Key Takeaways

- Curriculum changes and regulatory support are set to drive textbook demand, volume growth, and increased market share for S Chand's core business.

- Digital initiatives and disciplined capital management position S Chand for higher margins, recurring revenues, and flexibility for acquisitions or shareholder returns.

- Overdependence on print, slow digital growth, piracy threats, curriculum unpredictability, and ongoing cost pressures threaten long-term revenue and margin stability.

Catalysts

About S Chand- S Chand and Company Limited, an education content company, develops and delivers content, solutions, and services for the early learning, K-12, and higher education segments in India.

- The ongoing rollout of the new NCERT curriculum across K-12 classes is expected to accelerate over the next two years, driving higher textbook replacement demand, volume growth, and an expanded addressable market for S Chand's core K-12 business, supporting top-line growth and operating earnings.

- Increased adoption of digital learning solutions-exemplified by the company's launch and growing traction of the Test Coach app and rising content licensing deals-positions S Chand to capitalize on expanding digital penetration, adding new, higher-margin and recurring digital revenue streams that should improve overall net margins.

- The company's continued working capital discipline-evidenced by historic lows in receivable and inventory days-and net cash balance provide operating leverage and flexibility for future margin expansion, acquisitions, or shareholder payouts, enhancing net earnings and returns on equity.

- Regulatory tailwinds in the form of the National Education Policy (NEP) and increased standardization of curriculum create a market environment favoring established, branded content providers like S Chand, increasing market share and pricing power, which is likely to positively influence both revenues and margin sustainability.

- Persistent market consolidation, combined with the company's publicly stated intent to pursue targeted M&A, positions S Chand to gain additional share from unorganized sector players and fill product gaps, further supporting revenue growth and potential multiple expansion.

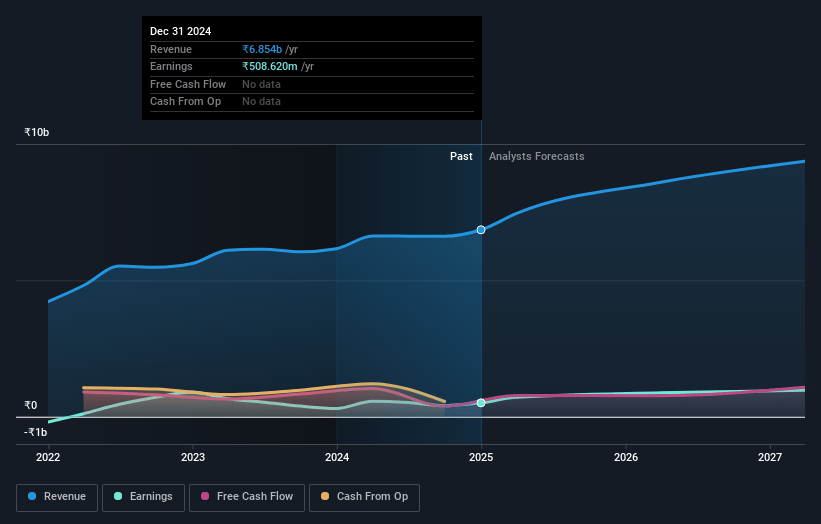

S Chand Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming S Chand's revenue will grow by 10.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.8% today to 11.1% in 3 years time.

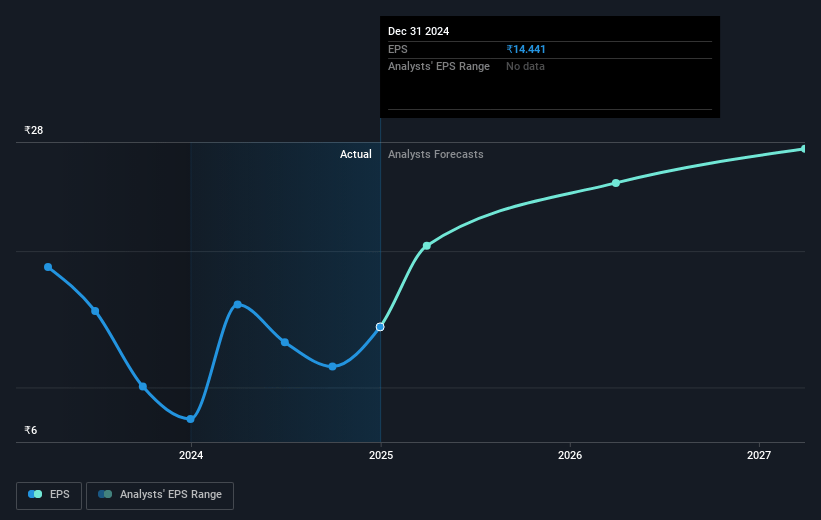

- Analysts expect earnings to reach ₹1.1 billion (and earnings per share of ₹30.6) by about July 2028, up from ₹635.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.0x on those 2028 earnings, up from 12.6x today. This future PE is lower than the current PE for the IN Media industry at 25.4x.

- Analysts expect the number of shares outstanding to decline by 0.57% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.95%, as per the Simply Wall St company report.

S Chand Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent challenges from digital adoption: The company noted that standalone digital revenue is still only around 2–3% of total sales, and digital adoption in schools remains low as demand for paid digital products is limited and mostly bundled free with books. If industry secular trends accelerate toward digital/EdTech at the expense of print, S Chand may face long-term revenue and margin erosion unless it successfully expands scalable, recurring digital revenue streams.

- Increased risk of piracy and content commoditization: Management explicitly acknowledged that piracy remains a substantial and ongoing threat, estimating ₹20–25 crores lost to piracy last year, with significant challenges in controlling unauthorized sales via e-commerce platforms. This persistent issue could continue to pressure revenue and profitability, especially as the company's core asset is its content.

- Heavy revenue dependence on slow, unpredictable curriculum changes: K-12 print textbook business (80%+ of revenue) remains highly linked to the timing and phasing of NCERT curriculum changes, which management described as "fluid," "confusing," and "stretching over 3–4 years" rather than occurring in two years as once hoped. This creates unpredictability and potential multi-year revenue volatility.

- Ongoing pressure on operating margins and working capital due to industry competition and cost structure: The company repeatedly cited intense competition as a reason for "conservative" revenue/margin guidance, with little room for price increases and a need to say "no" to some customers to maintain margin discipline. Legacy costs (employee costs increased in recent years), slow margin recovery, and reliance on credit sales can strain net margins and cash flows.

- Structural decline in the higher education segment and uncertain digital transition: S Chand's higher education business has "de-grown by ₹60–70 crores" since 2018 and faces continued challenges with piracy, low student purchasing, and slow rollout of new curriculum. Unless offset by rapid, successful digital initiatives-which management currently sees as a slow growth area-revenues and long-term earnings may be structurally constrained.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹286.0 for S Chand based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹9.7 billion, earnings will come to ₹1.1 billion, and it would be trading on a PE ratio of 13.0x, assuming you use a discount rate of 13.0%.

- Given the current share price of ₹226.7, the analyst price target of ₹286.0 is 20.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.