Catalysts

About Star Health and Allied Insurance

Star Health and Allied Insurance is a leading standalone health insurer in India focused primarily on retail health products, distribution and services.

What are the underlying business or industry changes driving this perspective?

- Accelerating shift toward private health coverage, supported by GST exemption on retail health indemnity and rising awareness of healthcare protection, is expected to structurally lift policy volumes and premium growth, directly boosting long term revenue and earnings.

- Disciplined portfolio recalibration, with full exit from loss making employer employee group business, annual repricing and tighter underwriting, is already lowering claim ratios and is likely to materially expand net margins and combined ratio over the next few years.

- Scaled, tech enabled distribution, including an 8 lakh strong agency force, rapidly growing digital and D2C channels and a widely used customer app, positions Star to capture outsized share of new to insurance customers and drive high quality, high persistency premium growth and profitability.

- Investments in AI and analytics for fraud detection, claims automation and dynamic pricing, combined with telemedicine and home healthcare capabilities, should sustainably reduce frequency and severity of claims and operating costs, improving net margins and return on equity.

- Rising adoption of long term and higher sum insured policies, supported by more affordable pricing post GST waiver and better customer retention, increases the lifetime value of each customer and enhances visibility on premium income, underwriting profits and investment income.

Assumptions

This narrative explores a more optimistic perspective on Star Health and Allied Insurance compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

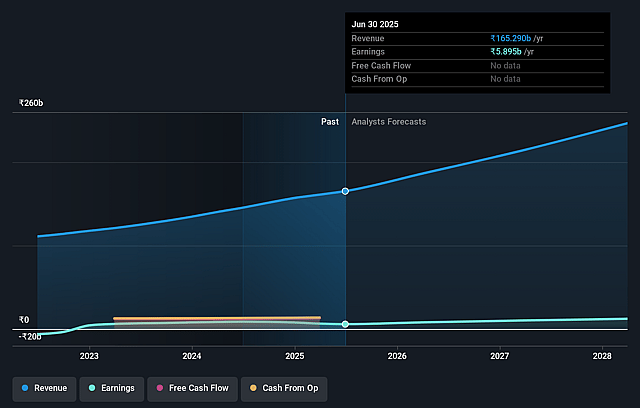

- The bullish analysts are assuming Star Health and Allied Insurance's revenue will grow by 22.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 3.3% today to 5.8% in 3 years time.

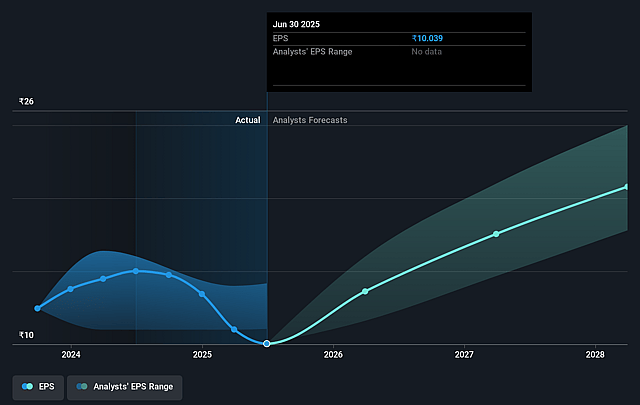

- The bullish analysts expect earnings to reach ₹17.0 billion (and earnings per share of ₹29.03) by about December 2028, up from ₹5.3 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹12.7 billion.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 31.6x on those 2028 earnings, down from 51.2x today. This future PE is lower than the current PE for the IN Insurance industry at 70.4x.

- The bullish analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.76%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- If post COVID medical inflation, claim severity and admission frequency remain structurally higher than pre FY 2023 levels, despite telemedicine, home health care and fraud controls, the company may be unable to restore loss ratios to earlier benchmarks. This could cap improvements in combined ratio and earnings.

- A larger and growing share of long term policies and aggressive new business growth could amplify IFRS and IGAAP timing differences. Acquisition costs are deferred in IFRS but fully expensed in IGAAP, which could create sustained pressure on reported profits and return on equity even as the top line expands.

- Reliance on GST driven affordability tailwinds and regulatory mandated commission reductions may prove temporary or uneven across competitors. If peers choose to subsidize distributors or underprice products, Star could either lose volume growth or compromise pricing discipline, which could weaken revenue and net margins.

- The strategic exit from large, loss making group portfolios and the sharp reduction of group business to 5 percent of the book improves quality today, but concentrates the franchise further in retail health. Any slowdown in retail demand, intensifying competition or regulatory change in that segment could therefore disproportionately affect premium growth and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Star Health and Allied Insurance is ₹638.5, which represents up to two standard deviations above the consensus price target of ₹512.23. This valuation is based on what can be assumed as the expectations of Star Health and Allied Insurance's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹650.0, and the most bearish reporting a price target of just ₹420.0.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be ₹295.4 billion, earnings will come to ₹17.0 billion, and it would be trading on a PE ratio of 31.6x, assuming you use a discount rate of 12.8%.

- Given the current share price of ₹464.6, the analyst price target of ₹638.5 is 27.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Star Health and Allied Insurance?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.