Key Takeaways

- Expansion into rural and industrial markets, along with innovation and diversification, positions the company for stable, long-term growth beyond its core automotive segment.

- Operational efficiency, disciplined expense control, and early moves into non-lubricant areas support strong margins and future revenue opportunities.

- Heavy reliance on automotive lubricants and exposure to electric vehicle trends and input cost pressures threaten long-term revenue growth, profitability, and strategic stability.

Catalysts

About Castrol India- Manufactures and markets automotive and industrial lubricants in India and internationally.

- The ongoing expansion into rural markets and increasing distribution reach-including now over 160,000 outlets and a growing sub-distributor network-should capitalize on rising vehicle ownership in tier-2, tier-3 and rural areas, positioning the company strongly for long-term volume and revenue growth.

- Robust double-digit growth in the industrial lubricant segment, especially through localization of higher-margin specialty products and chemical management services, enables Castrol India to benefit from ongoing industrialization and infrastructure development in India, diversifying revenues beyond the core automotive segment and supporting overall earnings stability.

- Investments in innovation, brand-building and digitization (e.g., upgraded distributor management, Fast Scan app used by 1 million mechanics) are enhancing market reach and customer engagement, supporting both premiumization strategies (which aid net margins) and sustained market share gains.

- Continued disciplined expense management and operational efficiency, supported by leveraging BP's global expertise, have allowed the company to maintain healthy EBITDA margins in a competitive and volatile input cost environment, pointing to the potential for long-term margin protection and earnings quality.

- Early development of non-lubricant lines (Auto Care products, data center fluids) and strong partnerships with OEMs for new technologies (circular engine oils, ethanol-mix adaptability) create optionality for future revenue streams and margin expansion beyond traditional lubricant markets.

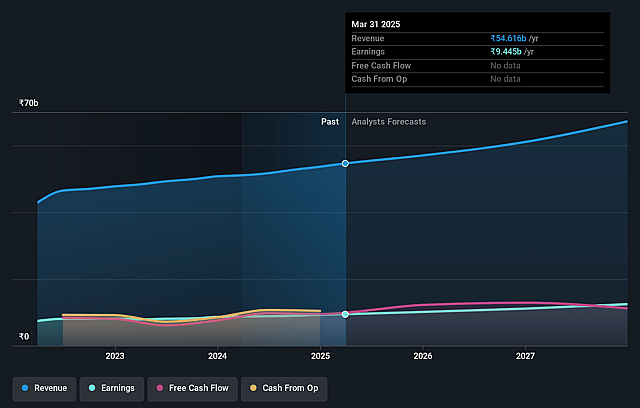

Castrol India Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Castrol India's revenue will grow by 6.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 17.2% today to 16.8% in 3 years time.

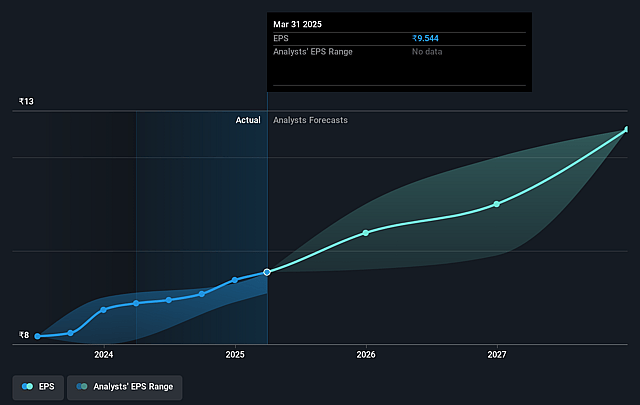

- Analysts expect earnings to reach ₹11.4 billion (and earnings per share of ₹12.13) by about August 2028, up from ₹9.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.5x on those 2028 earnings, up from 21.5x today. This future PE is greater than the current PE for the IN Chemicals industry at 26.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.45%, as per the Simply Wall St company report.

Castrol India Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Castrol India's core automotive lubricant business remains highly exposed to secular risks from the rapid adoption of electric vehicles and alternative mobility solutions; a structural decline in internal combustion engine (ICE) vehicles would decrease long-term lubricant demand and could materially impact revenue and earnings.

- The company's high concentration in automotive lubricants (about 87% of business, split between personal mobility and commercial vehicles) leaves it vulnerable to shifts in technology (e.g., longer service intervals, lower oil consumption per vehicle) and regulation, potentially resulting in declining sales volumes and pressure on revenue growth.

- While Castrol is diversifying into industrial lubricants and service-led models, the industrial segment contributes lower gross margins (roughly half that of automotive lubricants); a revenue mix shift towards this segment could drag overall net margins and profitability over the long term if volume growth does not compensate for margin dilution.

- BP's stated intent to carve out/divest the Castrol business globally introduces long-term uncertainty regarding strategic direction, capital allocation, and R&D investment; potential changes in parent control could disrupt existing operational efficiencies, impair future innovation, and risk market share erosion-negatively affecting future earnings.

- Persistent input cost volatility (e.g., base oil and crude-linked raw materials), increasing competition from global and local players, and anticipated regulatory tightening around emissions and waste management could compress margins and elevate compliance costs, putting downward pressure on overall earnings and cash flow sustainability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹233.833 for Castrol India based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹251.0, and the most bearish reporting a price target of just ₹210.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹68.0 billion, earnings will come to ₹11.4 billion, and it would be trading on a PE ratio of 29.5x, assuming you use a discount rate of 13.4%.

- Given the current share price of ₹208.1, the analyst price target of ₹233.83 is 11.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.