Key Takeaways

- Sustainable packaging initiatives and backward integration are expected to boost revenue growth and net margins through global regulatory support and operational efficiencies.

- Strategic international partnerships and a strong financial foundation position Huhtamaki India for enhanced export revenue growth and long-term profitability.

- Margin pressures from raw material inflation, geopolitical factors, and competition challenge revenue growth and profitability despite investments in innovative products.

Catalysts

About Huhtamaki India- Engages in the manufacture and sale of flexible consumer packaging and labelling solutions in India.

- Huhtamaki India's focus on blueloop sustainable packaging could act as a catalyst for future revenue growth, especially as global regulations shift in favor of environmentally friendly packaging solutions. Adopting higher premium products in this line could also lead to improved net margins as demand for sustainable packaging increases.

- The company’s strategy of backward integration for high-end blueloop structures is expected to result in cost savings and operational efficiencies that could positively impact net margins once these products see wider adoption among customers.

- There is potential for export revenue to grow due to favorable global tariff situations and strategic partnerships within the Huhtamaki global network. This could lead to revenue growth as the company taps into larger international markets.

- The company's commitment to operational efficiency, technology-enabled innovations, and delivering value through its products may help improve profitability and drive long-term earnings growth, even amidst a challenging market environment.

- Huhtamaki India's robust balance sheet and improvement in working capital positions provide a strong foundation for strategic investments and innovations, potentially enhancing earnings and shareholder value over time.

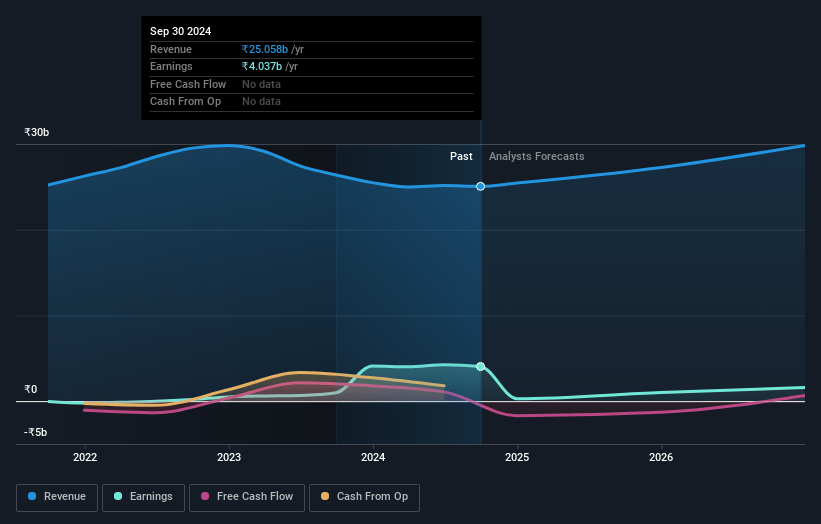

Huhtamaki India Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Huhtamaki India's revenue will grow by 7.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 16.1% today to 3.2% in 3 years time.

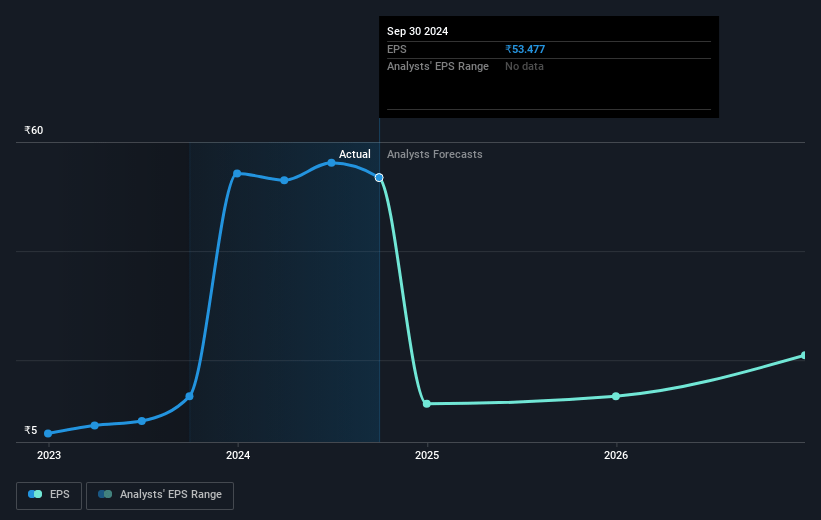

- Analysts expect earnings to reach ₹1.0 billion (and earnings per share of ₹12.57) by about February 2028, down from ₹4.0 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 35.3x on those 2028 earnings, up from 3.8x today. This future PE is greater than the current PE for the IN Packaging industry at 20.5x.

- Analysts expect the number of shares outstanding to grow by 0.13% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.77%, as per the Simply Wall St company report.

Huhtamaki India Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Raw material inflation and an adverse sales, customer, and product mix significantly impacted margins, resulting in lower EBIT on both a quarter-over-quarter and year-over-year basis, affecting overall earnings.

- Despite a slight improvement in volumes, net sales have decreased slightly on a year-over-year basis, indicating challenges in achieving significant revenue growth.

- High freight costs due to the Red Sea crisis and unfavorable global geopolitical events have pressured margins and could negatively impact revenue from exports.

- Increased competition from smaller players entering the packaging market has affected sales mix and margins, posing a risk to future revenue and profitability.

- The slow adoption of high-margin blueloop products in the market, despite investment and innovation efforts, continues to be a challenge, delaying the expected impact on net margins and operating income.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹334.0 for Huhtamaki India based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹31.5 billion, earnings will come to ₹1.0 billion, and it would be trading on a PE ratio of 35.3x, assuming you use a discount rate of 12.8%.

- Given the current share price of ₹200.8, the analyst price target of ₹334.0 is 39.9% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives