Catalysts

About Acutaas Chemicals

Acutaas Chemicals is a diversified global chemical company focused on advanced pharmaceutical intermediates, CDMO services, and high value specialty chemicals, including battery and semiconductor chemistries.

What are the underlying business or industry changes driving this perspective?

- Imminent commercialisation of electrolyte additive capacity in Q4 FY 26, backed by long term export contracts in the lithium ion battery value chain, is poised to add a new, scalable revenue stream from FY 27 and support sustained topline growth.

- Rising global demand for lithium ion batteries, driven by electric mobility and energy storage adoption, positions Acutaas battery chemicals portfolio to benefit from structurally increasing volumes, supporting higher asset turns and incremental operating leverage.

- Expanding semiconductor chemicals portfolio through Baba Fine Chemicals and the high value Indichem JV in Korea, with access to advanced technology and leading Asian customers, is expected to shift mix towards higher value products and support EBITDA margins near the upper end of the 28 to 30 percent range.

- Rapidly scaling pharma CDMO pipeline, with multiple validation batches dispatched and new molecules being added, enhances long term revenue visibility and should drive faster growing, higher margin CDMO contribution to earnings.

- Disciplined portfolio rationalisation away from low margin pharma intermediates, combined with process efficiencies and solar power led cost savings, underpins structurally improved gross margins and supports resilient net margin expansion even as growth investments ramp up.

- Strengthened balance sheet with significant net cash, improved working capital days and front loaded growth CapEx largely completed for the next phase provides capacity to capture new opportunities without diluting returns, supporting durable growth in earnings per share.

Assumptions

This narrative explores a more optimistic perspective on Acutaas Chemicals compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

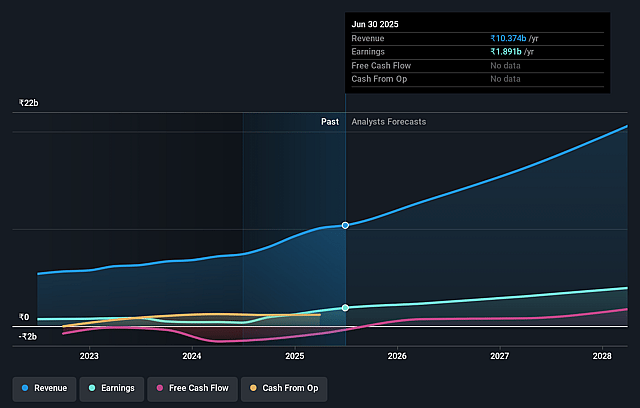

- The bullish analysts are assuming Acutaas Chemicals's revenue will grow by 37.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 20.4% today to 23.6% in 3 years time.

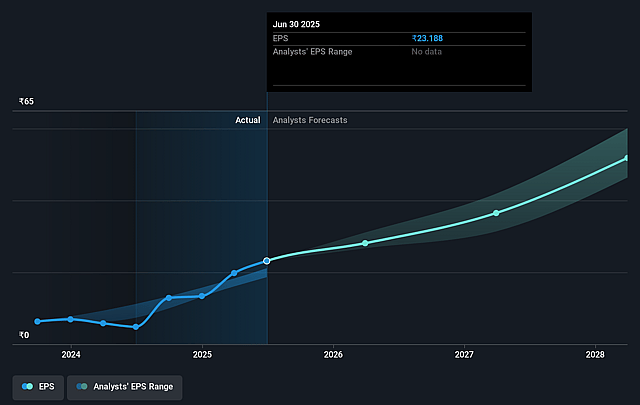

- The bullish analysts expect earnings to reach ₹6.8 billion (and earnings per share of ₹82.44) by about December 2028, up from ₹2.2 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹3.7 billion.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 44.0x on those 2028 earnings, down from 61.9x today. This future PE is greater than the current PE for the IN Pharmaceuticals industry at 28.6x.

- The bullish analysts expect the number of shares outstanding to grow by 3.4% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.76%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The growth thesis assumes smooth commercial ramp-up in battery and semiconductor chemicals. However, management itself highlights that semiconductor products are small in size today and that Indichem will only start contributing from H2 FY 27. Any delay in commissioning, qualification or customer adoption in these new verticals could push out the expected scaling curve and materially dampen revenue growth and operating leverage.

- Battery additives capacity is being built entirely for export lithium ion demand with long dated contracts, leaving the company exposed to global EV and storage cycles, geopolitical or trade shocks and technology shifts across chemistries. If customers retool faster than expected or reduce offtake, utilization could remain structurally below the planned 2.5 times asset turns, weighing on revenue and returns on invested capital.

- The margin reset relies heavily on a richer mix from pharma CDMO and advanced intermediates as well as process and energy efficiencies. Earlier industry experience in 2022 with Chinese competition and raw material volatility shows how quickly pricing can erode. If Chinese or other Asian suppliers re-enter aggressively or input costs spike again, gross margin and EBITDA margin near the 28 to 30 percent range could prove unsustainable, compressing net margins and earnings growth.

- CDMO is positioned as a long term, high growth, high margin pillar, yet it is inherently lumpy and dependent on a concentrated set of originator relationships, regulatory approvals and customer specific pipelines. If validation batches do not convert to commercial volumes on time, clients insource or diversify to other CDMOs, or projects fail in late stage development, the expected compounding in CDMO revenues and contribution to EBITDA and profit after tax could fall short of bullish expectations.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Acutaas Chemicals is ₹2290.0, which represents up to two standard deviations above the consensus price target of ₹1831.5. This valuation is based on what can be assumed as the expectations of Acutaas Chemicals's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹2290.0, and the most bearish reporting a price target of just ₹1125.0.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be ₹28.6 billion, earnings will come to ₹6.8 billion, and it would be trading on a PE ratio of 44.0x, assuming you use a discount rate of 12.8%.

- Given the current share price of ₹1694.4, the analyst price target of ₹2290.0 is 26.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Acutaas Chemicals?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.