Last Update15 Jul 25Fair value Increased 17%

Despite a reduction in consensus revenue growth forecasts, Narayana Hrudayalaya’s higher future P/E suggests improved market sentiment or expectations for profitability, driving the analyst price target up from ₹1443 to ₹1689.

WHAT'S IN THE NEWS

- Announced annual dividend of INR 4.50 per share.

- Scheduled board meeting to approve audited financial results for the quarter and year ended March 31, 2025, recommend dividend, and consider raising funds via private placement of debt securities subject to shareholder approval.

VALUATION CHANGES

Summary of Valuation Changes for Narayana Hrudayalaya

- The Consensus Analyst Price Target has significantly risen from ₹1443 to ₹1689.

- The Future P/E for Narayana Hrudayalaya has significantly risen from 35.33x to 41.54x.

- The Consensus Revenue Growth forecasts for Narayana Hrudayalaya has significantly fallen from 13.0% per annum to 11.4% per annum.

Key Takeaways

- New and existing facilities in India and Cayman boost margins, supported by efficiency improvements and revenue from expanded services.

- Strategic investments in the Caribbean and new health plans are set to increase revenue through medical tourism and patient engagement.

- High expenses and slow growth in new ventures may strain financial stability and profitability across existing and emerging markets.

Catalysts

About Narayana Hrudayalaya- Engages in the medical and healthcare services in India and internationally.

- The new facility in Cayman has begun bringing in revenue, and it is expected that with the full commissioning of services, such as emergency room and inpatient surgeries, there will be a further increase in revenue, improving margins as initial costs were already largely absorbed. This will positively impact both revenue and net margins as the facility ramps up.

- There is a noted improvement in margin performance for existing and new hospitals in India, with the EBITDA for new hospitals improving significantly. As these hospitals continue to optimize and increase their efficiency, they are expected to further improve net margins.

- Narayana Hrudayalaya's international expansion with a strategic investment in the Bahamas aims to capitalize on synergies with their Cayman operations, potentially driving revenue growth through increased medical tourism and enhanced market reach in the Caribbean region.

- Ongoing investments in new clinics and health plans, such as the integrated care and insurance offerings (Arya), aim to create a new revenue stream and enhance patient engagement, which could lead to increased patient volumes and revenue in the future.

- Narayana Hrudayalaya’s controlled approach to CapEx and cautious financial management ensures that they maintain a solid financial footing while expanding capacity. Their strategic focus on geographies with existing facilities and demand potential, like Bangalore and Calcutta, is likely to improve both revenue and earnings stability long term.

