Key Takeaways

- Capacity constraints, stagnating patient numbers, and external regulatory pressures limit Narayana Hrudayalaya's growth prospects and restrict margin expansion opportunities.

- Aggressive new ventures and rising operating costs are straining profitability, while intensifying competition and higher capital needs threaten long-term returns.

- Strategic focus on high-complexity care, digital efficiencies, and international diversification positions the company for sustained margin expansion and resilient long-term profitability.

Catalysts

About Narayana Hrudayalaya- Engages in the medical and healthcare services in India and internationally.

- Despite past high growth, Narayana Hrudayalaya's future revenue expansion is likely to slow as patient volumes are constrained by prolonged capacity delays and a lack of significant new bed additions until at least 2027, while outpatient and inpatient numbers have stagnated and average lengths of stay are flat, signaling organic growth may be limited without aggressive expansion.

- The company's aggressive clinic and insurance rollouts are resulting in growing cash burn, with management explicitly guiding for increasing losses in these segments over the next several years, which will act as a persistent drag on consolidated earnings and net margins.

- Rising manpower costs, wage inflation driven by urbanization, and a tightening labor market in India's healthcare sector will directly impact operating expenses and compress Narayana Hrudayalaya's margins, undermining its current efficiency advantage and placing downward pressure on long-term profitability.

- Increased regulatory risk, including ongoing and potential future price controls and stricter scheme reimbursements by government payers, will limit the company's ability to pass on cost increases and restrict realization growth per patient, curbing both revenue growth and EBITDA margin expansion prospects.

- Escalating industry competition from both branded hospital chains and tech-driven entrants threatens Narayana Hrudayalaya's ability to sustain market share and pricing, while capital requirements for greenfield expansion and international ventures are likely to lead to higher leverage and diminished return on capital employed, capping long-term earnings growth.

