Last Update04 Aug 25Fair value Increased 6.08%

The consensus price target for Navin Fluorine International has been raised to ₹4,990, reflecting improved fundamentals as margins expanded and the forward P/E multiple contracted, signaling enhanced profitability and valuation appeal.

What's in the News

- Navin Fluorine International completed a follow-on equity offering, raising INR 7.5 billion by allotting 1,602,564 equity shares at INR 4,680 each to qualified institutional buyers at a 2.46% discount to the floor price.

- The company’s board approved opening the equity issue, set the floor price at INR 4,798.28 per share, and amended the AGM notice to remove a previous fundraising item.

- Upcoming board meetings will consider and approve unaudited financial results for the quarter ended June 2025.

- Board approved a capital expenditure arrangement of approximately INR 1.2 billion.

- Announced a strategic alliance with Chemours to manufacture the Opteon two-phase immersion cooling fluid, supporting data center and AI cooling needs, with commercialization beginning in 2026.

Valuation Changes

Summary of Valuation Changes for Navin Fluorine International

- The Consensus Analyst Price Target has risen from ₹4744 to ₹4990.

- The Future P/E for Navin Fluorine International has significantly fallen from 52.03x to 45.55x.

- The Net Profit Margin for Navin Fluorine International has risen from 15.87% to 16.82%.

Key Takeaways

- Sustainability trends and global regulatory shifts drive premium pricing, margin gains, and export opportunities for Navin Fluorine across refrigerant and specialty chemical markets.

- Strategic investments in manufacturing, integration, and partnerships strengthen supply chains, expand capabilities, and support consistent growth in profitability and geographic reach.

- Dependence on favorable product pricing, successful innovation, and timely expansion amid global competition and regulatory risks threatens revenue growth and long-term profitability.

Catalysts

About Navin Fluorine International- Manufactures and sells specialty fluorochemicals in India and internationally.

- Accelerating global demand for lower global warming refrigerants (such as R32) and niche advanced fluorochemicals, driven by sustainability push and stricter environmental regulations, supports premium pricing and increased market share for Navin Fluorine-positively impacting revenue growth and gross margins.

- Growing global pharma and life sciences sector, rising health awareness, and successful commercialization of multiple high-value pharma intermediates and specialty molecules position Navin Fluorine for sustained expansion in high-margin applications-driving steady growth in operating profits and net margins.

- Supply chain diversification trends (including China+1 strategies by multinationals) are boosting direct engagements and export opportunities for Indian specialty chemical makers like Navin Fluorine, evidenced by strategic global partnerships (e.g., Chemours, Buss ChemTech), underpinning robust top-line growth.

- Significant capacity expansions and investments in advanced manufacturing/R&D (new HPP, high-purity HF, fluoro specialty, and CDMO infrastructure) enhance Navin Fluorine's ability to enter new chemistries and geographies, supporting order book visibility and enabling long-term revenue and EBITDA uplift.

- Increasing value-added product mix and backward/forward integration (including AHF project and new downstream molecules) improve supply security, margin resilience, and earnings quality-translating to durable improvements in return on invested capital (ROIC) and net income.

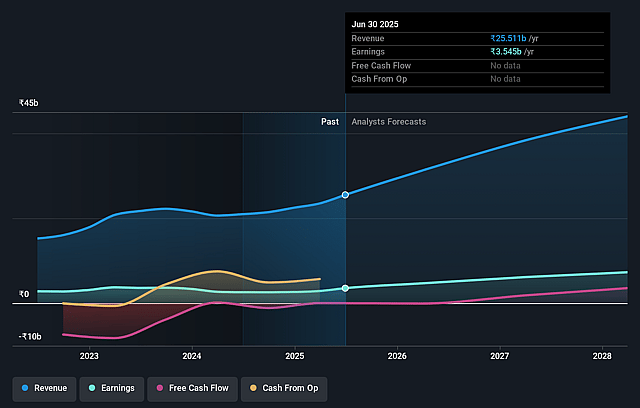

Navin Fluorine International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Navin Fluorine International's revenue will grow by 22.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 13.9% today to 16.8% in 3 years time.

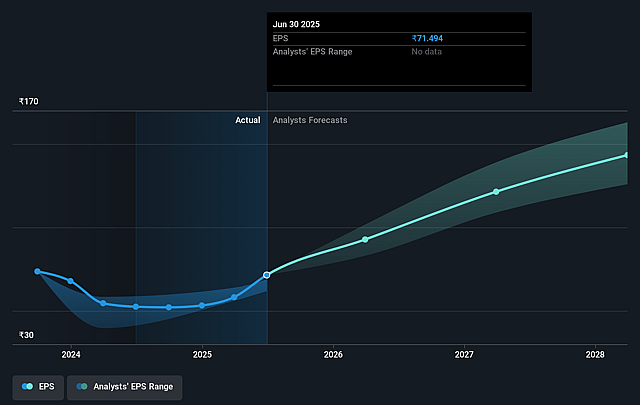

- Analysts expect earnings to reach ₹7.8 billion (and earnings per share of ₹153.61) by about August 2028, up from ₹3.5 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹6.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 48.1x on those 2028 earnings, down from 71.0x today. This future PE is greater than the current PE for the IN Chemicals industry at 26.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.61%, as per the Simply Wall St company report.

Navin Fluorine International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition from Chinese chemical manufacturers continues to exert downward pressure on pricing, particularly in agchem and specialty chemicals, limiting the potential for significant margin expansion and potentially causing flattish or only slightly up revenue growth for these segments.

- Heavy reliance on robust pricing for R32 refrigerant gases and similar products exposes Navin Fluorine to volatility if the current favorable pricing environment reverses, which could shrink both top-line revenue and EBITDA margins.

- The company's aggressive capacity expansion plans and large CapEx allocations (₹700-1,000 crore for FY'26-27) carry substantial execution risks; any delays, cost overruns, or underutilization of new plants would negatively impact return on capital employed and long-term earnings growth.

- Exposure to global trade disruption risks continues, as recent U.S. tariffs and other potential protectionist measures could impact exports, particularly of refrigerant gases and CDMO products, threatening foreign-derived revenues and exacerbating margin pressures.

- A strategic focus on niche and high-margin products entails dependence on sustained innovation and successful new product commercialization; failure to keep pace with rapid industry shifts, technology transitions, or regulatory changes (such as green chemistry mandates or phase-outs of certain fluorinated compounds) could erode the addressable market, impacting both revenue and long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹5032.607 for Navin Fluorine International based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹6151.0, and the most bearish reporting a price target of just ₹3880.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹46.5 billion, earnings will come to ₹7.8 billion, and it would be trading on a PE ratio of 48.1x, assuming you use a discount rate of 13.6%.

- Given the current share price of ₹4913.8, the analyst price target of ₹5032.61 is 2.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.