Key Takeaways

- Reliance on the expatriate market and vulnerability to regulatory changes threaten revenue stability and profitability across core geographies.

- Workforce shortages, rising capital costs, and digital disruption risk eroding margins, reducing returns, and weakening competitive positioning.

- Strategic mergers, digital innovation, disciplined cost control, and a focus on high-growth areas underpin resilient, scalable expansion and sustained margin improvement with limited financial risk.

Catalysts

About Aster DM Healthcare- Provides healthcare and allied services in India, the United Arab Emirates, Qatar, Oman, Kingdom of Saudi Arabia, Jordan, Kuwait and Bahrain, and Republic of Mauritius.

- The company faces significant risks from increasing government intervention in healthcare pricing and possible moves toward universal healthcare, both in India and the GCC, which could cap hospital profitability and exert sustained downward pressure on net margins and earnings over the long term.

- The over-dependence of Aster DM Healthcare on the expatriate-heavy patient base in the GCC makes it highly exposed to regional geopolitical instability or labor policy changes, and even potential diplomatic or economic disruptions could lead to substantial reductions in patient volumes and overall revenue stability.

- Intensifying workforce shortages in healthcare, driven by professional migration, population aging, and staff burnout, threaten to raise labor expenses, make clinical staffing less reliable, and degrade care quality, collectively shrinking operating margins and harming long-term earnings growth.

- The heavy capital expenditure program required for aggressive hospital and bed expansion could strain free cash flows and increase leverage, especially if revenue growth from these new facilities is delayed by local competition or regulatory hurdles, ultimately reducing future returns on capital and net profits.

- The accelerating shift toward digital health and technology-driven outpatient models may allow new entrants to capture profitable segments at the expense of legacy hospital operators like Aster, risking a decline in patient footfalls, slower revenue growth, and further compression of overall EBITDA margins.

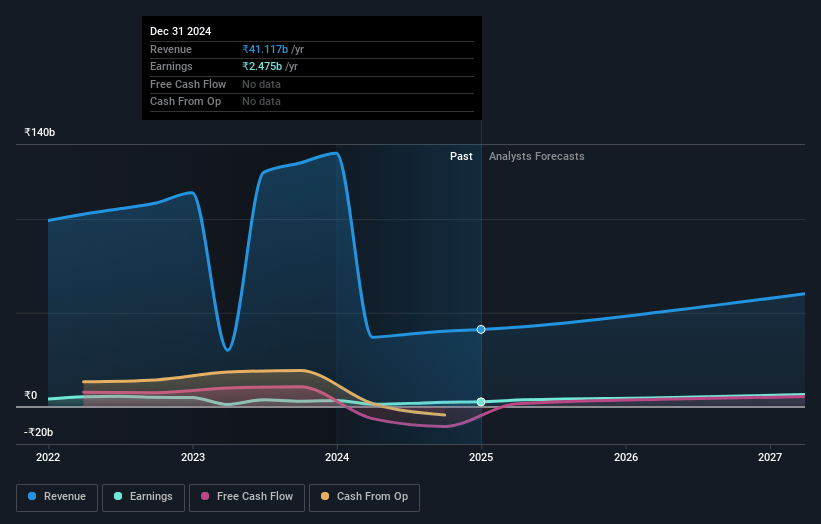

Aster DM Healthcare Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Aster DM Healthcare compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Aster DM Healthcare's revenue will grow by 18.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 7.4% today to 12.5% in 3 years time.

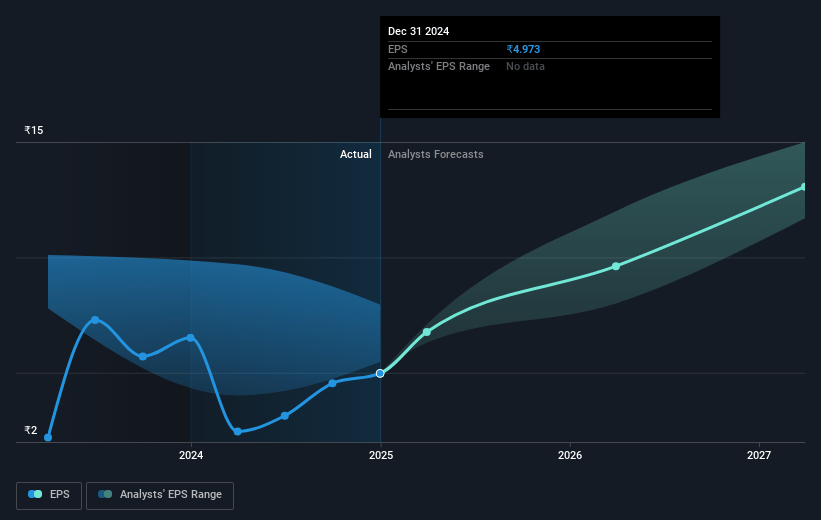

- The bearish analysts expect earnings to reach ₹8.5 billion (and earnings per share of ₹17.0) by about July 2028, up from ₹3.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 36.3x on those 2028 earnings, down from 100.8x today. This future PE is lower than the current PE for the IN Healthcare industry at 49.4x.

- Analysts expect the number of shares outstanding to decline by 0.18% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.73%, as per the Simply Wall St company report.

Aster DM Healthcare Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The upcoming merger with Quality Care India Limited (QCIL) will create one of India's top three hospital chains, significantly expanding scale, network reach, and operational synergies, which is likely to drive stronger revenue growth and margin expansion through procurement savings and shared best practices.

- Aster DM Healthcare has demonstrated consistent double-digit revenue growth, expanding EBITDA margins, and improved operational efficiencies, underpinned by disciplined cost control and turnaround of loss-making segments, pointing to sustained improvements in earnings and profitability.

- The company's ambitious expansion plans, focusing on high-growth geographies and specialty services, are being funded from internal accruals and existing cash reserves rather than additional debt, supporting a solid balance sheet and limiting downside risk to net margins from financial leverage.

- Digital transformation and adoption of new healthcare technologies, including the Aster Health app and integrated digital patient channels, are enhancing patient retention, optimizing operations, and opening new market opportunities, which can further boost revenue and lifetime patient value.

- Leadership strength, strategic talent acquisition, and resilient cluster-wise growth-despite temporary headwinds in Kerala-indicate a strong and agile operational foundation capable of adapting and delivering long-term growth in both revenue and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Aster DM Healthcare is ₹445.62, which represents two standard deviations below the consensus price target of ₹619.8. This valuation is based on what can be assumed as the expectations of Aster DM Healthcare's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹776.0, and the most bearish reporting a price target of just ₹410.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹68.3 billion, earnings will come to ₹8.5 billion, and it would be trading on a PE ratio of 36.3x, assuming you use a discount rate of 10.7%.

- Given the current share price of ₹598.45, the bearish analyst price target of ₹445.62 is 34.3% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.