Key Takeaways

- Strategic partnerships and domestic capacity position Neogen for dominant export and domestic market share, with potential for outsized growth in battery chemicals and lithium products.

- Diversification into new value chains and strong operational agility reduce revenue volatility, supporting margin expansion and premium positioning in sustainable specialty chemicals.

- Neogen Chemicals faces margin and earnings pressure from raw material volatility, regulatory costs, project execution risks, and competition-driven pricing challenges.

Catalysts

About Neogen Chemicals- Engages in the manufacture and sale of specialty chemicals in India.

- While analyst consensus views the Morita JV and technology partnership as providing a quality and speed advantage, a more bullish scenario is that this relationship will fast-track the approval process with global battery majors, accelerating Neogen's capture of large export contracts and yielding a far larger and stickier revenue base from export battery chemicals than is currently modeled, materially boosting revenue and EBITDA growth beyond expectations.

- Analyst consensus expects high growth in lithium products as Indian EV demand ramps up, but industry indications and customer urgency for non-China supply suggest the buildout could see utilization rates and pricing outpace projections; Neogen's first-mover, large-scale domestic capacity and unique technology tie-ups could establish it as the dominant supplier in India, driving a step-change in net margins and long-term market share.

- Neogen's diversification into semiconductor and flavor/fragrance value chains-largely overlooked by consensus-positions it to capitalize on multi-decade demand growth from global technology reshoring, further reducing revenue volatility and improving blended gross margins as these segments grow in the overall mix.

- The company's operational execution-demonstrated by rapid production realignment post-fire, sustained volume growth despite industry downturns, and ongoing cost and working capital improvements-points to embedded operating leverage that can drive significant sustained margin expansion and higher return on capital as new capacity comes online.

- Increasing global regulatory and OEM requirements for supply chain traceability and sustainability favor regional, technology-led suppliers like Neogen, positioning the company to command a premium for "green" specialty chemicals, which will support structurally higher margins and stable long-term cash flows.

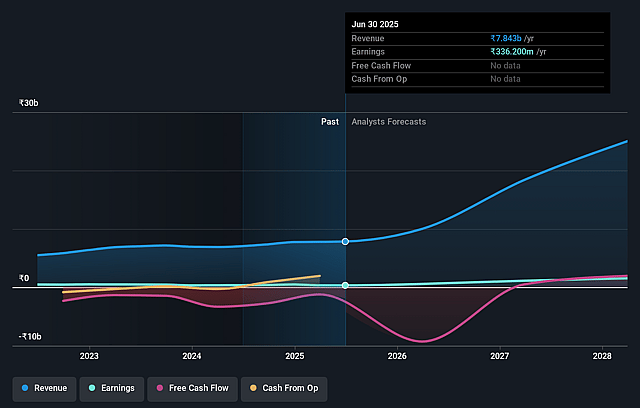

Neogen Chemicals Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Neogen Chemicals compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Neogen Chemicals's revenue will grow by 58.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.5% today to 7.7% in 3 years time.

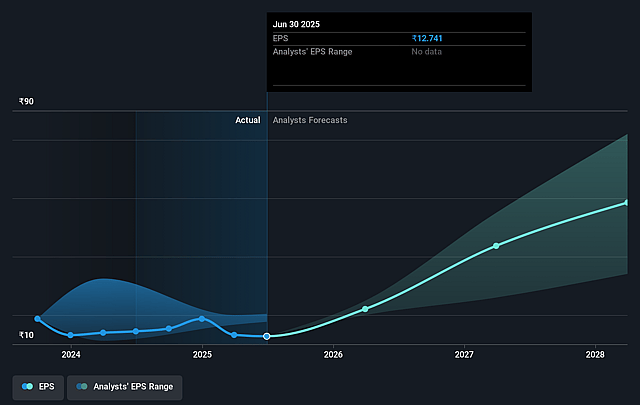

- The bullish analysts expect earnings to reach ₹2.4 billion (and earnings per share of ₹91.46) by about August 2028, up from ₹348.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 49.6x on those 2028 earnings, down from 125.5x today. This future PE is greater than the current PE for the IN Chemicals industry at 29.1x.

- Analysts expect the number of shares outstanding to grow by 0.44% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.65%, as per the Simply Wall St company report.

Neogen Chemicals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- High dependence on bromine and lithium-based compounds exposes Neogen Chemicals to raw material price volatility and demand shifts, which can lead to material declines in revenue and margin compression if trends toward alternative chemistries or substitutes accelerate.

- Significant expansion into lithium-ion battery materials carries the risk of technological disruption, as new battery chemistries or alternative compounds could swiftly erode the addressable market for Neogen's products and negatively impact future revenue potential.

- Heightened global regulatory scrutiny and tightening environmental norms in the chemical sector may drive up compliance and operational costs for Neogen, reducing net margins and making exports more difficult over time.

- Execution risks in large, capital-intensive growth projects-such as commissioning new plants, scaling specialty chemicals capacity, and forming complex JVs-could result in delays, under-utilization of assets, or cost overruns, ultimately depressing the company's return on capital and net earnings.

- Prolonged low pricing in key chemical segments due to Chinese overcapacity and aggressive competition, combined with long working capital cycles and high debt levels (as seen in recent financials), could strain cash flows and threaten earnings stability if prices do not recover as expected.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Neogen Chemicals is ₹2871.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Neogen Chemicals's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹2871.0, and the most bearish reporting a price target of just ₹1610.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹31.0 billion, earnings will come to ₹2.4 billion, and it would be trading on a PE ratio of 49.6x, assuming you use a discount rate of 13.6%.

- Given the current share price of ₹1539.8, the bullish analyst price target of ₹2871.0 is 46.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.