Catalysts

About Navin Fluorine International

Navin Fluorine International is a fluorochemicals company focused on high performance products, specialty chemicals and contract development and manufacturing services for global innovators.

What are the underlying business or industry changes driving this perspective?

- Scale up of new R32 capacity, aligned with tightening global refrigerant quotas and rising air conditioning needs, is set to drive structurally higher realizations per kilogram. This supports sustained revenue growth and robust EBITDA margins.

- The integrated AHF and electronic grade HF platform positions the company as a key supplier to advanced materials and electronics value chains. This enables higher value addition per tonne and long term expansion in gross margins.

- Deepening CDMO partnerships with large European innovators, including late stage molecules and a dedicated cGMP4 facility, are building a visible multi year revenue stream and improving earnings stability and operating leverage.

- Ramping fluoro specialty and Opteon immersion cooling projects, backed by firm orders through calendar 2026, tap into global shifts toward energy efficient and climate friendly solutions. This is boosting topline momentum and blended net margins.

- Brownfield debottlenecking in multipurpose plants and disciplined manufacturing excellence programs are raising asset turnover and reducing unit costs, translating volume led growth into faster EBITDA and PAT compounding.

Assumptions

This narrative explores a more optimistic perspective on Navin Fluorine International compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

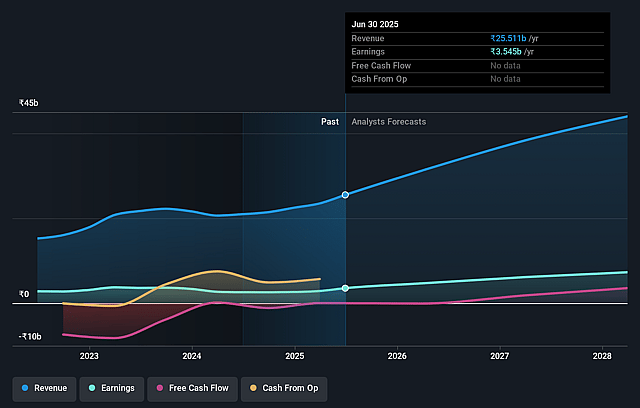

- The bullish analysts are assuming Navin Fluorine International's revenue will grow by 27.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 15.9% today to 18.2% in 3 years time.

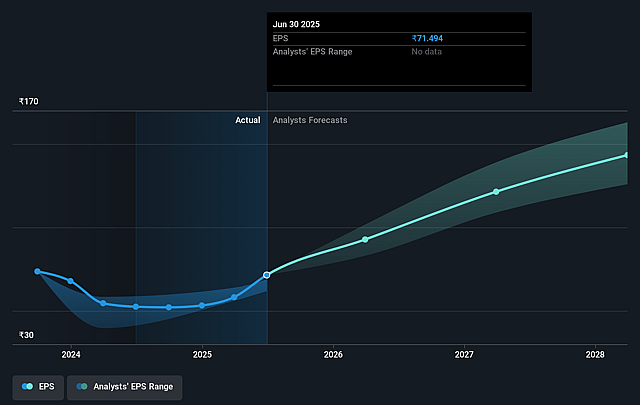

- The bullish analysts expect earnings to reach ₹10.5 billion (and earnings per share of ₹204.32) by about December 2028, up from ₹4.4 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹7.5 billion.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 54.3x on those 2028 earnings, down from 68.3x today. This future PE is greater than the current PE for the IN Chemicals industry at 23.3x.

- The bullish analysts expect the number of shares outstanding to grow by 2.97% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.44%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The bullish view assumes structurally tight R32 markets over many years, but management itself highlights that a queue of new capacities is coming up from Indian peers. If global demand or refrigerant pricing weakens due to slower RAC adoption, substitution by alternative low GWP gases or more aggressive capacity additions than expected, realizations per kilogram could decline and drag down revenue growth and EBITDA margins.

- The strategy relies on sustained high capital spending and brownfield debottlenecking funded through internal accruals, with a CapEx frame of around INR 1,000 crores over the next couple of years. Any execution delays, cost overruns, slower than expected commissioning of AHF, R32 and specialty assets or underutilization of new capacity could compress returns on capital, dilute operating leverage and weigh on earnings growth.

- Management is concentrating growth in a few large CDMO and specialty relationships with European innovators and a single major CDMO partner, while acknowledging lumpiness in orders and long regulatory timelines. If key late stage molecules fail, face regulatory setbacks or are reprioritized in client pipelines, visibility on the strong order book could deteriorate and lead to volatility in revenue and net margins.

- The long term thesis assumes persistent 28 to 30 percent EBITDA margins supported by efficiency and manufacturing excellence, yet the company also notes forex tailwinds, favorable sourcing costs and operating leverage as important current drivers. Any reversal in currency, higher raw material and energy costs, environmental compliance expenses or inability to sustain digital and process efficiency gains could erode gross margins and reduce profit after tax.

- The HF and advanced materials platform is positioned as a long term strategic play with full utilization targeted only by 2029 to 2030, and management is explicitly deprioritizing merchant HF sales in favor of higher value downstream products. If ramp up in electronic grade HF, advanced materials and Opteon projects is slower than anticipated or global demand in these niche segments proves less robust, asset sweating could disappoint and constrain both revenue momentum and blended net margins over the secular horizon.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Navin Fluorine International is ₹7000.0, which represents up to two standard deviations above the consensus price target of ₹5771.52. This valuation is based on what can be assumed as the expectations of Navin Fluorine International's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹7000.0, and the most bearish reporting a price target of just ₹4150.0.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be ₹57.5 billion, earnings will come to ₹10.5 billion, and it would be trading on a PE ratio of 54.3x, assuming you use a discount rate of 13.4%.

- Given the current share price of ₹5917.05, the analyst price target of ₹7000.0 is 15.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Navin Fluorine International?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.