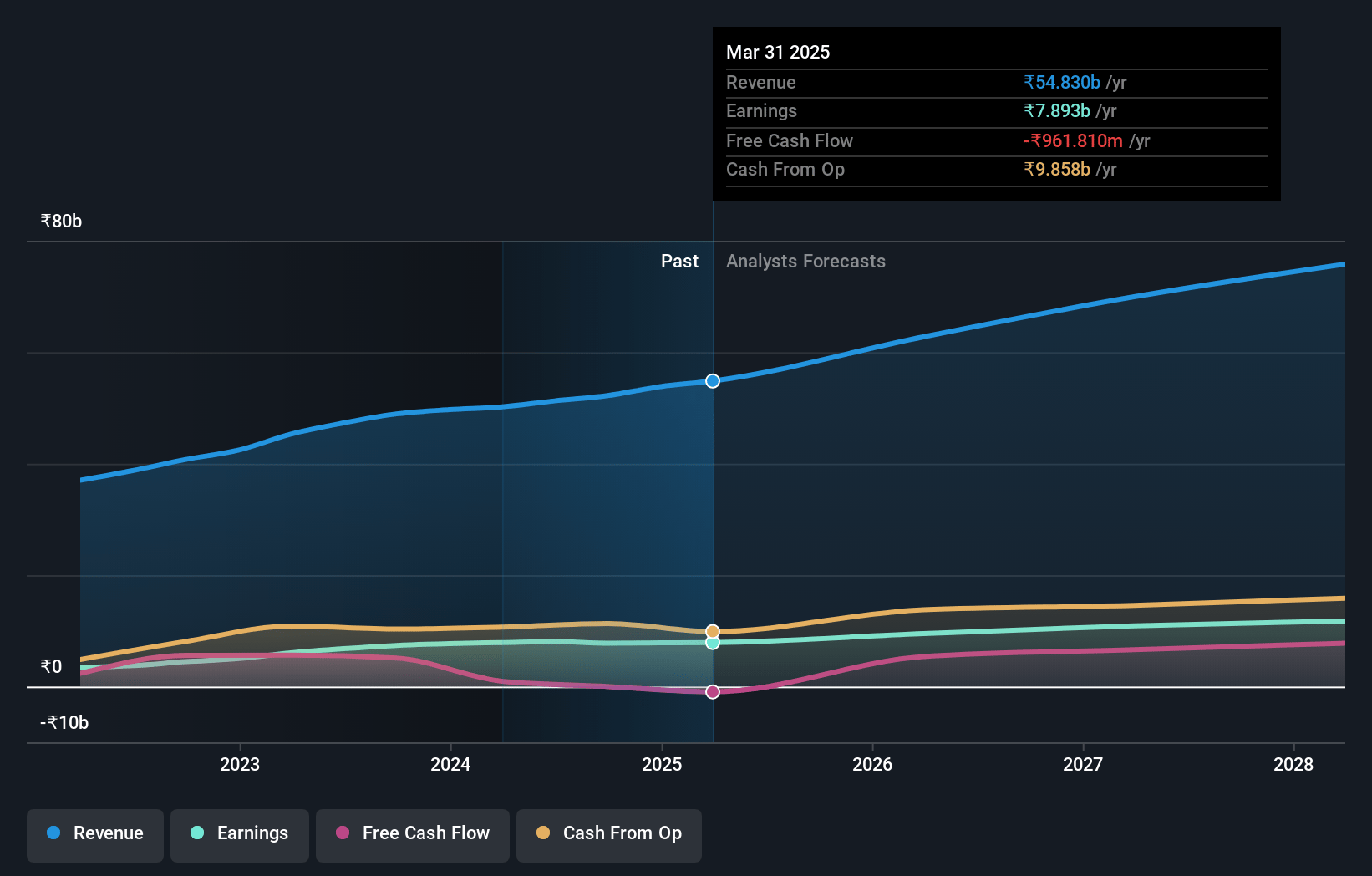

Narayana Hrudayalaya Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Narayana Hrudayalaya compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Narayana Hrudayalaya's revenue will grow by 9.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 14.4% today to 14.1% in 3 years time.

