Key Takeaways

- Rapid network scale and product expansion are driven by industry consolidation in a fragmented market and continued acquisition strategy.

- Operational efficiencies, margin gains, and cash flow improvement stem from proprietary tech, higher-margin segments, and a gradual shift to organic growth.

- Dependence on acquisitions, rising competition from digital platforms, and market pressures threaten growth, margins, and financial flexibility in a consolidating healthcare distribution sector.

Catalysts

About Entero Healthcare Solutions- Engages in the distribution and marketing of pharmaceutical, surgical products and other allied services in India.

- The company is benefiting from strong domestic demand as rising urbanization, middle-class growth, and wider healthcare access in India translate into outsized top-line growth (Q1 revenue growth at 28% YoY vs. a 9% market average; guided for 30% FY '26 revenue growth), indicating the market may be undervaluing Entero's direct exposure to macro-tailwinds supporting long-term revenue expansion.

- Industry consolidation and ongoing acquisition strategy in an under-penetrated, fragmented market (organized players are less than 10% of India's pharma distribution) allow Entero to rapidly scale its network and product base, setting the company up for sustained revenue growth and higher eventual operating leverage.

- Strategic investments in proprietary tech platforms and automation (substantial tech investments already made and now shifting to utilization) are enabling further operational efficiency, tighter working capital management (targeted 10% reduction in working capital days this year), and improved net margins.

- Expansion into higher-margin product segments (medical devices, diagnostics, specialty pharma) and deepening partnerships (including value-added services and exclusive pharma brand agreements) are expected to improve gross margin and earnings visibility, which may not yet be fully reflected in the current valuation.

- The company's cash flows and margin profile are set to strengthen as the inorganic growth rate normalizes (lower need for cash-draining acquisitions in 2–3 years) and organic growth takes precedence, further reducing risk and supporting both margin expansion and increased free cash flow.

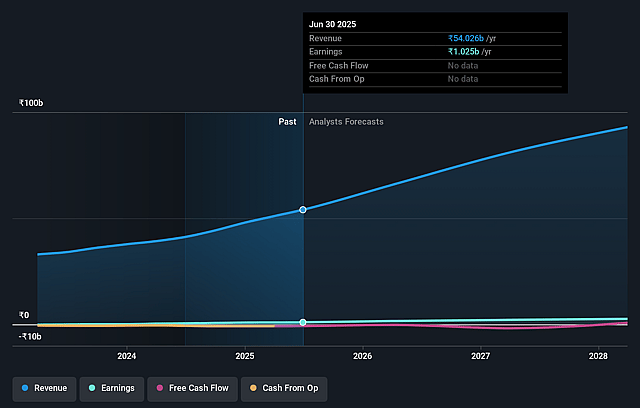

Entero Healthcare Solutions Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Entero Healthcare Solutions's revenue will grow by 23.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.9% today to 3.0% in 3 years time.

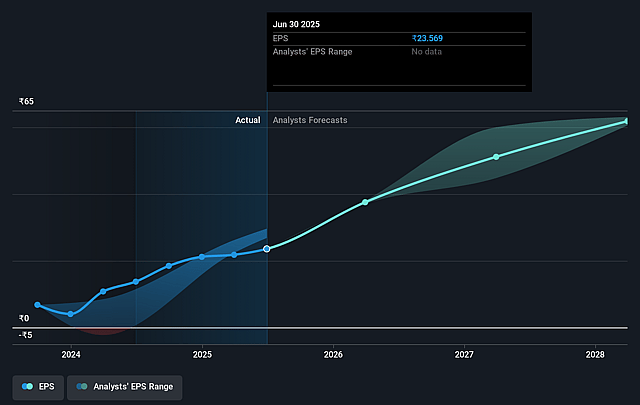

- Analysts expect earnings to reach ₹3.0 billion (and earnings per share of ₹59.15) by about September 2028, up from ₹1.0 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.6x on those 2028 earnings, down from 51.1x today. This future PE is lower than the current PE for the IN Healthcare industry at 47.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.73%, as per the Simply Wall St company report.

Entero Healthcare Solutions Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's heavy reliance on inorganic growth through acquisitions, which is expected to decline in the next few years as the market becomes saturated, could lead to slower overall revenue growth as their source of expansion shifts more to organic channels amid a highly fragmented industry. (Impacts revenue growth rate and earnings trajectory.)

- Margin pressure remains a risk due to continued dependence on supplier and customer negotiations, salary and wage inflexibility, and incremental costs of integration-especially as operating leverage benefits may be outpaced by increasing operating costs and as high-margin acquisition opportunities dwindle. (Impacts EBITDA/net margins.)

- The rapid proliferation of e-pharmacy, quick commerce, and direct-to-consumer (D2C) digital health platforms-particularly from competitors like Amazon and Zepto-poses a risk of disintermediation of traditional distributors like Entero, threatening both market share and per-unit realizations as digital adoption accelerates in India. (Impacts revenue, market share, and margins.)

- High working capital requirements and growing receivables in a fragmented market-despite ongoing ERP and data initiatives-could increase the company's exposure to credit risk, potentially straining liquidity and quality of cash flows, especially as scale and complexity rise post-acquisitions. (Impacts operating cash flow and financial flexibility.)

- Intensified competition, both from organized and emerging global players as well as regulatory pressures including potential price controls and increased generic penetration, may compress gross margins and limit Entero's ability to sustain top-line and earnings growth as the Indian healthcare distribution sector consolidates. (Impacts gross profit, revenue growth, and earnings.)

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1497.0 for Entero Healthcare Solutions based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹100.5 billion, earnings will come to ₹3.0 billion, and it would be trading on a PE ratio of 30.6x, assuming you use a discount rate of 12.7%.

- Given the current share price of ₹1203.3, the analyst price target of ₹1497.0 is 19.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Entero Healthcare Solutions?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.