceutical and nutraceutical products in India, the United States, and internationally.

- Alkem Laboratories is enhancing its profitability through strategic initiatives like focusing on a high-margin product mix and cost control measures, which are supporting EBITDA margin growth. This is likely to impact net margins positively.

- The company has made significant strides in its emerging markets business and anticipates substantial growth opportunities, which should drive revenue growth.

- Alkem is poised to launch multiple products in the U.S. market, including those with exclusivity, which could boost earnings and offset prior volume declines and price erosion in the U.S. market.

- The MedTech business, with plans to launch products in early 2025 under the partnership with Exactech, is expected to break even in the first year and drive additional revenue growth.

- Expansion in ROW markets beyond the U.S. and Chile, which have already shown substantial growth this quarter, is expected to diversify revenue streams and improve overall margins.

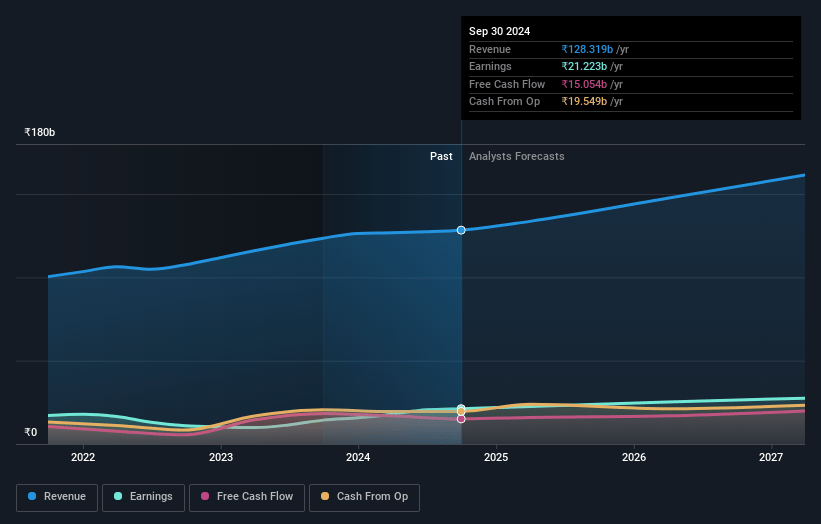

Alkem Laboratories Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Alkem Laboratories's revenue will grow by 9.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 16.5% today to 17.3% in 3 years time.

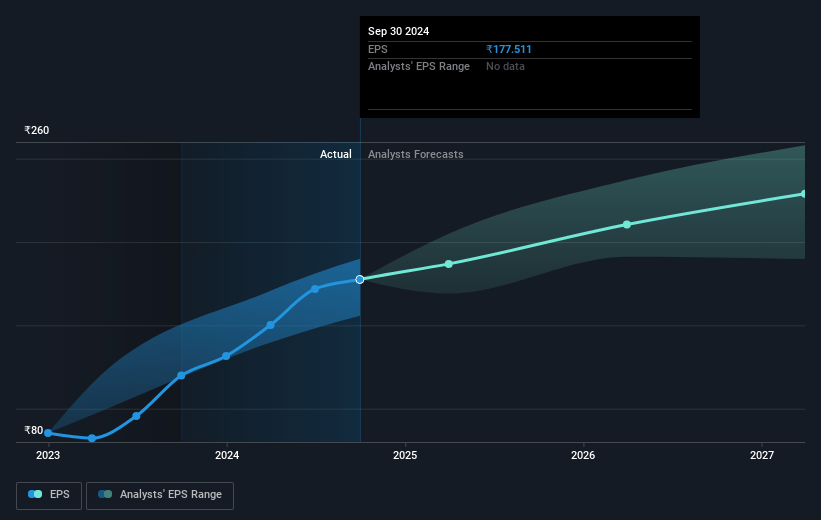

- Analysts expect earnings to reach ₹29.3 billion (and earnings per share of ₹228.9) by about January 2028, up from ₹21.2 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹23.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 35.5x on those 2028 earnings, up from 29.0x today. This future PE is greater than the current PE for the IN Pharmaceuticals industry at 33.1x.

- Analysts expect the number of shares outstanding to grow by 2.28% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.15%, as per the Simply Wall St company report.

Alkem Laboratories Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's growth in the U.S. market has been weak due to supply chain challenges, leading to significant volume and price erosion issues, which may negatively impact overall revenue growth.

- Alkem's focus on improving U.S. business profitability by withdrawing from low-margin products could result in a flattish to a mid-single-digit top-line erosion, affecting revenue.

- The domestic market witnessed a modest growth of 0.6%, and the company’s acute segment is facing headwinds, especially in anti-infectives, which is a significant part of its portfolio; this could suppress revenue growth expectations.

- Chronic exposure remains only 20% of the business, and while it is growing, a slow transition could limit improvement in net margins, as chronic generally offers higher margins.

- Uncertainty in the MedTech business and potential operational risks associated with its partner's bankruptcy might delay expected revenue benefits.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹5801.95 for Alkem Laboratories based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹7225.0, and the most bearish reporting a price target of just ₹4330.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹169.0 billion, earnings will come to ₹29.3 billion, and it would be trading on a PE ratio of 35.5x, assuming you use a discount rate of 12.2%.

- Given the current share price of ₹5151.45, the analyst's price target of ₹5801.95 is 11.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives