Key Takeaways

- Recovery in energy spending and capacity expansions could drive volume, margin, and revenue growth once current market headwinds and order declines subside.

- Structural support from antidumping policies and global diversification initiatives may uplift margins, market share, and reduce business cyclicality over time.

- Heavy dependence on the cyclical oil & gas sector, operational underperformance, and pricing pressures from imports threaten future profitability and sustainable growth.

Catalysts

About Maharashtra Seamless- Manufactures and sells seamless steel pipes and tubes in India.

- Slowdown in oil & gas capital expenditure and delayed PSU tendering has led to a sharp decline in order bookings and sales, depressing revenue and pressuring EBITDA margins; however, a cyclical recovery in domestic E&P spending-driven by India's long-term push for energy security-remains a key forward catalyst for volume and margin improvement if current market pessimism overhangs the stock.

- Increasing Chinese dumping has impacted realizations and margins, but the pending renewal of antidumping duties in 2026 (with company advocacy to broaden coverage and raise minimum import prices) offers a potential structural uplift for both realizations and domestic market share, positively impacting future gross margins and revenue.

- Significant capacity expansion projects (e.g., new Telangana line and cold drawn pipe finishing) are on schedule to become operational from late 2025/early 2026; completion should directly enable higher volumes, improved operating leverage, and the ability to tap into new or value-added product segments, supporting future topline and margin expansion.

- Long-term industry trends remain supportive: ongoing global energy transition (including increased need for gas pipeline infrastructure) and infrastructure growth in India and emerging markets will require extensive steel pipes and tubes, underpinning lasting demand and setting the stage for sustained revenue growth and higher utilization levels once sectoral headwinds subside.

- Financial strength and disciplined capital allocation (large net cash position and conservative CapEx) position Maharashtra Seamless to capitalize on China+1 diversification as global customers shift from Chinese suppliers, potentially improving export share and reducing cyclicality-both of which would support sustained growth in export revenues and reduce the long-term risk premium currently imbedded in the stock's valuation.

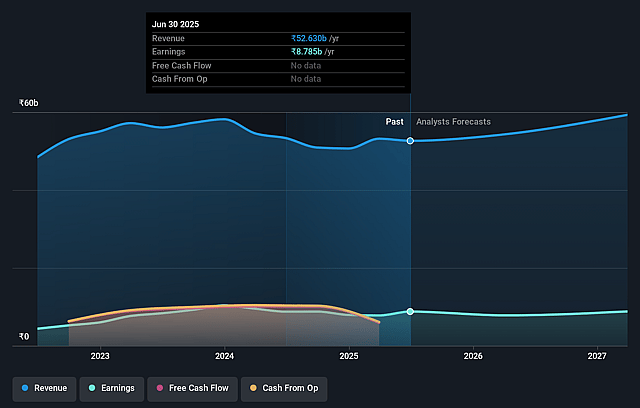

Maharashtra Seamless Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Maharashtra Seamless's revenue will grow by 6.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 16.7% today to 12.8% in 3 years time.

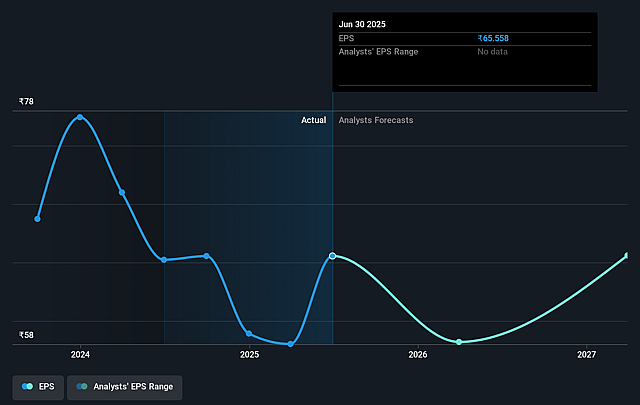

- Analysts expect earnings to reach ₹8.1 billion (and earnings per share of ₹60.85) by about September 2028, down from ₹8.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.9x on those 2028 earnings, up from 10.1x today. This future PE is lower than the current PE for the IN Metals and Mining industry at 23.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.53%, as per the Simply Wall St company report.

Maharashtra Seamless Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained slowdown in order booking and muted order flow from the oil & gas sector-driven by both a broader reduction in sector expenditure and delayed tenders from key customers like ONGC and Oil India-poses a continued risk of declining revenue and volume growth.

- Persistent dumping of seamless pipes from China, coupled with insufficient anti-dumping protection and a non-prohibitive minimum import price until at least 2026, is placing downward pressure on pricing and EBITDA margins, eroding the company's profitability.

- Heavy reliance on a cyclical and price-sensitive oil & gas sector (70% of dispatches) exposes the business to secular industry risks such as global energy transition and decarbonization policies, which could structurally dampen long-term demand and revenue stability.

- High proportion of profits now originating from treasury gains and other income, rather than core operating performance, signals operational underperformance; future earnings and dividend growth could be volatile if capital markets weaken or mutual fund gains reverse.

- Slow pace of technological product development (e.g., premium connections taking years to come to market while competitors advance) and conservative capital allocation strategy may result in lagging innovation and competitiveness, risking revenue and net margin compression as industry landscape evolves.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹790.0 for Maharashtra Seamless based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹63.6 billion, earnings will come to ₹8.1 billion, and it would be trading on a PE ratio of 18.9x, assuming you use a discount rate of 13.5%.

- Given the current share price of ₹664.0, the analyst price target of ₹790.0 is 15.9% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Maharashtra Seamless?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.