Key Takeaways

- Rising regulatory and compliance pressures, combined with client concentration and evolving global supply chains, threaten revenue stability and profit margins.

- Aggressive expansion and elevated leverage increase financial risk, while intensifying competition and limited integration could further squeeze margins and growth.

- Secular growth, global diversification, product innovation, margin expansion, and balance sheet strengthening position Anupam Rasayan for sustained revenue visibility and earnings stability.

Catalysts

About Anupam Rasayan India- Engages in the custom synthesis and manufacturing of specialty chemicals in India, Europe, Japan, Singapore, China, North America, and internationally.

- Despite expectations for robust revenue growth driven by new product launches and significant contract wins, Anupam Rasayan faces rising regulatory scrutiny and environmental compliance challenges in global markets, particularly in the US, EU and Japan. Stricter regulations could substantially raise compliance costs and disrupt plant operations, threatening future revenue scalability and compressing net profit margins across the business.

- The company's aggressive capital expenditure cycle and planned capacity expansion risk leaving it over-leveraged, especially as working capital remains elevated and inventory build-up has yet to normalize. Any cyclical downturn or delays in contract ramp-up could increase interest expense, squeeze operating cash flows, and erode earnings-putting pressure on both return ratios and balance sheet health over time.

- A high concentration of revenue (over 70 percent from just 10 customers) exposes Anupam Rasayan to significant client concentration risk. Loss of a major customer, delay in product commercialization, or renegotiation of pricing could derail assumed revenue growth trajectories and lead to abrupt declines in EBITDA margins.

- With the global chemical supply chain rapidly evolving, there is a tangible risk of supply chain re-globalization and onshoring by Western chemical users. If foreign customers reduce their exposure to Indian specialty chemical suppliers, Anupam Rasayan's export order book and long-term contracted revenues could fall short of current bullish projections, leading to unanticipated top line stagnation.

- As multinational competitors in China and Southeast Asia catch up in R&D and cost efficiency, Anupam Rasayan's technical moat could erode, resulting in price-based competition in both overseas and domestic markets. This margin pressure, combined with limited backward integration compared to larger global peers, could compress gross margins and limit long-term earnings growth, particularly if raw material price volatility cannot be fully passed through.

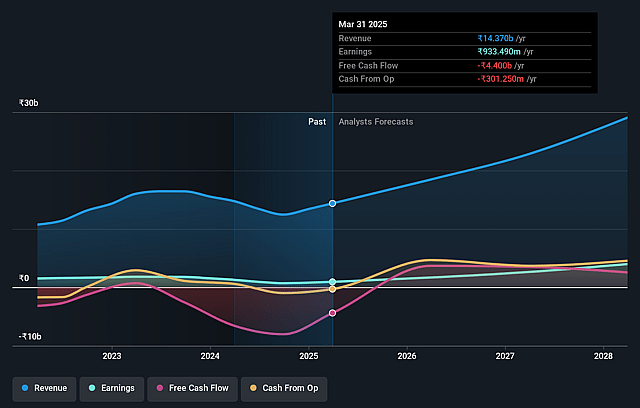

Anupam Rasayan India Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Anupam Rasayan India compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Anupam Rasayan India's revenue will grow by 22.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 6.5% today to 16.0% in 3 years time.

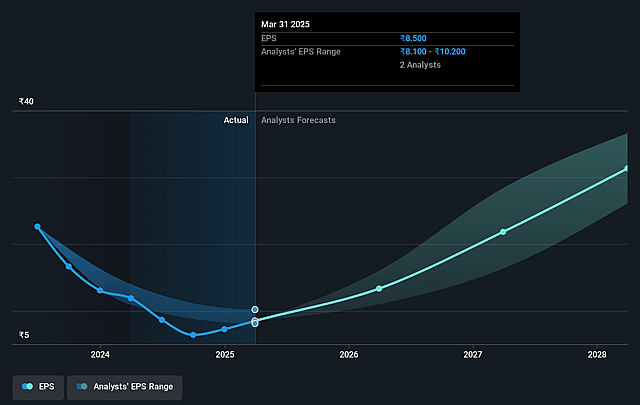

- The bearish analysts expect earnings to reach ₹4.3 billion (and earnings per share of ₹29.08) by about August 2028, up from ₹933.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 20.1x on those 2028 earnings, down from 132.0x today. This future PE is lower than the current PE for the IN Chemicals industry at 27.2x.

- Analysts expect the number of shares outstanding to grow by 0.91% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.75%, as per the Simply Wall St company report.

Anupam Rasayan India Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Anupam Rasayan is seeing strong secular tailwinds from global shifts such as the China+1 strategy and multinational customers diversifying supply chains, which is resulting in a record high and growing order book of ₹14,646 crores over the next 4-10 years, directly supporting multi-year revenue visibility and topline growth.

- The company has signed multi-year LOIs and long-term contracts with blue-chip MNCs in Japan and the US, with many contracts now being commercialized-this geographical diversification in high-value markets will lower revenue volatility and further increase export revenues.

- Ongoing investment in capacity expansion and vertical integration (including backward integration via Tanfac) is enabling Anupam Rasayan to not only launch new molecules but also expand into high-growth areas like EV battery chemicals and pharma intermediates, which are typically higher-margin segments and can support margin expansion and earnings stability.

- R&D and product launches, particularly in specialty, pharma, and advanced electronic chemicals-including proprietary, patented, and IP-protected chemistries-are broadening the company's product mix and creating additional revenue streams, helping to mitigate risks from single-product or single-industry dependence and strengthen long-term EBITDA growth.

- The company is actively deleveraging its balance sheet by using warrant proceeds to retire long-term debt, which coupled with improved working capital management as revenue scales, will lower interest outflows and improve net margins and overall cash flow, resulting in a stronger financial position for future growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Anupam Rasayan India is ₹520.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Anupam Rasayan India's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1305.0, and the most bearish reporting a price target of just ₹520.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹26.6 billion, earnings will come to ₹4.3 billion, and it would be trading on a PE ratio of 20.1x, assuming you use a discount rate of 13.8%.

- Given the current share price of ₹1120.5, the bearish analyst price target of ₹520.0 is 115.5% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.