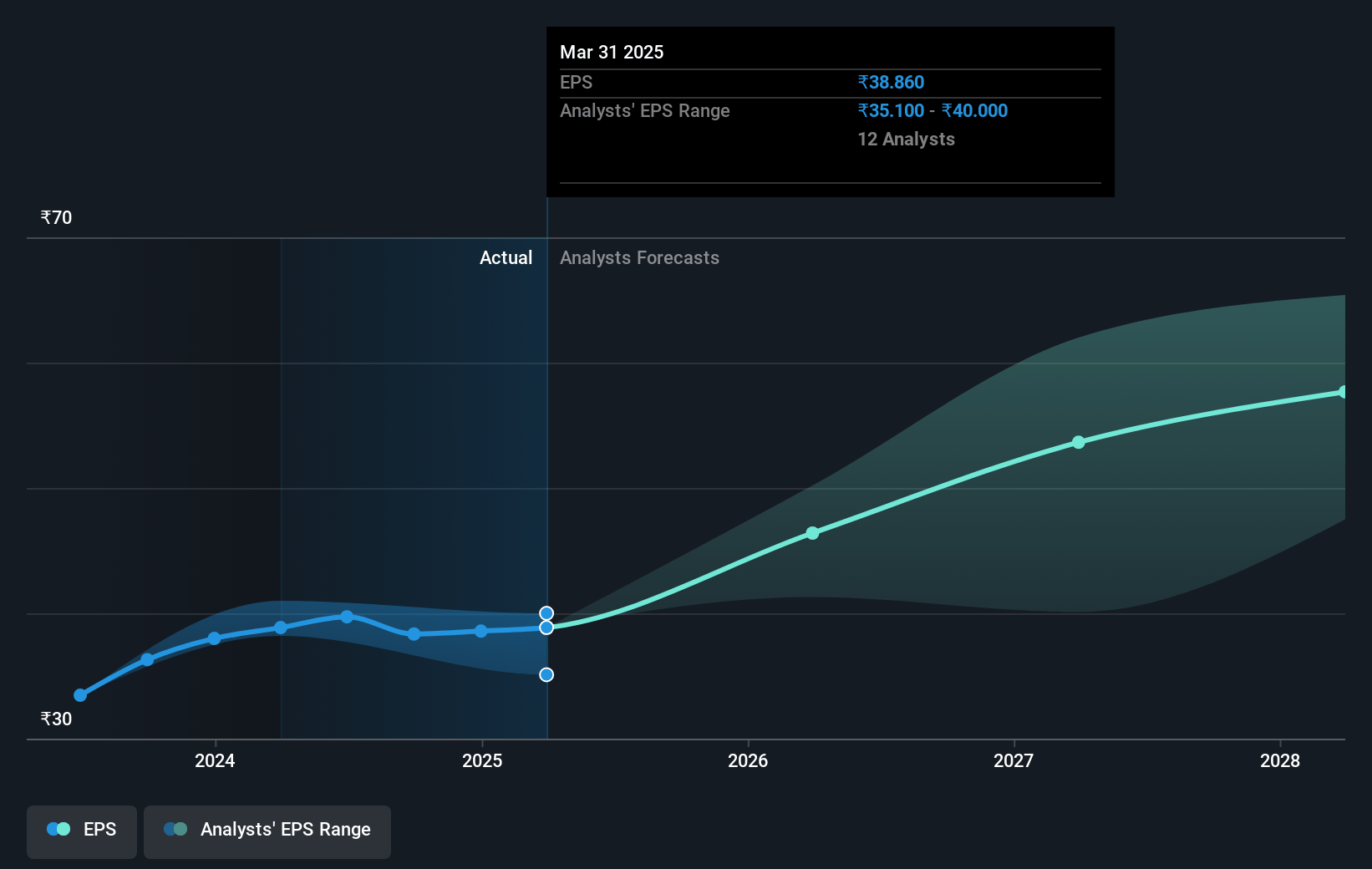

- The bearish analysts expect earnings to reach ₹10.0 billion (and earnings per share of ₹49.07) by about July 2028, up from ₹7.9 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 33.4x on those 2028 earnings, down from 50.2x today. This future PE is lower than the current PE for the IN Healthcare industry at 50.1x.

- Analysts expect the number of shares outstanding to grow by 0.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.55%, as per the Simply Wall St company report.

Narayana Hrudayalaya Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Narayana Hrudayalaya's sustained focus on throughput improvements, premium bed mix, and higher-complexity procedures has enabled double-digit revenue and margin growth even without capacity addition, indicating strong potential for continued earnings expansion as new capacities come online in future years.

- The successful launch and ramp-up of new facilities in Cayman, with stable high margins and opportunities for occupancy growth, demonstrates the company's ability to diversify revenues and maintain robust net margins internationally, reducing concentration risk from India.

- Ongoing reconfiguration toward higher-margin specialties such as oncology and orthopedics, as well as expansion into retail chemotherapy centers, positions the company to capture secular demand trends for specialized care, potentially increasing average revenue per patient and supporting sustainable EBITDA margin improvement.

- The company's investments in digitization, AI-driven efficiency, and proprietary hospital management software have enabled Narayana Hrudayalaya to control costs and boost operational leverage, which could further expand net margins and support long-term profitability as these technologies scale.

- Prudent manpower planning through in-house nursing and doctor training programs, paired with strong retention of clinicians and a measured asset-light expansion strategy, enhances the company's ability to efficiently execute growth, maintain service quality, and protect operating margins as new centers open.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Narayana Hrudayalaya is ₹1158.42, which represents two standard deviations below the consensus price target of ₹1703.38. This valuation is based on what can be assumed as the expectations of Narayana Hrudayalaya's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹2059.0, and the most bearish reporting a price target of just ₹1013.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹70.9 billion, earnings will come to ₹10.0 billion, and it would be trading on a PE ratio of 33.4x, assuming you use a discount rate of 12.5%.

- Given the current share price of ₹1951.3, the bearish analyst price target of ₹1158.42 is 68.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.