Narratives are currently in beta

Key Takeaways

- Expansion into new product lines and increased capacity in industrial and furniture segments suggests potential for significant revenue and margin growth.

- Geographic and market expansion, along with stable pricing, positions the company for improved distribution and profitability in key business areas.

- Volatility in resin prices and government spending threatens revenue stability, while cash management issues and cost pressures raise concerns about profitability and growth.

Catalysts

About Supreme Industries- Engages in the manufacture and sale of plastic products in India.

- Supreme Industries has commenced commercial production at a new greenfield unit dedicated for industrial and ball valves, indicating potential revenue growth from new product lines and increased capacity in the industrial segment.

- The company anticipates improved profitability and about 15% volume growth in its Cross Laminated Film business due to better demand and market penetration, likely impacting revenue and net margins positively.

- Ongoing and planned expansions, including a new facility at Kanpur for window manufacturing and additional capacity for Plastic Pipe systems, signal potential earnings growth from increased production capacity and new market opportunities.

- Supreme Industries is pursuing geographic expansion and market penetration with the opening of new showrooms and retail outlets for its Furniture segment, which could lead to higher revenue and margin improvement as distribution efficiency increases.

- Government infrastructure spending is expected to increase in the second half of the financial year, paired with stable PVC pricing. This could positively influence revenue growth and margins in the Plastic Pipe System business.

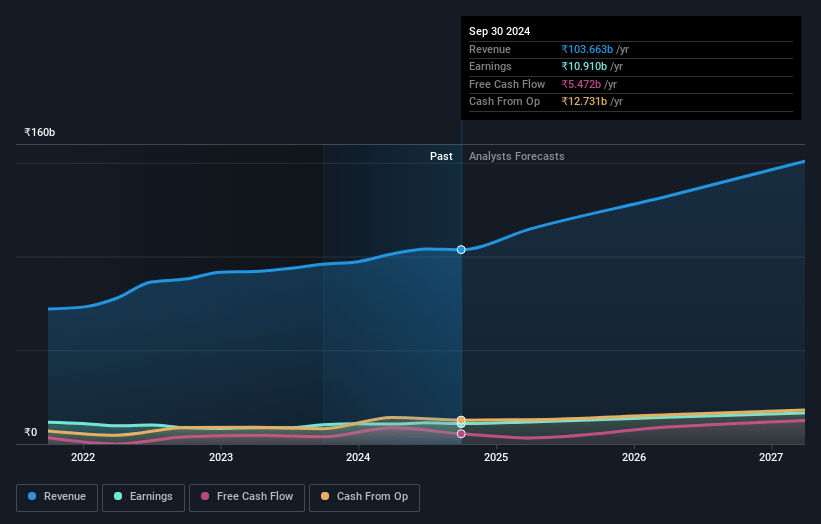

Supreme Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Supreme Industries's revenue will grow by 16.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.5% today to 11.1% in 3 years time.

