Last Update 07 Dec 25

Fair value Decreased 4.94%506285: Interim Dividend Decision Will Drive Bullish Sentiment Into 2025

Narrative Update on Bayer CropScience

Analysts have trimmed their price target for Bayer CropScience by approximately EUR 275, reflecting slightly softer expectations for revenue growth and profit margins, even as long term valuation multiples remain supportive.

What's in the News

- A board meeting is scheduled for November 7, 2025 to review the unaudited financial results for the quarter ended September 30, 2025. (Key Developments)

- The board will consider the declaration of an interim dividend for the 2025-26 financial year at the November 7, 2025 meeting. (Key Developments)

- The record date for the proposed interim dividend will be fixed during the upcoming board meeting. (Key Developments)

Valuation Changes

- The fair value estimate has fallen moderately, from €5,556.78 to €5,282.11 per share, which implies a lower upside versus prior assumptions.

- The discount rate is broadly unchanged, easing slightly from 13.35% to 13.34%, which indicates a similar risk profile to the previous model.

- The revenue growth forecast has been trimmed, moving from 9.28% to 8.92%, which reflects more conservative expectations for top-line expansion.

- The net profit margin projection has declined, from 13.65% to 12.83%, which points to somewhat weaker anticipated profitability.

- The future P/E multiple has risen slightly, from 35.87x to 36.63x, which suggests that valuation support remains intact despite softer fundamentals.

Key Takeaways

- Strategic cost reductions and efficiency improvements are expected to enhance net margins and unlock substantial additional cash.

- Developing biological solutions and biofuels aims to offer new revenue streams, boosting future growth prospects.

- Regulatory challenges, market cyclicality, and rising production costs threaten Bayer CropScience's profitability and revenue stability, compounded by competitive pressures from generics and climate change complications.

Catalysts

About Bayer CropScience- Engages in the manufacture, sale, and distribution of insecticides, fungicides, herbicides, and various other agrochemical products and corn seeds in India, Germany, Bangladesh, and internationally.

- Bayer CropScience plans to capitalize on its innovation pipeline, with a focus on seeds and traits, predicting incremental sales of over EUR 3.5 billion by 2029, which will significantly drive revenue.

- The company aims to expand its EBITDA margin annually by 100 to 150 basis points through controllable measures within a diversified margin program, impacting earnings positively.

- Strategic cost reductions and efficiency improvements across R&D, product supply, and go-to-market approaches are expected to unlock over EUR 1 billion in margin improvement and more than EUR 1.5 billion in cumulative cash, enhancing net margins.

- Dedicated efforts toward developing new value pools, such as biological solutions and biofuels, are anticipated to provide significant additional revenue streams by 2030, positively influencing future growth.

- By pursuing strategic divestments and optimizing the portfolio, Bayer CropScience expects to streamline operations and enhance free cash flow, estimating over EUR 3 billion in free operating cash flow by 2029.

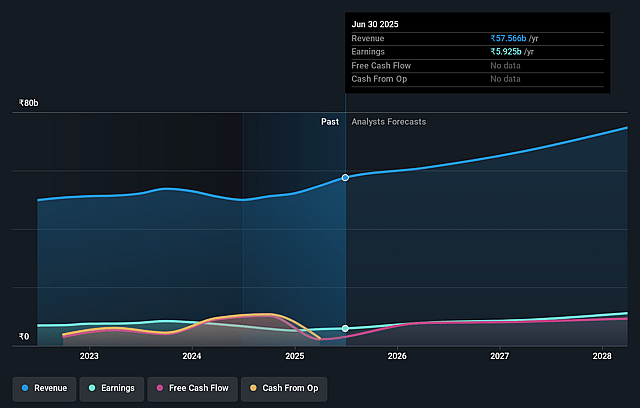

Bayer CropScience Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Bayer CropScience's revenue will grow by 9.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.3% today to 14.9% in 3 years time.

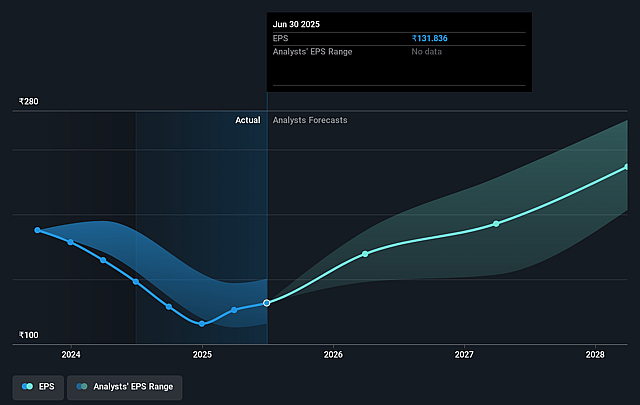

- Analysts expect earnings to reach ₹11.2 billion (and earnings per share of ₹231.15) by about September 2028, up from ₹5.9 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹10.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 34.1x on those 2028 earnings, down from 39.3x today. This future PE is greater than the current PE for the IN Chemicals industry at 26.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.45%, as per the Simply Wall St company report.

Bayer CropScience Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Bayer CropScience is experiencing pricing pressures in its Crop Protection segment due to the increase in generics, specifically from Chinese producers, which could lead to strained profit margins. This impacts net margins and overall profitability.

- Regulatory disruptions in Europe and other regions can lead to significant sales losses, impacting revenue growth and creating uncertainty around future earnings.

- Cyclical nature and volatility in the agriculture market, driven by factors such as grain prices and currency fluctuations, can lead to unpredictable revenue and earnings outcomes.

- Climate change and increasing pest pressures add complexity and risk in product planning, potentially affecting yields and future revenue streams.

- Rising production costs in Europe and North America, contrasted with lower costs in regions like China, can disadvantage Bayer's cost structure, further pressuring net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹5939.111 for Bayer CropScience based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹6520.0, and the most bearish reporting a price target of just ₹5180.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹75.1 billion, earnings will come to ₹11.2 billion, and it would be trading on a PE ratio of 34.1x, assuming you use a discount rate of 13.5%.

- Given the current share price of ₹5176.45, the analyst price target of ₹5939.11 is 12.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Bayer CropScience?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.