Key Takeaways

- Rising digital marketing costs, increased competition, and domestic saturation threaten margins and growth prospects amidst evolving consumer and regulatory landscapes.

- Heavy reliance on India and mounting compliance burdens further limit international diversification and strain profitability.

- Premiumization, digital expansion, and ongoing innovation position Honasa for sustained revenue growth, market share gains, and steady improvement in margins and profitability.

Catalysts

About Honasa Consumer- Operates as a digital-first beauty and personal care company in India and internationally.

- Honasa Consumer's reliance on influencer-driven and digital-first marketing faces significant risks as consumer ad fatigue increases and algorithmic shifts on major platforms erode cost efficiency, which will drive up customer acquisition costs and result in sustained net margin pressure.

- Intensifying competition from both global FMCG giants and rapidly proliferating direct-to-consumer startups is likely to catalyze aggressive industry-wide price wars, eroding Honasa's pricing power and putting downward pressure on earnings and gross margins.

- The company's limited international presence and muted management focus on expanding outside India leaves it highly exposed to domestic market saturation, making it difficult to diversify or grow revenue meaningfully if urban demand slows or local channels become saturated.

- Sustainability-related regulations targeting plastic use and more stringent standards regarding labeling and product composition are expected to accelerate, forcing Honasa to re-engineer packaging and supply chains at considerable cost, thus further compressing margins and increasing compliance-related expenses for new product launches.

- Heightened inflation and ongoing macroeconomic uncertainties are poised to dampen consumer discretionary spending in India, curbing demand growth for non-essential personal care products and ultimately capping topline growth despite attempts at premiumization and product innovation.

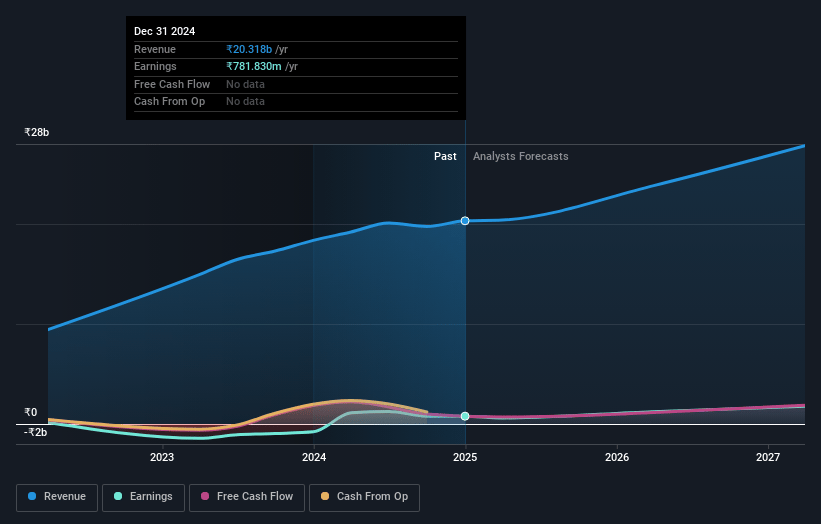

Honasa Consumer Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Honasa Consumer compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Honasa Consumer's revenue will grow by 13.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 3.5% today to 7.5% in 3 years time.

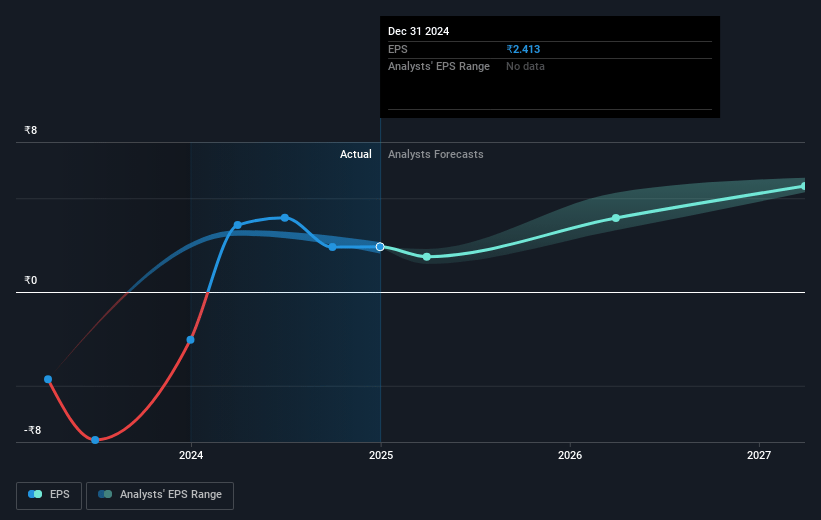

- The bearish analysts expect earnings to reach ₹2.2 billion (and earnings per share of ₹7.09) by about July 2028, up from ₹726.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 42.1x on those 2028 earnings, down from 122.7x today. This future PE is lower than the current PE for the IN Personal Products industry at 59.4x.

- Analysts expect the number of shares outstanding to decline by 0.08% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.91%, as per the Simply Wall St company report.

Honasa Consumer Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rapid premiumization trends in hair care and skin care, coupled with increasing consumer demand for natural, sustainable, and ingredient-led products, may continue to favor Honasa's portfolio and support topline revenue growth over the long term.

- Ongoing expansion of the company's direct distribution network, with a significant increase in direct outlets and consistent gains in retail market share across core categories like shampoo and face wash, positions Honasa for incremental revenue and enhanced profitability.

- Investment in R&D, product innovation, and adoption of advanced technologies-including proprietary AI and first-to-market innovations-can drive brand differentiation and allow for premium pricing, which could bolster both gross margins and earnings in the future.

- The company's digital-first approach and strong execution in e-commerce, modern trade, and emerging channels such as quick commerce may enable Honasa to capture market share in a rapidly digitizing economy, contributing to both revenues and margin expansion.

- Scaling young and high-growth brands with the intention to replicate the successful trajectory of Derma Co, along with efficiencies in A&P spend and working capital improvements, increases the likelihood of sustained net margin improvement and robust earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Honasa Consumer is ₹197.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Honasa Consumer's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹400.0, and the most bearish reporting a price target of just ₹197.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹29.8 billion, earnings will come to ₹2.2 billion, and it would be trading on a PE ratio of 42.1x, assuming you use a discount rate of 13.9%.

- Given the current share price of ₹274.25, the bearish analyst price target of ₹197.0 is 39.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.