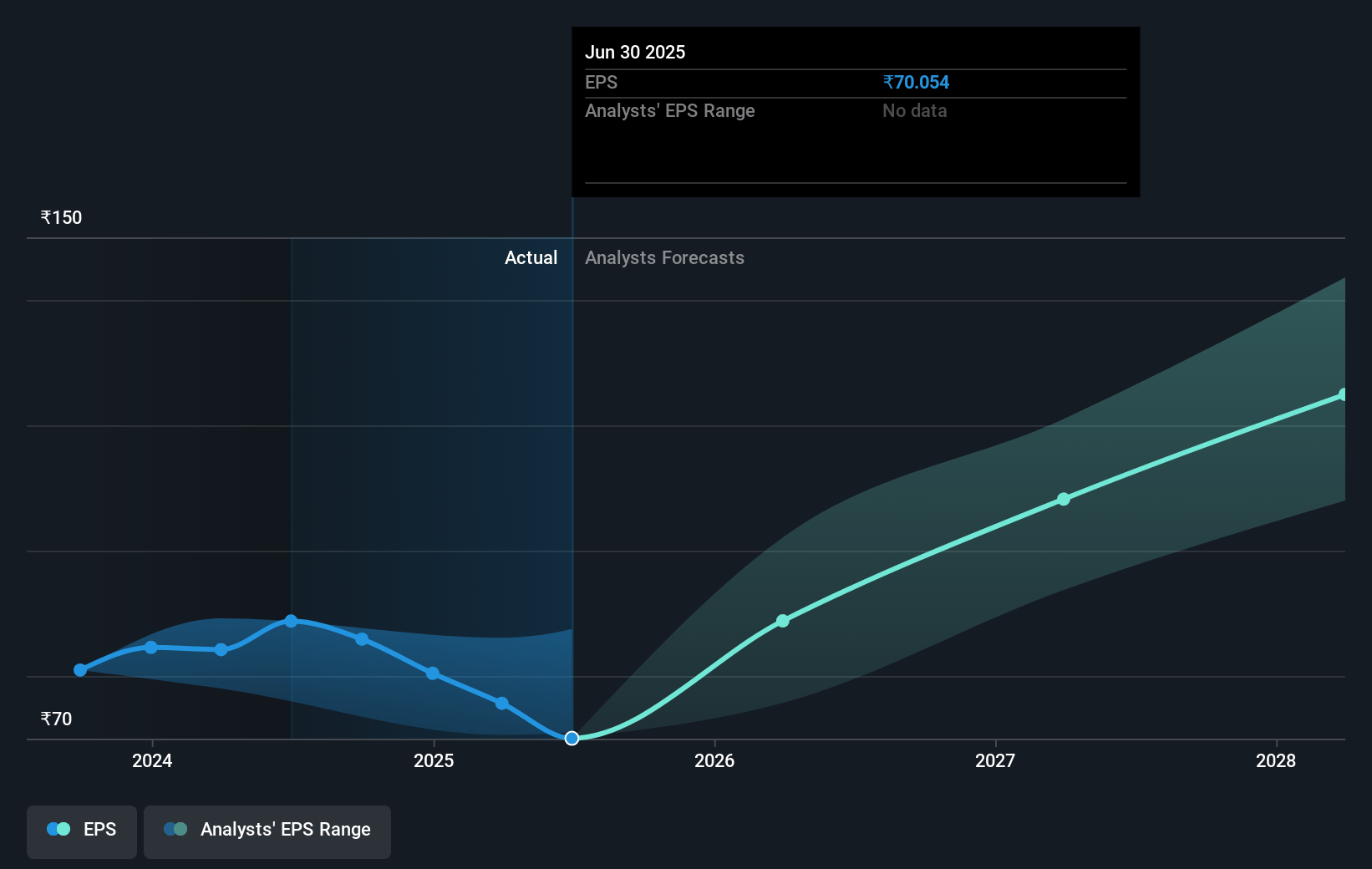

- Analysts expect earnings to reach ₹18.0 billion (and earnings per share of ₹130.4) by about January 2028, up from ₹10.9 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹14.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 57.1x on those 2028 earnings, up from 54.7x today. This future PE is greater than the current PE for the IN Chemicals industry at 20.5x.

- Analysts expect the number of shares outstanding to grow by 2.88% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.0%, as per the Simply Wall St company report.

Supreme Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's revenue from the Plastic Piping System business is threatened by extreme volatility in PVC resin prices and reduced government infrastructure spending, which could lead to inconsistent performance in revenue.

- The decline in cash surplus from ₹1,178 crores in March 2024 to ₹674 crores in September 2024 indicates potential cash management issues, potentially impacting the company's ability to finance future operations and expansions from its earnings.

- The reported 9% decrease in consolidated operating profit for the second quarter, alongside reduced margin pressures due to inventory losses of around ₹35 to ₹40 crores, points to challenges in maintaining profitability and consistent earnings growth.

- The adjustment of growth expectations for the Plastic Pipe System from 25% to 16%-18% due to de-stocking and extended monsoon effects showcases the vulnerability to external factors, impacting the anticipated revenue growth.

- Ongoing fluctuations in freight rates and import-dependent raw material costs such as PVC and CPVC resin could challenge cost stability, negatively impacting net margins and potentially resulting in earnings volatility.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹5170.96 for Supreme Industries based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹6483.0, and the most bearish reporting a price target of just ₹3240.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹162.6 billion, earnings will come to ₹18.0 billion, and it would be trading on a PE ratio of 57.1x, assuming you use a discount rate of 13.0%.

- Given the current share price of ₹4699.6, the analyst's price target of ₹5170.96 is 9.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives