Narratives are currently in beta

Key Takeaways

- Expansion in production capacity and focus on renewable energy are likely to drive revenue growth and improve profitability through cost reduction.

- Initiatives in recycling, minor metals recovery, and value-added products aim to diversify revenues and enhance gross margins.

- Hindustan Zinc faces operational and market risks, including production inefficiencies, cost overruns, and reliance on renewable energy, impacting revenue and earnings growth.

Catalysts

About Hindustan Zinc- Explores for, extracts, and processes minerals in India, rest of Asia, and internationally.

- Hindustan Zinc is focused on expanding its mined metal and refined metal production, with plans to increase capacity from 1.2 million tonnes to 1.45 million tonnes by FY '27, providing a solid path for revenue growth.

- Plans to significantly reduce the cost of production through increased use of renewable energy are expected to result in lower operational costs, enhancing net margins and profitability.

- Hindustan Zinc is working on a 10 million-tonne recycling plant to reprocess tailings, which could provide an efficient revenue stream with minimal input costs, contributing to future earnings growth.

- The company aims to expand its capabilities in the recovery of minor metals and value-added products, potentially diversifying its revenue base and improving gross margins.

- Hindustan Zinc's strong position in growing sectors like zinc and silver, essential for low-carbon energy solutions, suggests an increase in product demand that could drive future revenue and profitability.

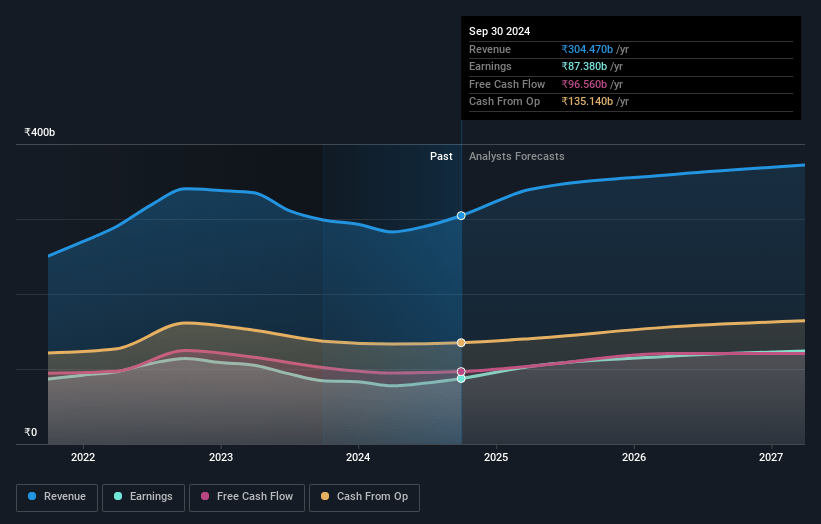

Hindustan Zinc Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Hindustan Zinc's revenue will grow by 7.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 29.6% today to 35.7% in 3 years time.

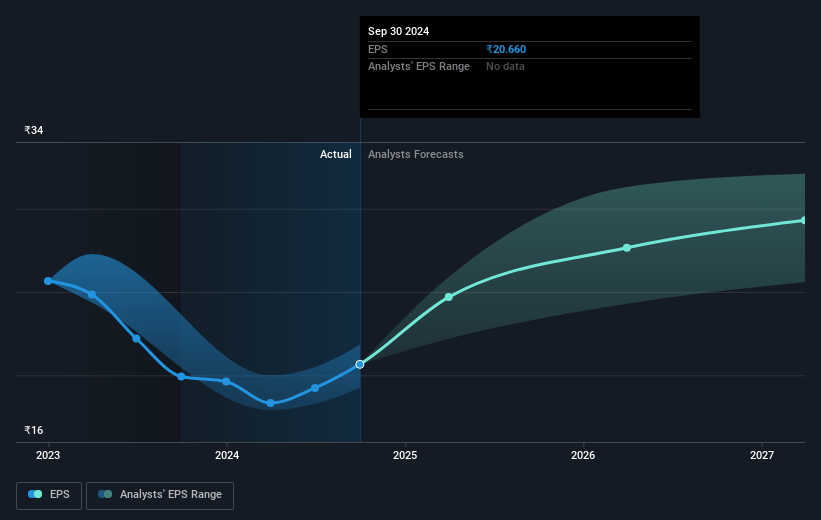

- Analysts expect earnings to reach ₹142.0 billion (and earnings per share of ₹33.59) by about January 2028, up from ₹93.9 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.7x on those 2028 earnings, down from 19.7x today. This future PE is lower than the current PE for the IN Metals and Mining industry at 22.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.21%, as per the Simply Wall St company report.

Hindustan Zinc Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The shutdown of the Fumer plant and ongoing maintenance issues have negatively impacted production levels, which could constrain future revenue growth if not resolved effectively. This highlights potential risks in the operational execution that could affect earnings.

- The company's cost reduction strategy heavily relies on increasing the share of renewable energy, with no immediate near-term solution to achieve the targeted production cost of $1,000 per tonne. The reliance on this strategy to improve margins presents execution risks that could impact net earnings if costs do not align with expectations.

- Operational challenges like the delays in obtaining Chinese Visas for technical support and geotechnical issues in mines could lead to production inefficiencies. These could affect the expected output and impact both revenue and profitability if not managed promptly.

- Market risks include variability in commodity prices (zinc and silver) despite recent high prices. Any downturn could negatively impact revenue, especially considering lower production volumes and the hedging gains being one-off events.

- The expansion projects towards increasing production capacity involve substantial capital expenditure with a gestation period. Any delays or cost overruns could impact cash flow and financial performance, potentially affecting earnings until these projects are completed and operational.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹422.0 for Hindustan Zinc based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹540.0, and the most bearish reporting a price target of just ₹305.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹397.8 billion, earnings will come to ₹142.0 billion, and it would be trading on a PE ratio of 18.7x, assuming you use a discount rate of 14.2%.

- Given the current share price of ₹438.15, the analyst's price target of ₹422.0 is 3.8% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives