Key Takeaways

- Leveraging technology and unbundled services is expanding revenue streams, strengthening margins, and reducing reliance on traditional business cycles.

- Strategic acquisitions and international expansion position Medi Assist for accelerated growth and increased market share amidst favorable regulatory shifts.

- Reliance on large clients, digital disruption, regulatory pressures, and rising public schemes threaten Medi Assist’s growth, margins, and relevance in an increasingly competitive market.

Catalysts

About Medi Assist Healthcare Services- Provides third party administration services in India and internationally.

- The company is seeing robust growth ahead of the industry in group, retail, government, and international medical insurance segments, supported by rising healthcare insurance adoption in India, demographic shifts (aging, chronic diseases), and broader government initiatives (“Insurance for All”). This is likely to directly drive higher revenue growth as the addressable market expands.

- Ongoing investments in proprietary technology, such as AI-driven claims adjudication, machine learning-based fraud prevention, predictive analytics, and digital customer engagement, are now being monetized as SaaS solutions to insurers outside the traditional TPA model—significantly enhancing operating leverage and supporting improved net margins over time.

- Successful unbundling of services—offering technology platforms and specialized tools (fraud detection, claims) separately to insurers—enables Medi Assist to capture new revenue streams and broaden its market share, insulating revenue growth from traditional TPA cyclicality.

- The company’s expansion into new international markets using its Mayfair platform, and the recent acquisition of Paramount Health Services to build a pan-India presence, are positioned to accelerate top-line growth and provide increased cross-selling opportunities, while further leveraging economies of scale for margin accretion.

- The regulatory environment’s push for standardized, transparent insurance processes and consumer rights is expected to favor scaled, organized, and technologically advanced players like Medi Assist, supporting long-term earnings stability and enhanced profit margins as industry compliance barriers rise.

Medi Assist Healthcare Services Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Medi Assist Healthcare Services's revenue will grow by 17.5% annually over the next 3 years.

- Analysts are assuming Medi Assist Healthcare Services's profit margins will remain the same at 12.6% over the next 3 years.

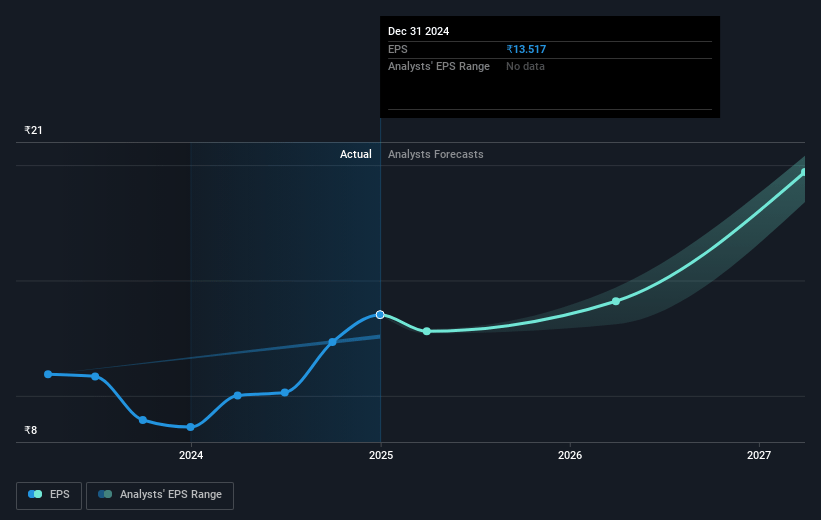

- Analysts expect earnings to reach ₹1.5 billion (and earnings per share of ₹22.75) by about July 2028, up from ₹909.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 44.1x on those 2028 earnings, up from 43.5x today. This future PE is lower than the current PE for the IN Healthcare industry at 50.1x.

- Analysts expect the number of shares outstanding to grow by 0.36% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.55%, as per the Simply Wall St company report.

Medi Assist Healthcare Services Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increasing penetration of government-led health coverage schemes and a growing focus on PM-JAY and public sector contracts could ultimately limit the addressable private insurance market for TPAs like Medi Assist, leading to slower long-term revenue growth.

- Heightened regulatory scrutiny, including performance-based penalties and rapid digital compliance mandates for claims turnaround in government and private contracts, could increase operational costs and compress net margins.

- Ongoing digitalization and insurtech disruption may lead insurers to bypass traditional TPAs through direct technology-enabled claims models or self-funded platforms, threatening Medi Assist’s relevance and future revenue streams.

- Slowing formal employment growth in key segments (e.g., IT/ITES, large corporates) is already resulting in muted volume/lives growth in group insurance, raising concerns that benefit expansion alone cannot sustain former revenue growth trajectories.

- Market dependence on a handful of large insurance clients and reliance on continuous M&A to boost presence pose risks of revenue volatility and limited pricing power, especially as industry competition intensifies and new digital or unbundled players erode market share and margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹643.333 for Medi Assist Healthcare Services based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹11.7 billion, earnings will come to ₹1.5 billion, and it would be trading on a PE ratio of 44.1x, assuming you use a discount rate of 12.5%.

- Given the current share price of ₹560.85, the analyst price target of ₹643.33 is 12.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.