Key Takeaways

- Heightened environmental regulation, shifting demand for bio-based products, and rising competition threaten profitability and future growth of Sudarshan's synthetic pigment business.

- Heavy debt from the Heubach acquisition increases financial risk, with integration challenges likely to suppress earnings and extend operational pressures.

- Strategic shift toward specialty pigments, export expansion, and improved operational efficiency position the company for stronger profitability, global growth, and long-term financial health.

Catalysts

About Sudarshan Chemical Industries- Manufactures and sells organic, inorganic, effect pigments, and dispersions in India, the United States, Europe, China, Mexico, Japan, and internationally.

- Escalating global environmental regulations and a heightened focus on ESG compliance in the chemicals industry are likely to substantially increase Sudarshan Chemical's compliance, operational, and upgrade costs, putting long-term pressure on net margins and overall profitability as regulatory regimes only get more stringent.

- Consumer and end-market preferences are shifting towards natural, bio-based, and non-toxic alternatives, which threatens future demand for Sudarshan's mainly synthetic pigment portfolio, risking long-term top-line stagnation or decline as alternative chemistries erode market share.

- The company's plan to fund the large Heubach acquisition primarily through hefty new debt alongside recent equity issuances will result in a burdened capital structure, raising financial risk and the likelihood that interest costs as well as integration costs will weigh on earnings for several years post-acquisition.

- Persistent delays or execution challenges in integrating Heubach, a business currently showing operational losses, could result in prolonged periods of depressed EBITDA and net income, especially if expected synergies or turnaround efforts fall short or take longer than anticipated.

- Intensifying competition from large global and regional pigment manufacturers, including a potential resurgence of lower-cost Chinese rivals, is expected to compress pricing power and gross margins industry-wide, making it increasingly difficult for Sudarshan to protect or grow profitability even as it expands its global footprint.

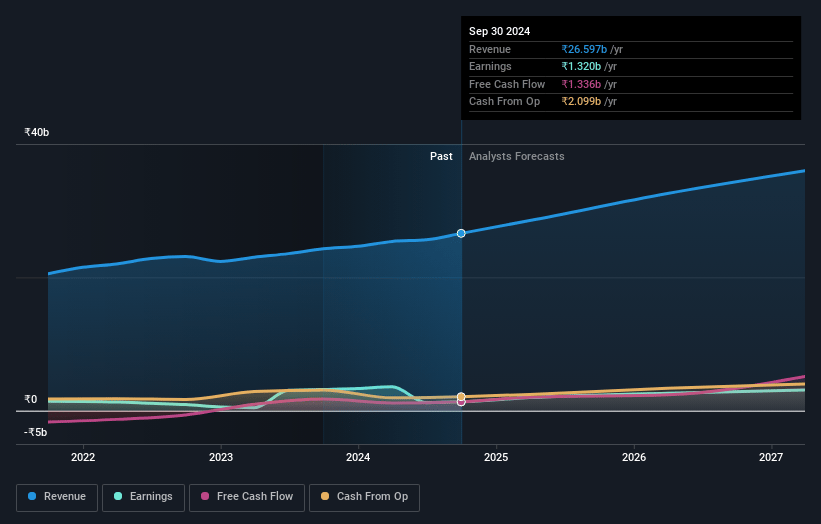

Sudarshan Chemical Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Sudarshan Chemical Industries compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Sudarshan Chemical Industries's revenue will grow by 11.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 4.3% today to 8.9% in 3 years time.

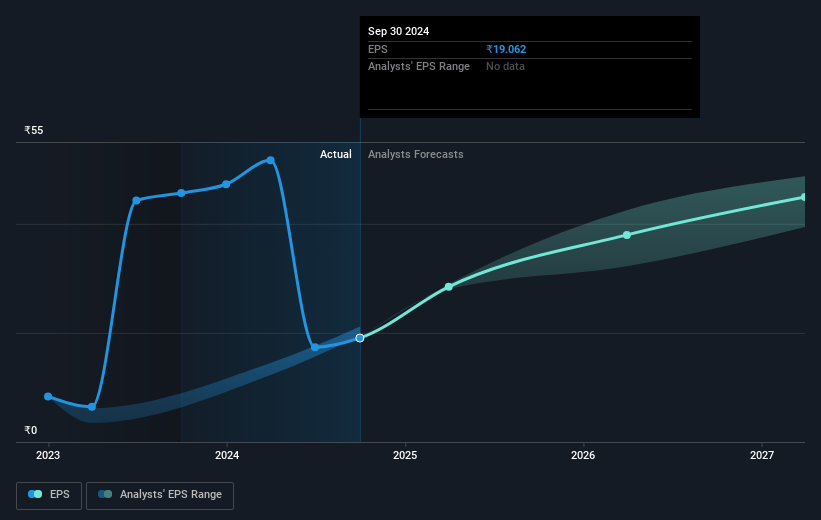

- The bearish analysts expect earnings to reach ₹3.4 billion (and earnings per share of ₹42.53) by about July 2028, up from ₹1.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 29.5x on those 2028 earnings, down from 84.0x today. This future PE is lower than the current PE for the IN Chemicals industry at 29.6x.

- Analysts expect the number of shares outstanding to grow by 1.67% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.45%, as per the Simply Wall St company report.

Sudarshan Chemical Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sudarshan Chemical Industries is seeing sustained growth in both exports and domestic markets, with eight consecutive quarters of year-on-year sales growth and healthy EBITDA margin improvement, suggesting underlying business strength that could help drive earnings higher in the long-term.

- The company is executing a significant product mix shift toward higher margin specialty pigments, supported by ramping up of new products and capacity additions, which is already increasing gross margins above historical averages and could continue to bolster net profitability.

- International expansion momentum is strong, with export share rising to 52% and ongoing investments in technical manpower and overseas distribution to support growth, positioning Sudarshan to benefit from global supply chain diversification and higher revenue visibility in future years.

- The ongoing acquisition of Heubach Global Pigment business-funded via a mix of equity and debt-may enable Sudarshan to quickly scale up, gain access to new technologies and markets, and deliver synergy-driven improvement in top-line growth and EBITDA, while maintaining manageable financial leverage levels.

- The company's focus on debt reduction, operational efficiency, and working capital optimization has resulted in improved free cash flow and healthier balance sheet, enabling it to fund growth strategically while supporting higher return ratios over the long-term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Sudarshan Chemical Industries is ₹835.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Sudarshan Chemical Industries's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1330.0, and the most bearish reporting a price target of just ₹835.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹38.3 billion, earnings will come to ₹3.4 billion, and it would be trading on a PE ratio of 29.5x, assuming you use a discount rate of 13.4%.

- Given the current share price of ₹1260.85, the bearish analyst price target of ₹835.0 is 51.0% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.