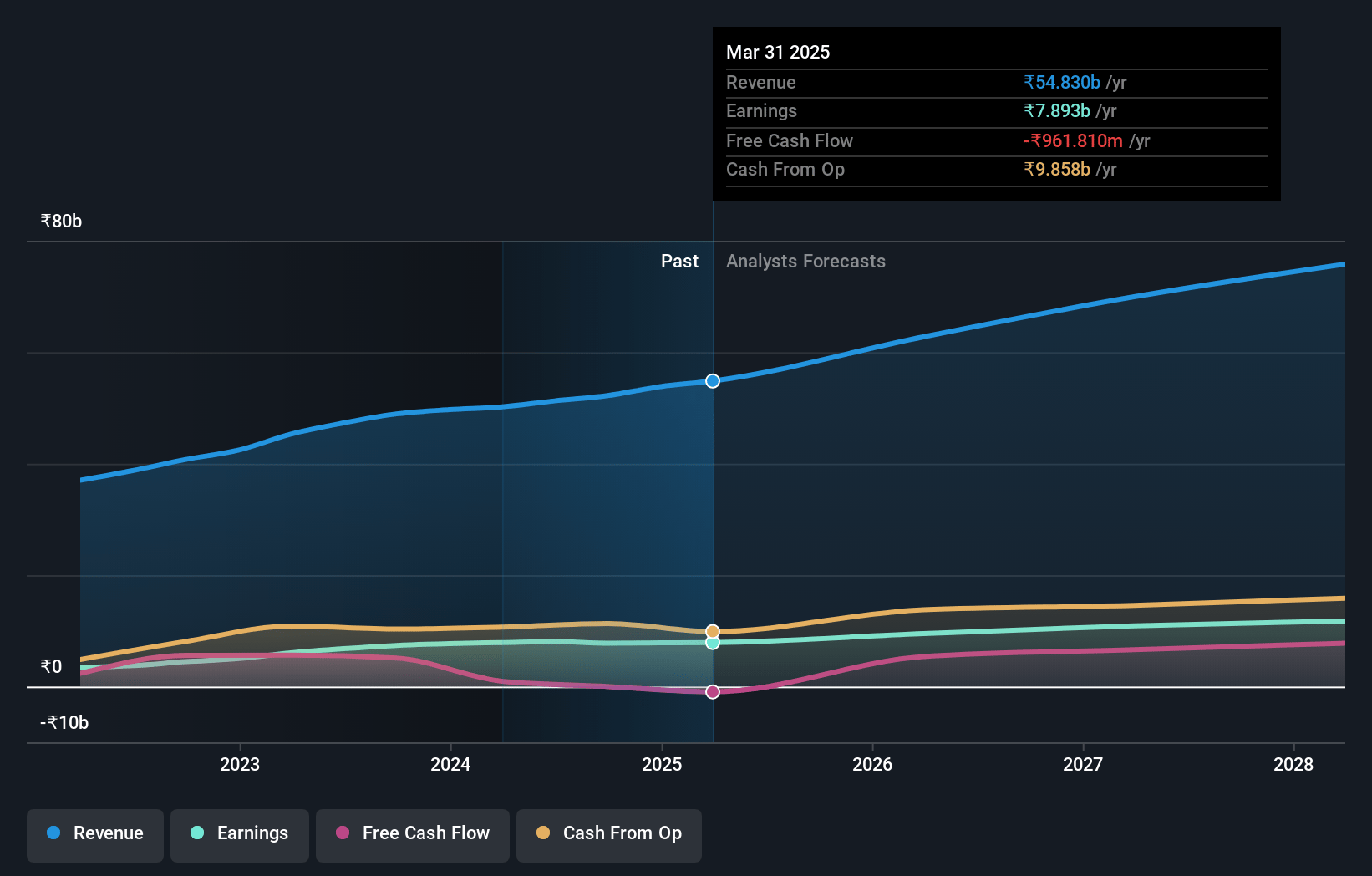

Narayana Hrudayalaya Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Narayana Hrudayalaya's revenue will grow by 13.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.6% today to 15.2% in 3 years time.

