Key Takeaways

- Distribution expansion, new adjacent product launches, and focus on local innovations position the company for market share gains and higher margins.

- Emphasis on sustainability, digital transformation, and JSW Group integration enhances operational efficiency, competitive edge, and earnings resilience.

- Rising competition, sector-wide demand weakness, execution risks, cost pressures, and slower innovation threaten Akzo Nobel India's growth prospects, profitability, and strategic positioning.

Catalysts

About Akzo Nobel India- Manufactures, distributes, and sells paints and coatings in India and internationally.

- Distribution expansion into 8,000 towns over the next two years and programs to win back lapsed dealers position the company to capture greater market share amidst rapid urbanization and increasing demand for premium housing, directly supporting future revenue growth.

- Launches in adjacent product categories such as construction chemicals and a strong pipeline of innovation/products tailored for local markets aim to drive both premiumization and volume, positively impacting both top-line revenue and net margins.

- Growing consumer preference for eco-friendly and sustainable products, where Akzo Nobel's global R&D foundation provides a competitive advantage, is likely to drive higher-margin product sales and pricing power, supporting long-term EBITDA margin expansion.

- Ongoing digital transformation and automation initiatives, such as the nationwide rollout of digital lead management, are expected to increase operational efficiency and productivity, resulting in improved net margins over time.

- Integration with JSW Group unlocks potential industrial synergies and operational scale, particularly in industrial and coil coatings, creating cross-selling opportunities and enhancing resilience and earnings growth.

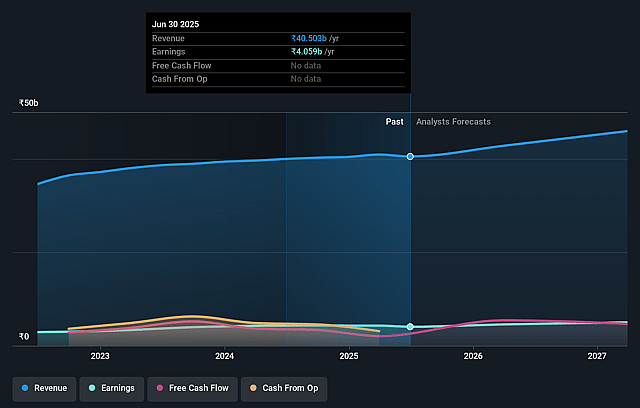

Akzo Nobel India Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Akzo Nobel India's revenue will grow by 7.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.0% today to 11.6% in 3 years time.

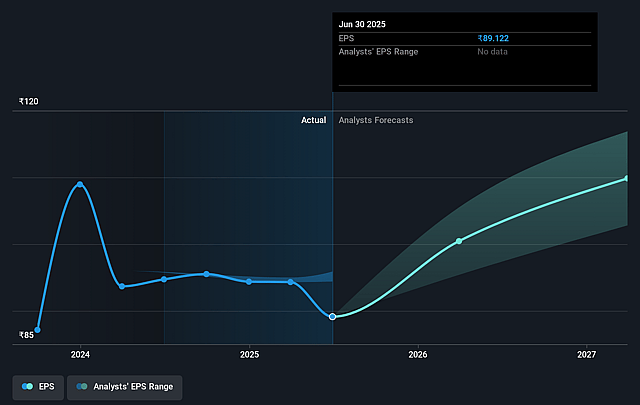

- Analysts expect earnings to reach ₹5.8 billion (and earnings per share of ₹128.34) by about August 2028, up from ₹4.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 43.4x on those 2028 earnings, up from 38.5x today. This future PE is greater than the current PE for the IN Chemicals industry at 26.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.45%, as per the Simply Wall St company report.

Akzo Nobel India Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heightened competitive intensity from established players and well-funded new entrants such as Grasim and JSW Paints increases the risk of market share erosion, particularly in price-sensitive and economy segments, which may restrain long-term revenue growth and compress net margins.

- The ongoing industry-wide lull, with the paint sector's growth dropping from a historical 1.2–1.5x GDP multiplier to just 0.3–0.6x GDP, points to persistent demand-side weakness; if this macro trend continues, Akzo Nobel India's top-line and earnings growth could remain under pressure for an extended period.

- The split of core powder coatings (Interpon) from the listed entity and changing management structure, coupled with potential integration and cultural alignment issues post-acquisition (especially as JSW seeks to combine divergent business models and philosophies), creates execution and transition risks that could negatively impact operational efficiencies and margin stability.

- Raw material inflation and new antidumping duties introduce uncertainty to input costs; if Akzo Nobel India is unable to fully pass these increases to consumers, its net margins and overall profitability may be squeezed over the medium to long term.

- Slower innovation and a lag in quickly scaling up to high-growth segments like construction chemicals, compared to more agile or better-funded competitors, weaken Akzo Nobel India's positioning in emerging categories, risking reduced market relevance and future revenue streams.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹3853.5 for Akzo Nobel India based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹50.1 billion, earnings will come to ₹5.8 billion, and it would be trading on a PE ratio of 43.4x, assuming you use a discount rate of 13.4%.

- Given the current share price of ₹3429.75, the analyst price target of ₹3853.5 is 11.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.