Key Takeaways

- Expansion into high-margin specialty wires and backward integration is set to improve profitability and strengthen competitive positioning as new capacities become operational.

- Enhanced working capital management and favorable industry dynamics are expected to support sustainable free cash flow and long-term growth prospects.

- Heavy expansion plans, margin pressure, cyclical market exposure, execution risks, and rising compliance threats may undermine profitability and earnings stability.

Catalysts

About Bansal Wire Industries- Manufactures and sells steel wires worldwide.

- Sustained government investment in infrastructure and manufacturing in India is driving strong and ongoing demand for steel wire products; Bansal Wire's planned capacity expansions and healthy pipeline position it to capture significant volume growth, supporting long-term revenue increases.

- The company's pivot to higher-margin specialty wires-such as hose wire, IHT (for EVs), and steel cord (largely import substitutes)-is likely to boost operating margins and future profitability as these segments scale up, especially post FY '28, as customer approvals come through and production ramps up.

- Backward integration through the Sanand project is expected to secure raw material supply, reduce input costs, and enhance EBITDA per tonne beginning in FY '28, enabling margin recovery and earnings improvement after a temporary decline during the current expansion phase.

- Improved working capital management and organizational restructuring have already delivered strong free cash flow and are expected to further reduce inventory and debtor days, supporting higher cash conversion and funding growth through internal accruals, positively impacting future net margins and capital returns.

- The ongoing formalization of the Indian wire sector and "Make in India" policies favor organized domestic players like Bansal Wire, enabling market share gains and reducing competition from imports, which bodes well for sustained revenue growth and improved earnings visibility over the long term.

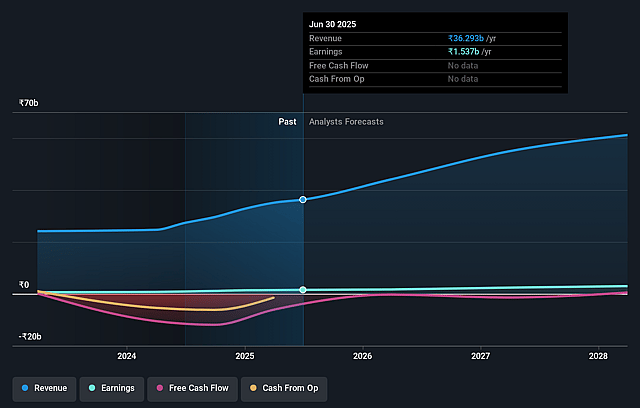

Bansal Wire Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Bansal Wire Industries's revenue will grow by 22.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.2% today to 4.7% in 3 years time.

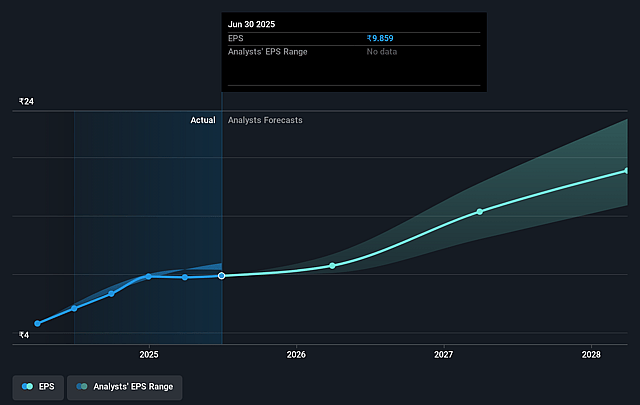

- Analysts expect earnings to reach ₹3.2 billion (and earnings per share of ₹17.98) by about September 2028, up from ₹1.5 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ₹3.6 billion in earnings, and the most bearish expecting ₹2.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 43.2x on those 2028 earnings, up from 37.6x today. This future PE is greater than the current PE for the IN Metals and Mining industry at 23.6x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.85%, as per the Simply Wall St company report.

Bansal Wire Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Plans for aggressive capacity expansion and market share gains through substantial CapEx (₹700-750 crores over two years) could result in overcapacity if demand does not materialize as anticipated, leading to depressed asset turns, lower ROCE/ROE, and weaker earnings quality.

- Management has guided for a 20% reduction in EBITDA margins over FY'26-27 due to focus on volume growth and product mix changes, which may not recover until FY'28, risking erosion in profitability and potentially affecting net margins and investor sentiment.

- Sustained exposure to highly cyclical end markets (infrastructure, automotive, construction) heightens earnings volatility, especially if macroeconomic conditions or infrastructure investments slow, directly impacting revenues and earnings predictability.

- Dependency on customer approvals and staggered ramp-up for higher-margin specialty wire products (with significant contribution delayed until FY'28) introduces execution risk and delays diversification into more profitable segments, potentially prolonging reliance on commoditized, low-margin products and flatlining profitability.

- Rising compliance requirements (e.g., environmental regulations, ESG investments at Sanand) and global trade headwinds, such as protectionism and competition from low-cost Asian producers, could escalate costs, pressure margins, and restrict exports, ultimately weighing on both top-line growth and net profit margins in the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹486.75 for Bansal Wire Industries based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹550.0, and the most bearish reporting a price target of just ₹440.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹67.2 billion, earnings will come to ₹3.2 billion, and it would be trading on a PE ratio of 43.2x, assuming you use a discount rate of 13.8%.

- Given the current share price of ₹369.0, the analyst price target of ₹486.75 is 24.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Bansal Wire Industries?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.