Key Takeaways

- Strategic acquisitions and expansion in specialty diagnostics are expected to boost revenue, enhance test offerings, and improve net margins over time.

- Micro-marketing strategies and B2C growth initiatives are likely to increase market share and operating leverage, particularly in smaller towns.

- The integration, expansion, and significant investment in technology at Metropolis Healthcare may temporarily dilute margins and strain resources, affecting short-term revenue and earnings stability.

Catalysts

About Metropolis Healthcare- Provides diagnostic services in India and internationally.

- The acquisition of Core Diagnostics is anticipated to enhance Metropolis Healthcare's revenue starting in March of the financial year, with operational efficiencies and synergies expected to improve margins by Q1 FY '26. This move is predicted to widen net margins over time as synergies are realized and costs are optimized.

- Metropolis is exploring additional inorganic growth opportunities in the northern markets with a focus on acquiring high-EBITDA and high-ROCE local labs. These acquisitions are expected to improve revenue and earnings by leveraging Metropolis' brand to enhance the test offerings and scale operations.

- Investments in expanding specialty diagnostics, particularly genomics and molecular diagnostics, are aimed at strengthening Metropolis Healthcare’s specialty segment. This expansion is likely to increase revenue due to the higher value and demand for specialty tests.

- The introduction of micro-marketing strategies, tailored to optimize offerings for different geographies, aims to enhance market share in Tier 2, 3, and 4 towns. This could lead to an increase in revenue by approximately 2% starting in Q4.

- The expansion of collection centers and the focus on B2C growth (expected to rise by 8% to 10% over three years) should increase revenue and improve operating leverage, potentially expanding net margins as more customers are served directly through company-operated centers.

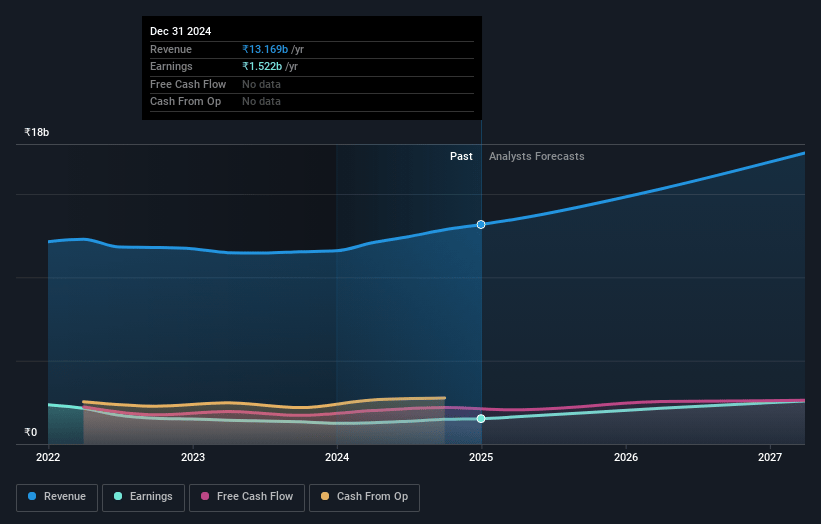

Metropolis Healthcare Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Metropolis Healthcare's revenue will grow by 17.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.6% today to 15.1% in 3 years time.

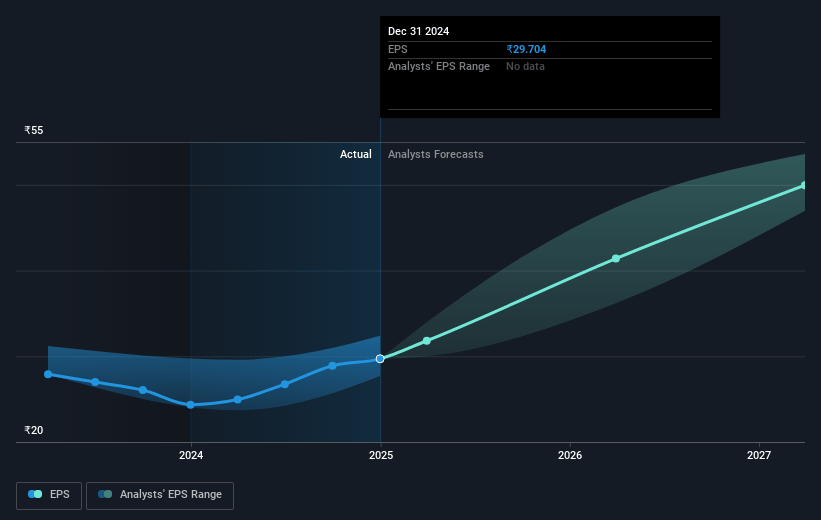

- Analysts expect earnings to reach ₹3.2 billion (and earnings per share of ₹62.2) by about February 2028, up from ₹1.5 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 46.6x on those 2028 earnings, down from 61.9x today. This future PE is greater than the current PE for the IN Healthcare industry at 42.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.15%, as per the Simply Wall St company report.

Metropolis Healthcare Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The integration of Core Diagnostics is expected to result in temporary margin dilution, requiring up to 2-3 years to align with Metropolis's margin profile, potentially impacting short-term net margins.

- Continued focus on geographical expansion and acquisition of independent labs might strain resources and could result in increased operational costs, affecting net margins and earnings if synergies are not realized quickly.

- The dependency on acute testing, which exhibited low volumes during this quarter, indicates potential vulnerability to seasonal fluctuations, potentially impacting revenue stability.

- Price adjustments in micro-markets could face resistance or fail to achieve desired volume growth, which might not offset adjustments, posing risks to revenue growth.

- Significant investments in technology and the addition of new labs and collection centers bring upfront costs, which, if not matched by expected volume increases, may adversely affect net margins and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹2095.824 for Metropolis Healthcare based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹2740.0, and the most bearish reporting a price target of just ₹1675.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹21.5 billion, earnings will come to ₹3.2 billion, and it would be trading on a PE ratio of 46.6x, assuming you use a discount rate of 12.2%.

- Given the current share price of ₹1839.3, the analyst price target of ₹2095.82 is 12.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives