Key Takeaways

- Shifting industry trends and advanced technologies threaten the company's traditional steel-forging business model, constraining revenue growth and future competitiveness.

- Continued reliance on internal combustion markets, high customer concentration, and increased ESG pressures expose profitability to ongoing structural risks.

- Strategic capacity expansions, promoter commitment, and improved product offerings are expected to boost margins, financial stability, and long-term revenue resilience through diversification and debt reduction.

Catalysts

About Ramkrishna Forgings- Engages in the manufacture and sale of forged components for automobiles, railway wagons and coaches, and engineering parts in India and internationally.

- Intensifying demand for lighter, alternative materials such as aluminum and composites in the automotive and rail sectors is expected to erode the long-term addressable market for traditional steel-forged components, leading to stagnating or shrinking revenues even as Ramkrishna Forgings continues to invest in incremental capacity.

- The global acceleration of the electric vehicle transition threatens the company's core customer base, which remains heavily exposed to internal combustion engine vehicles and commercial vehicles, raising the likelihood of sustained volume declines and downward pressure on earnings over time.

- Heightened global focus on ESG compliance and increasing carbon costs will elevate operating expenses for forging companies in India, potentially rendering Ramkrishna Forgings less competitive in export markets and compressing net margins over the long term.

- Persistent customer concentration risk in cyclical end segments, coupled with limited penetration into higher-value, advanced technology products, reduces the company's ability to diversify revenue streams or defend profitability as traditional contract volumes are lost to industry disruptions.

- The rise of advanced manufacturing technologies, such as additive manufacturing and near-net-shape processes, is likely to reduce the technical and pricing moat of conventional forging, requiring capital-intensive adaptation with uncertain payoffs and weighing down prospective free cash flows and returns on capital.

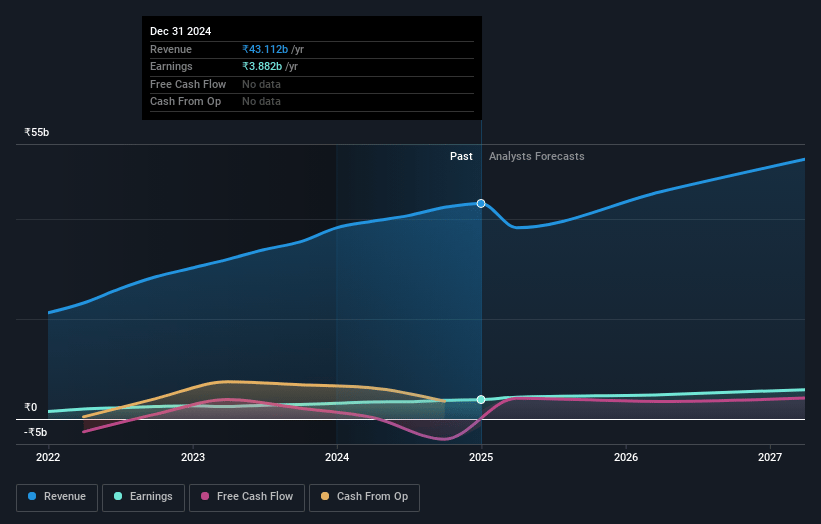

Ramkrishna Forgings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Ramkrishna Forgings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Ramkrishna Forgings's revenue will grow by 3.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 8.2% today to 13.0% in 3 years time.

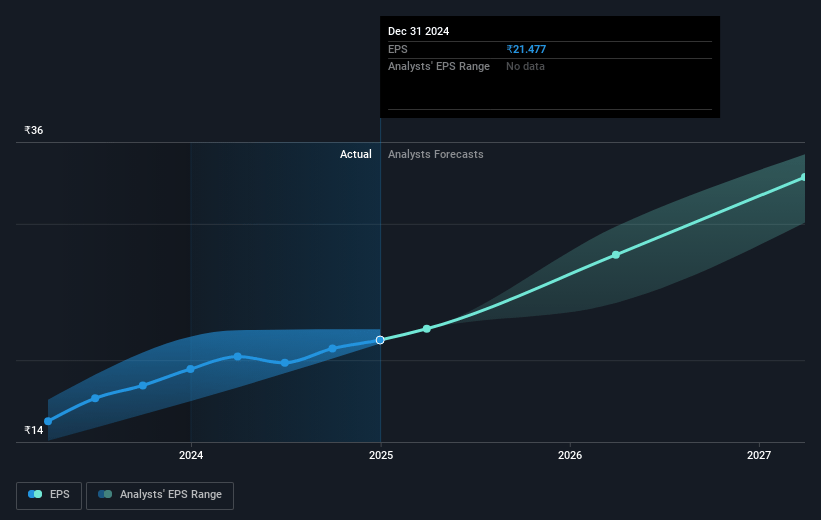

- The bearish analysts expect earnings to reach ₹5.8 billion (and earnings per share of ₹34.95) by about July 2028, up from ₹3.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 25.9x on those 2028 earnings, down from 35.6x today. This future PE is greater than the current PE for the IN Metals and Mining industry at 23.2x.

- Analysts expect the number of shares outstanding to grow by 0.24% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.1%, as per the Simply Wall St company report.

Ramkrishna Forgings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is projecting robust revenue growth of 15 to 20 percent for FY '26, supported by a strong order pipeline, capacity additions, and new product wins, which could lead to a sustained increase in revenues and cash flows.

- The management remains confident in restoring and further expanding EBITDA margins, with a target of reaching 24 to 25 percent margins by FY '28, underpinned by improved product mix, higher value-added offerings, and operational efficiencies that may drive strong future earnings.

- The promoters are demonstrating financial commitment by issuing warrants priced substantially above the current market price and injecting ₹204.75 crores to offset the inventory discrepancy, directly shoring up net worth and reflecting strong alignment with minority shareholders' interests-this action could stabilize financial ratios and investor confidence.

- Recent capacity expansion in cold, hot, and warm forging, along with entry into high-value automotive and non-automotive orders and diversification across regions (with 41 percent exports, and new business growth expected from railways and passenger vehicles), supports long-term revenue scalability and resilience.

- The company is nearing the end of its heavy capital expenditure cycle and expects a sharp decline in CapEx requirements (to ₹100–150 crores annually) alongside substantial debt reduction through free cash flow, promoter funds, and tax refunds, which may enhance net margin, return on equity, and balance sheet health in the medium term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Ramkrishna Forgings is ₹560.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Ramkrishna Forgings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1111.0, and the most bearish reporting a price target of just ₹560.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹44.8 billion, earnings will come to ₹5.8 billion, and it would be trading on a PE ratio of 25.9x, assuming you use a discount rate of 14.1%.

- Given the current share price of ₹651.35, the bearish analyst price target of ₹560.0 is 16.3% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.