Narratives are currently in beta

Key Takeaways

- Increased production capacity and new acquisitions might drive revenue growth and enhance operational efficiencies, boosting net margins and earnings.

- Optimizing logistics and utilizing green power can lower operational costs, potentially improving profitability and EBITDA margins.

- Operational and competitive pressures, combined with high capital costs, threaten Ambuja's profitability, despite necessary expansions driving long-term growth potential.

Catalysts

About Ambuja Cements- Manufactures and markets cement and cement related products to individual homebuilders, masons and contractors, and architects and engineers in India.

- The commissioning of the 200-megawatt solar power project in Gujarat is expected to significantly reduce energy costs, thus potentially improving net margins.

- The acquisition of new limestone reserves and upcoming plant expansions will increase production capacity, which may drive future revenue growth.

- The ongoing expansion of grinding units and the expected increases in production capacity should lead to higher sales volumes, positively impacting future earnings.

- Better fuel management, increased share of green power, and optimization of logistics are set to lower operational costs, potentially enhancing overall profitability and EBITDA margins.

- The potential integration of new acquisitions such as Penna Cement and other group synergies can lead to increased operational efficiencies, thereby boosting net margins and earnings in the future.

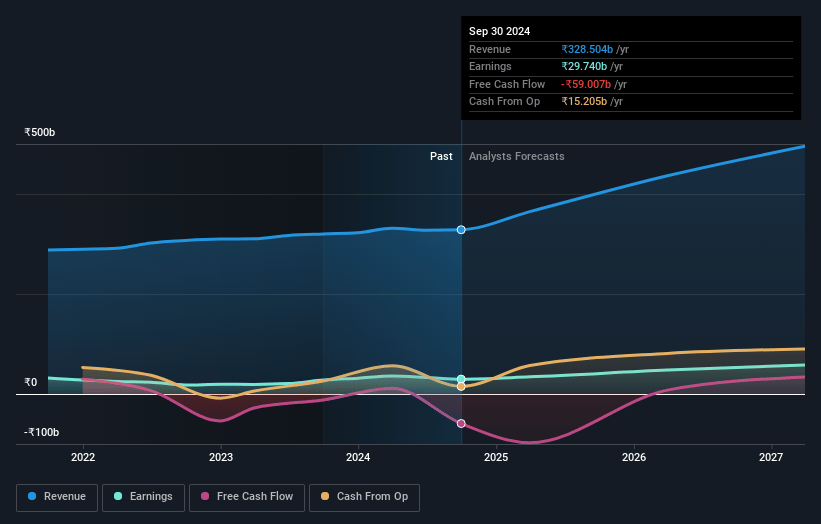

Ambuja Cements Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ambuja Cements's revenue will grow by 18.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.1% today to 12.5% in 3 years time.

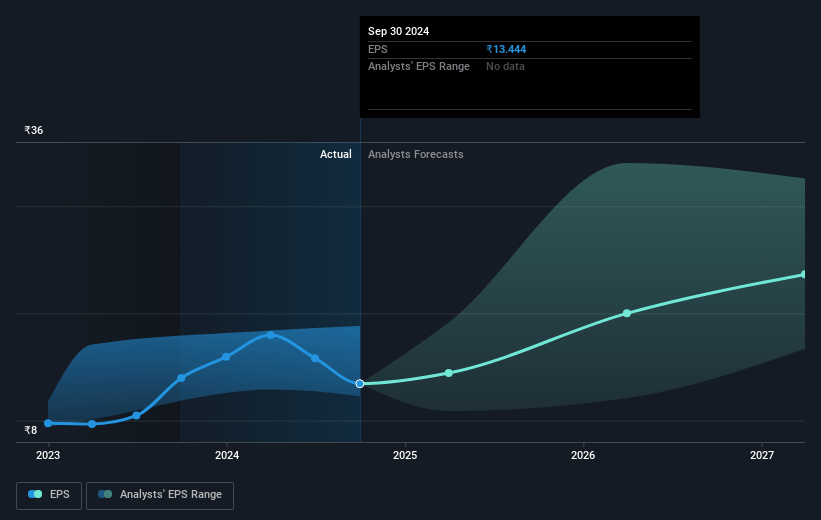

- Analysts expect earnings to reach ₹68.2 billion (and earnings per share of ₹24.07) by about January 2028, up from ₹29.7 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ₹80.4 billion in earnings, and the most bearish expecting ₹41.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 39.2x on those 2028 earnings, down from 43.3x today. This future PE is greater than the current PE for the IN Basic Materials industry at 35.5x.

- Analysts expect the number of shares outstanding to grow by 4.78% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.44%, as per the Simply Wall St company report.

Ambuja Cements Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing integration and maintenance of newly acquired projects such as Sanghi and Penna are resulting in higher operational costs, affecting margins and profitability until full efficiencies are achieved.

- The competitive pricing environment in the South, along with historically depressed market prices, may impact the ability of Ambuja to maintain premium pricing, which could hinder revenue growth.

- With increased demand growth expectations, substantial upcoming industry capacity additions could exert pressure on pricing and market share, affecting revenue potential and profit margins.

- High capital expenditure requirements for expansion and integration projects could strain cash flows, even though they are necessary for scaling up operations, impacting net earnings in the short term.

- The heavy reliance on achieving cost reductions through future projects like coal mine acquisitions and renewable energy capacity may carry execution risks, impacting cost reduction targets and the overall financial performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹647.19 for Ambuja Cements based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹921.0, and the most bearish reporting a price target of just ₹405.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹544.8 billion, earnings will come to ₹68.2 billion, and it would be trading on a PE ratio of 39.2x, assuming you use a discount rate of 13.4%.

- Given the current share price of ₹522.2, the analyst's price target of ₹647.19 is 19.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives