Key Takeaways

- Ongoing capacity expansion, R&D innovation, and green initiatives position Jubilant Ingrevia for strong margin gains, higher-value revenues, and global market share growth.

- Premium nutraceutical demand and shifting global sourcing trends boost export-led revenues, sustainable pricing power, and diversification across specialty end-markets.

- Weakness in legacy businesses, execution challenges in specialty pivot, high capex risks, rising regulatory costs, and global trade shifts threaten revenue growth and margins.

Catalysts

About Jubilant Ingrevia- Engages in the life science products and solutions in India, the United States, Europe, China and internationally.

- Analyst consensus highlights strong growth from Specialty Chemicals, but this likely underestimates the multi-year margin expansion and volume ramp-up ahead, as Jubilant Ingrevia has only achieved half the revenue potential from recent large CapEx, positioning the segment for outsized EBITDA and earnings compounding as existing capacity nears full utilization.

- While analyst consensus points to rising revenue and net margins from higher-value Nutrition & Health Solutions and new vitamin B3 capacity, the impact is set to be even more significant as the human and cosmetic-grade nutrition segment rapidly scales, tapping into global premium nutraceutical demand and offering both volume and structural price/margin lifts over time.

- Jubilant Ingrevia is uniquely poised to capture accelerating market share in global specialty chemicals as regulatory-driven China+1 sourcing and supply chain diversification disproportionately benefit Indian incumbents, directly driving export-led revenue growth and higher global price realization as Western buyers lock into reliable, ESG-compliant suppliers.

- The company's aggressive and ongoing R&D build-out, with dedicated teams developing advanced chemistries and securing 25+ new CDMO opportunities across pharma, agrochemicals, and semiconductors, is set to expand the product pipeline into higher-value applications and create multiple structural revenue legs, increasing both diversification and margin profile.

- With a fast-growing portfolio of green manufacturing initiatives and a leading ESG score, Jubilant Ingrevia is cemented as a supplier of choice for global customers prioritizing sustainable sourcing, which should drive long-term pricing power, entry into new global supply chains, and sustained improvement in revenue quality and net margins.

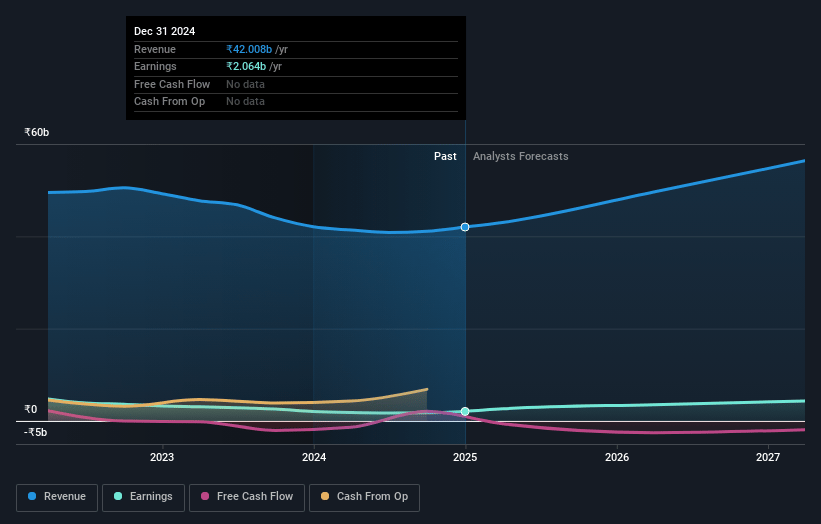

Jubilant Ingrevia Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Jubilant Ingrevia compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Jubilant Ingrevia's revenue will grow by 20.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 6.0% today to 10.9% in 3 years time.

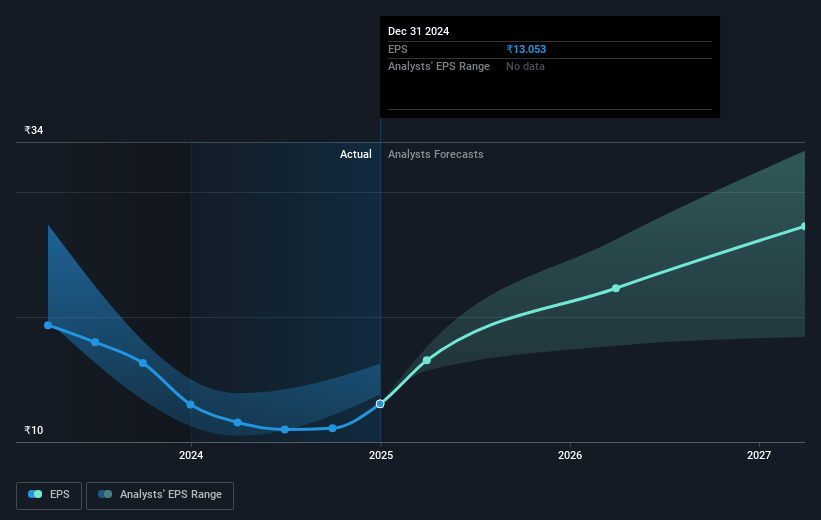

- The bullish analysts expect earnings to reach ₹8.0 billion (and earnings per share of ₹50.57) by about July 2028, up from ₹2.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 31.9x on those 2028 earnings, down from 51.5x today. This future PE is greater than the current PE for the IN Chemicals industry at 29.6x.

- Analysts expect the number of shares outstanding to decline by 0.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.14%, as per the Simply Wall St company report.

Jubilant Ingrevia Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Jubilant Ingrevia continues to face sustained weakness and downward cycles in its legacy acetyls and chemical intermediates businesses, with persistent low volumes and depressed pricing due to weak paracetamol demand and intense competition, which poses significant risk to overall topline revenue and net margins.

- There is substantial execution risk in their strategy to shift the portfolio toward specialty chemicals and nutrition, as meaningful ramp-up of capacity utilization, customer approvals, and commercialization of new CDMO and semiconductor products may take longer than anticipated, hindering expected earnings and revenue growth.

- The company's capital expenditure plans, which involve sustained annual investments of INR six hundred crores to INR eight hundred crores for several years, increase risk of capital misallocation, potential overextension, and could negatively impact return ratios and cash flows if revenue realization lags investment.

- Jubilant Ingrevia is exposed to structural industry trends such as global decarbonization, increasing environmental regulations, and push toward green chemistry, all of which may raise compliance costs, require significant further capex, and threaten demand for traditional chemical products, thereby squeezing long-term profitability and margins.

- Rising global protectionism, de-globalization, and realignment of supply chains may disrupt Jubilant's export-driven growth, especially given their growing overseas revenue share, risking increased operational costs and loss of export market share, directly impacting future revenue streams and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Jubilant Ingrevia is ₹1100.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Jubilant Ingrevia's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1100.0, and the most bearish reporting a price target of just ₹713.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹73.4 billion, earnings will come to ₹8.0 billion, and it would be trading on a PE ratio of 31.9x, assuming you use a discount rate of 14.1%.

- Given the current share price of ₹819.2, the bullish analyst price target of ₹1100.0 is 25.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.