Key Takeaways

- Growth in recruitment and niche businesses, coupled with AI advancements, boosts revenue and enhances operational efficiencies, improving margins and earnings.

- Naukri Gulf's expansion into GCC offers revenue diversification and geographical risk reduction, supporting growth.

- Delayed revenue recognition and continued losses in non-recruitment segments, along with external challenges, may strain profitability and financial flexibility.

Catalysts

About Info Edge (India)- Operates as an online classifieds company in the areas of recruitment, matrimony, real estate, and education and related services in India and internationally.

- The recruitment business is experiencing double-digit growth after several quarters of low single-digit growth, driven by a recovering hiring market, especially in non-IT sectors like BFSI, health care, and manufacturing, which is expected to positively impact revenue.

- Increased user engagement on platforms like Naukri, driven by AI-powered enhancements and new features, is showing tangible gains in user metrics and productivity, likely improving net margins through operational efficiencies.

- Niche and adjacent businesses such as iimjobs, Naukri Gulf, and Zwayam are demonstrating significant billing growth, which holds the potential for substantial revenue contributions in the future, thus positively influencing earnings.

- The deployment and scaling of AI and machine learning initiatives across all Info Edge platforms are enhancing user engagement and operational productivity, potentially lowering operating costs and increasing net margins.

- The $100 crore+ Naukri Gulf business, growing at around 18-20%, presents expansion opportunities in the GCC region, which may enhance revenue and diversify geographical risk, supporting overall earnings growth.

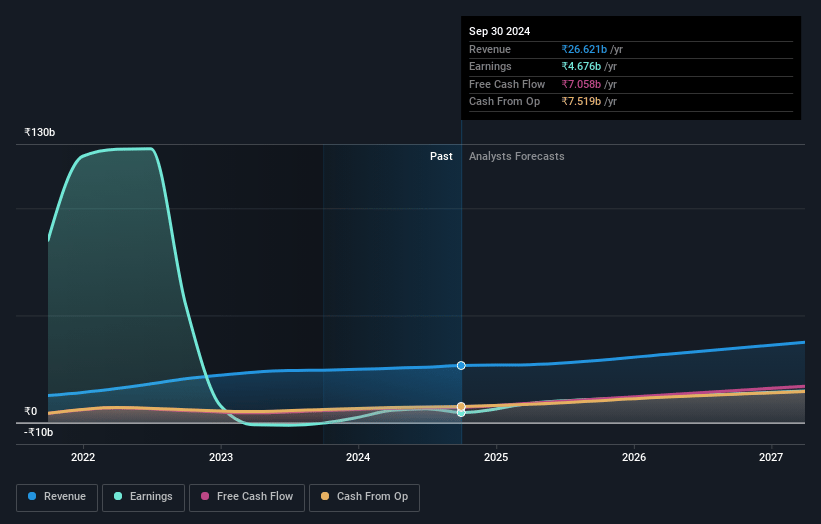

Info Edge (India) Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Info Edge (India)'s revenue will grow by 15.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 17.6% today to 45.8% in 3 years time.

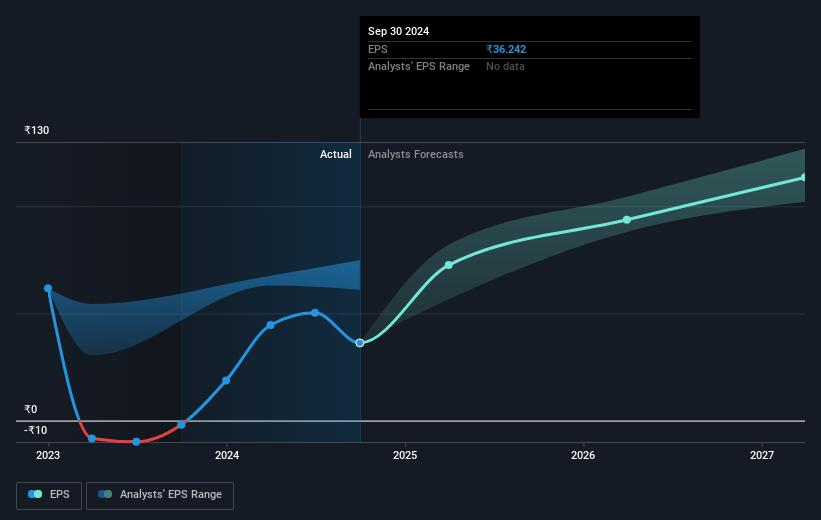

- Analysts expect earnings to reach ₹18.6 billion (and earnings per share of ₹132.87) by about January 2028, up from ₹4.7 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 91.5x on those 2028 earnings, down from 205.6x today. This future PE is greater than the current PE for the IN Interactive Media and Services industry at 25.0x.

- Analysts expect the number of shares outstanding to grow by 2.75% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.72%, as per the Simply Wall St company report.

Info Edge (India) Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The recruitment segment saw revenue growth lag behind billing growth, which could indicate delayed revenue recognition affecting short-term earnings.

- Significant deferred tax charges related to changes in long-term capital gains tax reduced net profits, potentially impacting the company's financial flexibility and margins.

- The non-recruitment business is still operating at a loss, and although cash losses have decreased, ongoing losses could strain profitability.

- The Shiksha business faced challenges due to external factors like tighter restrictions for international students, affecting its revenue growth potential.

- Increased competition, especially from companies like Housing.com, in segments like real estate could potentially impact future revenues by necessitating higher marketing spend or reducing pricing power.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹8270.48 for Info Edge (India) based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹9330.0, and the most bearish reporting a price target of just ₹4150.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹40.6 billion, earnings will come to ₹18.6 billion, and it would be trading on a PE ratio of 91.5x, assuming you use a discount rate of 13.7%.

- Given the current share price of ₹7445.15, the analyst's price target of ₹8270.48 is 10.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives