Key Takeaways

- Strategic acquisitions, strong IP partnerships, and international expansion are expected to drive sustained revenue growth, margin expansion, and reduce regional risk.

- Investment in AI, analytics, and recurring subscription models enhances operational efficiency, monetization, and earnings stability amid the global mobile gaming surge.

- Regulatory headwinds, competitive pressures, margin erosion, slow IP and content diversification, and risk of technological disruption threaten Nazara's long-term growth and profitability.

Catalysts

About Nazara Technologies- Operates a gaming and sports media platform in India, Africa, the Middle East, the Asia Pacific, the United States, and internationally.

- Analysts broadly agree that strategic acquisitions like Fusebox, Curve Games, and well-known IPs such as Barbie and Little Angel are growth drivers, but they may still underappreciate the compounding scale benefits-Nazara's rapid global expansion and integration is likely to create a content ecosystem with major network effects, accelerating multi-year growth in user acquisition and driving operating leverage across higher-margin segments, ultimately delivering outsized revenue and EBITDA margin expansion versus consensus.

- The analyst consensus expects IP partnerships to improve engagement and cut acquisition costs, yet this could be an understatement-Nazara's emerging ability to consistently secure and operationalize top-tier IPs could cement it as the default gateway for global entertainment brands into India and emerging markets, resulting in recurring high-margin licensing revenue growth and a structural uplift to long-term net margins.

- Nazara's early and expanding international footprint, especially through Nodwin (eSports) and acquired publishing platforms, positions the company to uniquely capture the massive, long-term shift toward digital entertainment in Africa, the Middle East, and Western markets, reducing regional risk and unlocking new, diversified revenue streams, which supports both sustained top-line growth and expanding EBITDA margins.

- The company's scaling investments in AI, analytics, and centers of excellence for user acquisition and monetization are set to deliver industry-leading operational efficiency, cost optimization, and rapid innovation cycles-within a context of surging smartphone and data adoption-making Nazara a dominant beneficiary of the mobile gaming boom, driving structural improvements in both revenue growth and net profitability.

- Nazara's growing base of recurring, high-quality subscription revenues from platforms like Kiddopia and cross-platform synergies with its physical gaming assets (Funky Monkeys, Smaaash) are likely to support resilient earnings growth and reduce earnings volatility, while the accelerating adoption of digital payments and regulatory clarity in India points to higher in-app monetization rates and durable EPS expansion over the coming years.

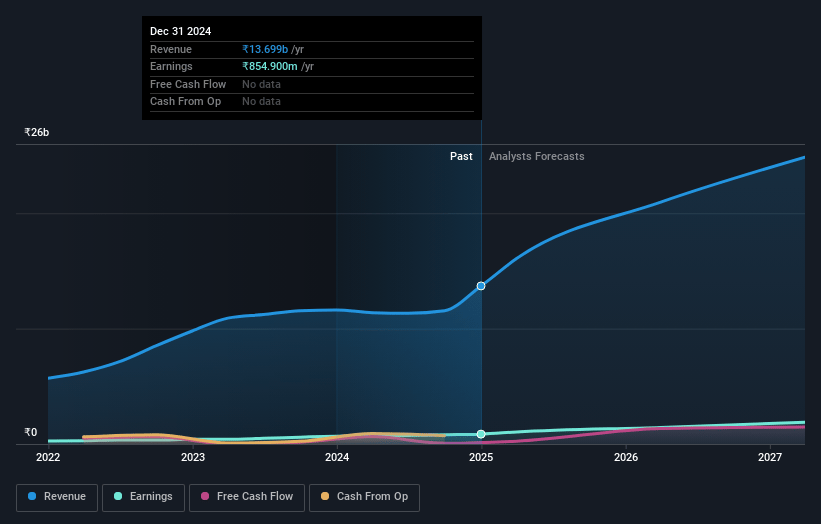

Nazara Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Nazara Technologies compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Nazara Technologies's revenue will grow by 31.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 5.4% today to 7.8% in 3 years time.

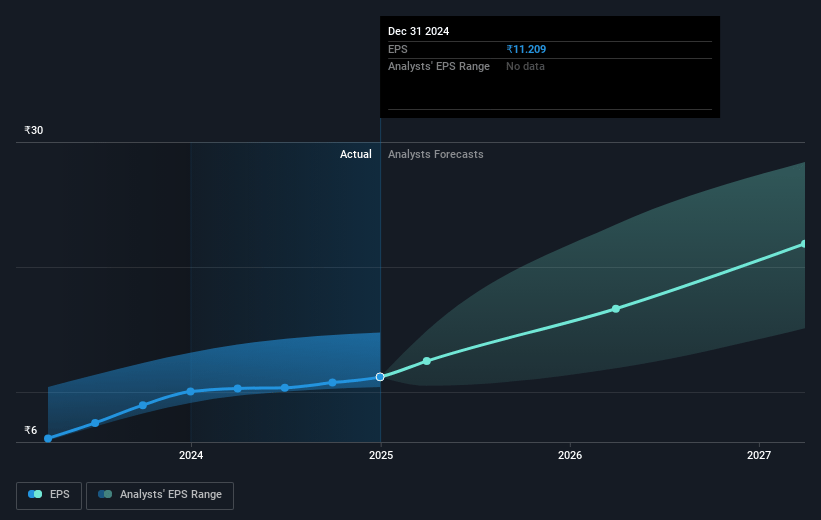

- The bullish analysts expect earnings to reach ₹2.9 billion (and earnings per share of ₹32.72) by about July 2028, up from ₹869.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 91.8x on those 2028 earnings, down from 152.4x today. This future PE is greater than the current PE for the IN Entertainment industry at 34.4x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.08%, as per the Simply Wall St company report.

Nazara Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Growing regulatory uncertainty and stricter tax regimes for online real-money gaming, such as the new GST on deposits in India and pending litigation around retrospective GST, could further restrict Nazara's addressable market and increase compliance costs, thereby reducing long-term revenues and profits.

- Overreliance on volatile segments like eSports and mobile gaming, which face intensifying competition from global giants and new entrants, exposes Nazara to concentration risk; should consumer preferences shift or adoption plateau, both revenues and earnings could stagnate or decline.

- Persistent pressure on net margins due to high user acquisition costs, rising platform commissions (especially to Apple and Google, which have surged from ₹15-18 crores to ₹61 crores this quarter), and ongoing investments in IP development are eroding profitability despite top-line growth.

- Limited success in accelerating original IP creation and international content diversification, as highlighted by stagnant revenues in recent acquisitions such as Kiddopia and Curve Games, could prevent Nazara from achieving sustainable growth in untapped regions, capping future revenue expansion.

- The threat of technological disruption from new gaming paradigms such as blockchain and AR/VR, which remain largely outside Nazara's current portfolio, may render some assets obsolete or less attractive, leading to long-term declines in both user engagement and average revenue per user, impacting earnings and overall industry profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Nazara Technologies is ₹1500.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Nazara Technologies's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1500.0, and the most bearish reporting a price target of just ₹705.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹36.8 billion, earnings will come to ₹2.9 billion, and it would be trading on a PE ratio of 91.8x, assuming you use a discount rate of 16.1%.

- Given the current share price of ₹1430.4, the bullish analyst price target of ₹1500.0 is 4.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.