Key Takeaways

- Regulatory and technological advancements, including increased FDI and AI in claims processing, could boost revenue growth by enhancing operational efficiencies and attracting global capital.

- Expanding market presence through strategic partnerships and digital initiatives aims to increase customer retention and broaden the policyholder base, driving revenue growth.

- Rising claim ratios and medical inflation, combined with increased competition, challenge Star Health's profitability and may deter investor confidence due to operational inefficiencies.

Catalysts

About Star Health and Allied Insurance- Provides health insurance products in India.

- The company expects a significant impact of regulatory reforms including the increase of the FDI cap in insurance from 74% to 100%, which can attract global capital and expertise, potentially boosting revenue growth.

- Structural growth opportunities are anticipated from increased demand for retail health insurance in semi-urban, rural, and smaller towns, alongside the introduction of innovative insurance products such as the Super Star policy, potentially increasing premium income and revenue.

- Emphasis on technology and automation with investments enabling real-time claims processing and AI-led pre-authorization is expected to enhance operational efficiencies, potentially improving net margins by reducing costs and enhancing service quality.

- Strategic partnerships through bancassurance and the planned increase in agent count to 1 million over the next 3 years aim to deepen market penetration and expand distribution channels, which can enhance revenue growth from new premiums.

- Focus on customer-centric innovations and digitally-driven execution, through initiatives like tailored products for underserved geographies and enhanced digital service platforms, is anticipated to drive customer retention and widen the policyholder base, contributing to revenue and earnings growth.

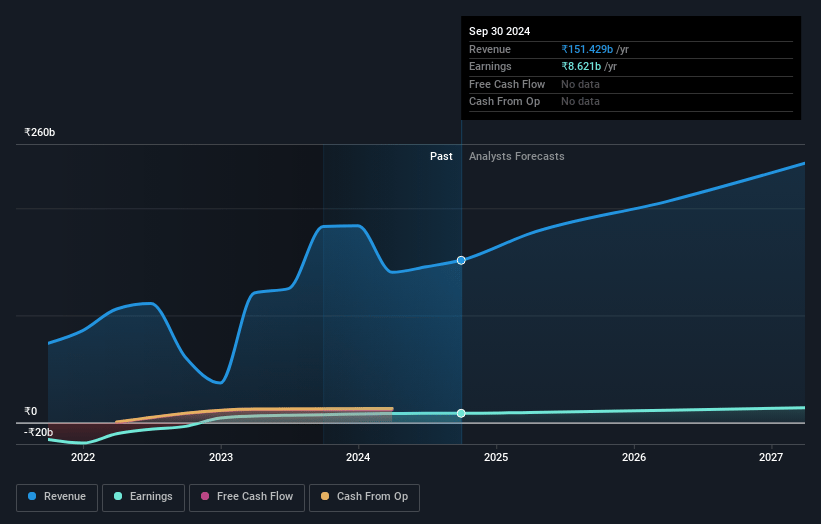

Star Health and Allied Insurance Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Star Health and Allied Insurance's revenue will grow by 17.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.0% today to 4.9% in 3 years time.

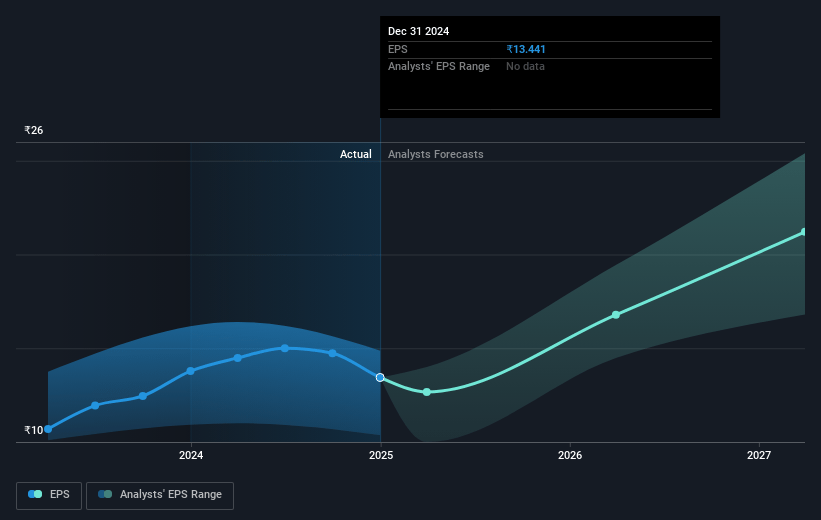

- Analysts expect earnings to reach ₹12.7 billion (and earnings per share of ₹21.6) by about May 2028, up from ₹6.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.0x on those 2028 earnings, down from 35.5x today. This future PE is lower than the current PE for the IN Insurance industry at 71.8x.

- Analysts expect the number of shares outstanding to grow by 0.45% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.53%, as per the Simply Wall St company report.

Star Health and Allied Insurance Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's overall claim ratio stands at 70.3%, driven by higher frequency and severity of claims, particularly due to increased surgical intervention and hospitalization rates, which can negatively impact net margins and profitability.

- Loss ratio in the group segment increased to 89.8% from 77.3% last year, showing weakness despite strategic recalibration, which may continue to pressure earnings if not managed effectively.

- The company's profit before tax fell to ₹1,054 crores from ₹1,480 crores, and PAT decreased to ₹787 crores from ₹1,103 crores in the previous year, indicating declining profitability and challenges in maintaining net margins.

- The increase in the combined ratio to 101.1% from 97.3% signifies increased expense ratios relative to premiums, reflecting operational inefficiency that might deter future investor confidence and impact earnings.

- Persistently rising medical inflation and intensified competition could further challenge pricing strategies and affect future revenue growth and profitability if the company cannot adjust rapidly.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹493.636 for Star Health and Allied Insurance based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹640.0, and the most bearish reporting a price target of just ₹390.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹259.1 billion, earnings will come to ₹12.7 billion, and it would be trading on a PE ratio of 33.0x, assuming you use a discount rate of 12.5%.

- Given the current share price of ₹389.8, the analyst price target of ₹493.64 is 21.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.