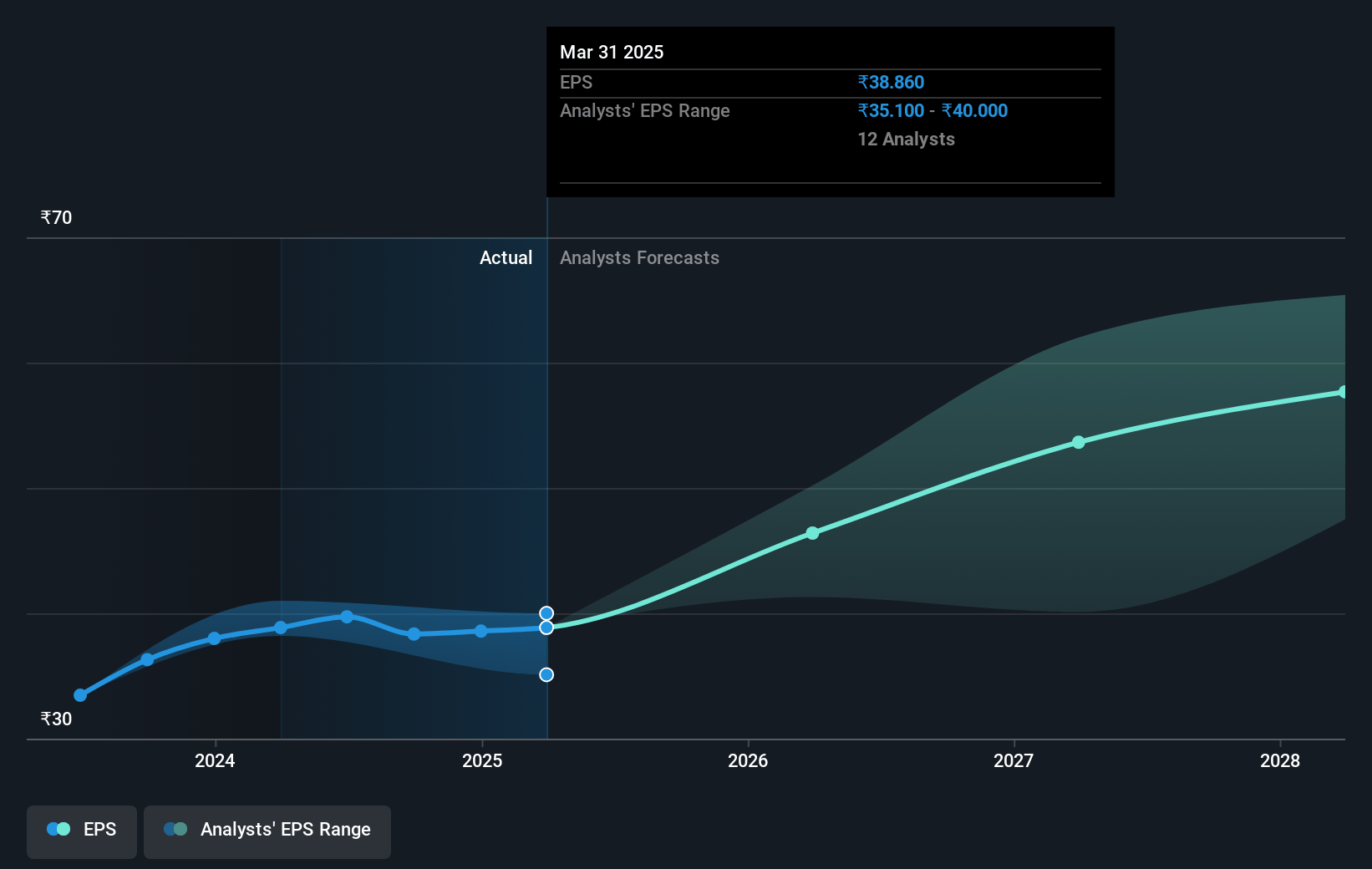

- Analysts expect earnings to reach ₹11.8 billion (and earnings per share of ₹57.49) by about March 2028, up from ₹7.8 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 35.3x on those 2028 earnings, down from 40.8x today. This future PE is lower than the current PE for the IN Healthcare industry at 38.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.53%, as per the Simply Wall St company report.

Narayana Hrudayalaya Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The new facilities in Cayman were bearing significant costs before generating revenue, which could impact short-term net margins and overall earnings.

- Expansion into The Bahamas and lack of focus on immediate U.S. markets may lead to higher costs without proportionate revenue growth, affecting the financial stability of overseas ventures.

- Occupancy rates in India have not shown significant improvement, remaining below 60%, which can limit revenue potential and impact overall profitability.

- High planned CapEx for new projects, particularly in expensive markets like Bangalore, could strain financial resources and lead to inefficiencies if expected returns are not realized, affecting long-term revenue and margins.

- The nascent insurance and clinic ventures have not reached profitability, with increasing expenses potentially impacting net earnings if growth does not meet expectations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1443.077 for Narayana Hrudayalaya based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1690.0, and the most bearish reporting a price target of just ₹1013.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹77.6 billion, earnings will come to ₹11.8 billion, and it would be trading on a PE ratio of 35.3x, assuming you use a discount rate of 12.5%.

- Given the current share price of ₹1573.2, the analyst price target of ₹1443.08 is 9.0% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.